LAY HONG (Part 2) - Feed costs and how we can use it to tell the future

Chicken King

Publish date: Sat, 01 Sep 2018, 08:25 AM

In my last article, I wrote about the impact of egg prices on the profitability of LAYHONG. In this article, we are going to discuss about their costs, which is chicken feed. Chicken feed is mostly made from corn and soybeans that can only be imported using USD. Therefore, there will be a few moving parts - corn price, soy price, and USD exchange rate. Furthermore, chicken feed has a very long shelf life, so the company can stock up a lot at one time and keep them for a long time before consuming the feed and recognizing the cost from when they bought it. Therefore, ascertaining the exact impact might get a little bit tricky.

What is the sensitivity?

Soybean and corn prices are different and we do not know the proportion they are mixed when making chicken feed. We also do not know how many tons of feed were used because it isn’t publicly disclosed. Therefore, we need to find some way to determine Lay Hong’s profit sensitivity to feed price movements.

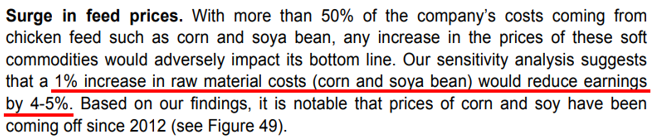

Luckily for us, UOB’s report in April has already given us the answer.

Link to UOB report: https://research.uobkayhian.com/content_download.jsp?id=44935&h=5de467a7575b9538de41b90d8df790b7

4-5% change in profit for every 1% change in feed prices. On the surface it might seem that it is extremely sensitive, however, corn and soybean prices tend to be far more stable than egg prices (recall that egg prices fluctuated 35% quarter-on-quarter as shown in my last article?).

How much does the management usually stock up?

Answering this question is important! Because if a poultry farmer’s standard procedure is to always maintain 6 months’ worth of feed stock, whatever price he pays now to buy the chicken feed will only be recognized in the P&L 6 months later.

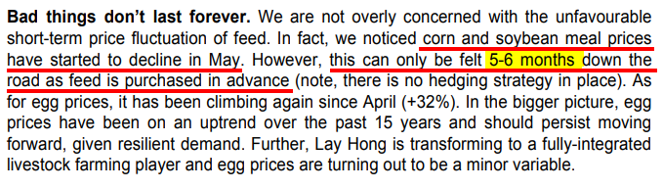

So how to find out how much does Lay Hong buy in advance? UOB’s report is here to save the day again (analyst reports are useful for finding facts, not opinions, as they have access and can get these details from the company’s management):

https://research.uobkayhian.com/content_download.jsp?id=46500&h=f72f75a7a20745214ee32fff9bc0ef0f

For Lay Hong it’s 5-6 months.

So what is the feed cost trend?

Since Lay Hong only recognizes their feed costs in their P&L 5-6 months after they purchased it, this gives us an edge! Because we will be able to predict whether higher or lower costs will be recognized in the coming next 2-3 quarters!

In the charts below, I will state in each period which quarter will the costs be recognized.

Note: This is cost (down is good).

Observations:

- In the recently announced 1st quarter, corn was down 4%, soybean was flat, Ringgit strengthened 2%. So overall costs should be flat or slightly down quarter-on-quarter, which led me to believe why the dismal results was mainly due to egg price (in my last article).

- For the next 2 quarters (2nd and 3rd), corn and soybean prices will be trending up, but fortunately, Ringgit strengthened to offset the impact. Therefore, I also expect the next 2 quarters to have stable feed costs.

- THEN HERE COMES THE JUICY PART: STARTING MAY, CORN AND SOYBEAN PRICES CRASHED! With the Ringgit weakening offsetting some of the benefit, let’s assume the feed costs will be lower by 9% quarter-on-quarter, which benefit will be felt in the 4th quarter (3 quarters to go though).

To put it into numbers:

4.5 profit sensitivity x 9% feed cost decrease = 4Q19 earnings might shoot up by 40%!

If we take RM11 million as the normal profit every quarter, with the feed cost savings alone, we might be able to see at least RM16 million profit in 4Q19. This should already be able to offset whatever profit Lay Hong lost in the 1st quarter from the low egg prices. Note that this is excluding the contribution from the NH Foods JV processing plant that will be coming online in the 3rd quarter.

Too good to be true? Were the sellers too focused on short term swings in quarterly earnings and ignored what's coming that could be seen from a mile away? Let me know what you think.

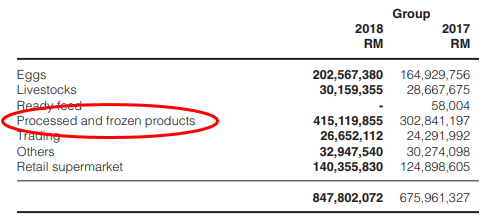

In Part 1 I shared about Lay Hong's egg business, which in the 1st quarter was probably making losses (like LTKM) because eggs were selling at 22 sen/egg while layer farms in Malaysia typically produce at a cost of 26 sen/egg. However, this is only 24% of their total revenue. Furthermore, Lay Hong was still profit making in the 1st quarter. This buffer comes from their next segment which I think is the exciting part - processed and frozen products.

In my next article, I will be discussing about Lay Hong's "processed and frozen products" segment which is 50% of their revenue and how does NH Foods Japan fit into the whole picture. Stay tuned!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on CKing Stock Ideas

Created by Chicken King | Sep 05, 2018

Created by Chicken King | Sep 02, 2018

Created by Chicken King | Aug 31, 2018

Discussions

NH Foods Ltd. holding 20.28% of mother shares & 25.5% of warrants. Only Yap family keep disposing warrants.

They r totally disposing 40,679,800 warrants through open market. Let's say average price of warrant RM0.30, then they get RM12,203,940 of cash.

How many warrants have been sold by NH Foods Ltd? NIL.

2018-09-01 09:12

To play in layhong, more pertinent question is what is next move of Mr Yap. Cos 6months down the road, people still can foresee another next 6months feed impact on layhong btm line. If unfortunately that time if unfavorable, even with good q4. We still make nothing right?

2018-09-01 11:29

Chicken King, I think feed cost is another main reason affecting LayHong's earning in Apr-Jun'18 quarter. The feed cost will continue to impact LayHong in next 2 quarters and hope the higher eggs price can mitigate the negative impact. All in all, I think LayHong's next quarter earnings should improve QoQ but lower YoY.

2018-09-01 12:01

Chicken King, I have one question :

In Jan-Mar quarter, LayHong's "other income" was RM13.2mil and that boosted its Q4FY18's earnings. Do you know what that other income is and why so high ? Thanks in advance for your sharing.

2018-09-01 12:03

Sir, Chicken King

Pls scan for the sensitivity profit contribution from 大红's Frozen Food Processing increased by every 5% of segment revenue.

As i trust this segment will anticipate far better margin of 10% apprx. If I'm correctly.

Tq !

2018-09-01 13:47

Bro, thx for sharing. The pic above has painted over perfectly. U've missed out the depreciation of MYR against USD which is 1 of the key risks.

2018-09-01 22:10

Value88, for other income, you may refer to Annual report p.122, mainly project management fee, reversal of impairment a/c receivable which are one-off income, rental income, etc

=============

value88 Chicken King, I have one question :

In Jan-Mar quarter, LayHong's "other income" was RM13.2mil and that boosted its Q4FY18's earnings. Do you know what that other income is and why so high ? Thanks in advance for your sharing.

2018-09-01 23:14

Goinvest88, you might wanted to use the usage of corn at 55% and soya at 15% for your study.

2018-09-02 15:24

Normally, composition of the broiler feed should be 2:1, 2 for corn and 1 for soy meal, not soybean. See table2 to table5.

http://www.scielo.br/pdf/rbca/v12n1/v12n1a06.pdf

You can find the latest future prices of corn & soy meal here.

https://www.cnbc.com/agriculture/

2018-09-02 16:06

smalltimer

https://www.thestar.com.my/metro/metro-news/2017/09/16/local-maize-can-save-country-billions-of-ringgit-largescale-corn-farming-will-eliminate-import-cost/.

How much local produce of corn is used?

2018-09-01 08:49