LAY HONG (Part 1) - Why did the profit collapse and will it happen again?

Chicken King

Publish date: Fri, 31 Aug 2018, 05:07 PM

Greetings forumers, this is my first article on i3.

LAYHONG has been on many people’s radars lately as the share price has fallen more than 40% over the last 2 months. Many have jumped in and caught the falling knife. After considering all the info and rumours that’s been circulating in the investment community, I have did some research and have strong reasons to believe that the market has overreacted by selling down the stock too much and thus value has emerged.

I will post my findings in multiple parts. I welcome any constructive feedback and discussions on this idea.

First question to ask:

1) Why was Lay Hong’s recent result so poor?

The reason is simple: It was mainly because of EGG PRICES! Although higher feed cost was highlighted as the main reason in the quarterly report (more on this in my next article).

First, we need to understand the 3 different types of eggs Lay Hong sells:

- Table eggs – normal/cheap eggs that are sold at volatile market prices (low margin)

- Functional eggs – branded eggs with stable prices due to better pricing power (higher margin)

- Liquid eggs – customized pasteurized eggs sold to corporate customers like McDonalds (highest margin)

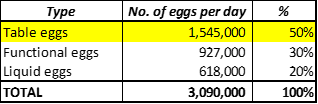

According to the annual report, Lay Hong currently produces 3 million eggs per day. So how many of these eggs are sold as the low margin table eggs?

Based on information extracted from the annual report, 34.2% of total egg revenue came from functional eggs. Since functional eggs are more expensive, let’s just assume it is only 30% of total eggs produced.

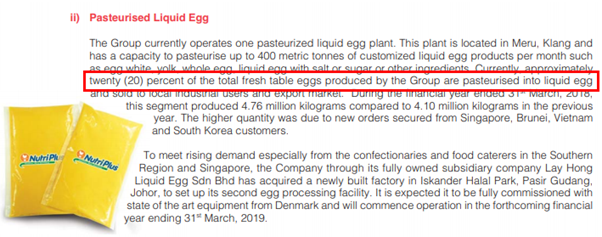

For liquid eggs, management disclosed that 20% of eggs produced were pasteurized into liquid eggs.

Therefore, the breakdown should be roughly like this:

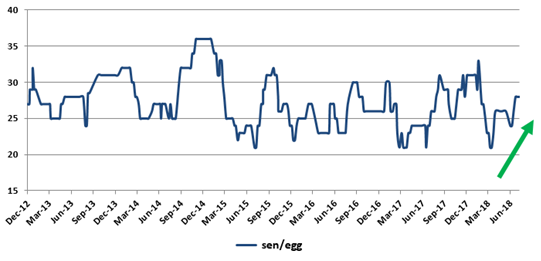

Now let’s take a look at the egg price trend.

I compiled the official egg price data from this website and presented it as a chart below: http://www.dvs.gov.my/index.php/pages/view/1825

We can see that Lay Hong had to sell their table eggs 35% cheaper compared to the last quarter!

The reason for such a large drop in profit from RM11 million to only RM2.3 million is because Lay Hong had to sell their table eggs cheaper while the costs to farm the eggs increased slightly.

To estimate the impact, let’s assume Lay Hong needed to sell their table eggs cheaper by an average of 9 sen/egg compared to the last quarter (assuming production costs remain flat to see only the impact from egg price):

1.545 million eggs x 90 days x -9sen per egg = -RM12.5 million

This means Lay Hong’s 1st quarter profit was reduced by approximately RM12 million due to lower egg prices alone!

Now that we see how Lay Hong’s profit is so sensitive to egg prices, we know that PROFIT SHOULD REBOUND STRONGLY NEXT QUARTER by observing how egg prices have recovered after the Hari Raya low season.

Next question to consider:

2) Should Lay Hong be considered a high risk commodity business with low margins and volatile earnings?

Lay Hong’s management is actually working towards changing this:

They are building a second liquid egg plant which will be fully commissioned by this year! This will allow them to allocate more eggs to be pasteurized, thus reducing the volatility of their earnings in the future.

The conclusion of this article:

1) Lay Hong’s profit should rebound strongly,

2) and profits should become more stable in the future.

After a 40% fall in share price, the above-mentioned negatives should be more than adequately priced-in by the market as the stock have de-rated from 16x PER to only 9x PER now! Of course, there are some other issues surrounding the stock that’s causing more concern. We will discuss those in my subsequent articles.

Stay tuned for Part 2 where I will share why I think there’s even more EXPLOSIVE upside to Lay Hong’s prospects in the mid-term.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on CKing Stock Ideas

Created by Chicken King | Sep 05, 2018

Created by Chicken King | Sep 02, 2018

Created by Chicken King | Sep 01, 2018

Discussions

Very interesting write-up. 50% collapse in share price looks compelling. Please share more...

2018-08-31 17:39

Lol dont use 'rebound strongly by next quarter' unless youre actually doing their accounts

2018-08-31 18:09

Always appreciate ppl who willing to share their homeworks. No matter good or bad news.

2018-08-31 19:50

Hi, thats good sharing, something that you may look into.

Egg section is just contributing 25% of Layhong's revenue.

Few more factor that may play around rather than just looking at price of egg.

Soybean and corn price may take huge impact too. Eggs come from chicken, and chicken come from Soybean and corn! Take not there will be some lagging for material price, as company will stock up these material 3 to 6 months normally.

On top of that, currency is impacting the profit too, as layhong use USD in material purchasing.

So, instead of looking at just egg price. There are more too look at.

Thats not so straight forward.

One thing to discover, what make the share price drop so much CONTINUOUSLY for 2 months. Everything come with reason. There are something that we do not know behind this huge & quick drop in share price.

2018-08-31 21:20

Thanks for sharing. Hope this old articles can help you a bit.

https://klse.i3investor.com/files/my/blog/img/bl3557_20170522_001.jpg

https://klse.i3investor.com/files/my/blog/img/bl3557_20170522_002.jpg

https://klse.i3investor.com/files/my/blog/img/bl3557_20170522_003.jpg

https://klse.i3investor.com/files/my/blog/img/bl3557_20180224_014.jpg

https://klse.i3investor.com/files/my/blog/img/bl3557_20180224_015.jpg

2018-08-31 21:30

Thanks for sharing. Cut loss is not a big deal, the bigger deal is want to know how I die.

2018-08-31 22:12

Why not guess the Yap holding company is also short of cash. A margin unwinding cycle might in progress

2018-08-31 22:29

My question is last quarter shld be high egg consume since more cakes & cookies being baked...& Since the price of chicken food increase..what'rationale to drop the egg price? Egg control price is 2-4 weeks during puasa...is this the caused? Then govt the culprit?

2018-09-01 08:28

It is out already. For those who need the link https://klse.i3investor.com/blogs/ckinginvest/172147.jsp

2018-09-01 08:30

If you observe the egg price trend for the past few years, they have always came down during the Ramadan month. Reason is simple: less meals per day equals less demand for eggs. Eggs spoil in 2-3 weeks. So egg farmers will be scrambling to clear their stock. The oversupply will the cause egg prices to collapse.

Posted by smalltimer > Sep 1, 2018 08:28 AM | Report Abuse

My question is last quarter shld be high egg consume since more cakes & cookies being baked...& Since the price of chicken food increase..what'rationale to drop the egg price? Egg control price is 2-4 weeks during puasa...is this the caused? Then govt the culprit?

2018-09-01 08:34

What about more cookies & cakes being baked? Since been in egg business for many years & if trend in ramadan is always throw price, why not reduce production hence reduce cost...sell as meat during ramadan la

2018-09-01 08:42

A laying hen will continue to lay 5-7 eggs per week regardless of season. To reduce production would mean culling the hen. Most of the time, it is not worth culling them unless the egg prices fall too low for long periods of time. But once industry-wide volume is reduced, big players will benefit from the price rebound while small players need 6-8 weeks to re-grow new hens to catch up. Industrialized layer farms generally have stronger financials compared to mini farmers to sit through the low cycle.

Posted by smalltimer > Sep 1, 2018 08:42 AM | Report Abuse

What about more cookies & cakes being baked? Since been in egg business for many years & if trend in ramadan is always throw price, why not reduce production hence reduce cost...sell as meat during ramadan la

2018-09-01 08:55

To Chicken King, yr analysis is great But u must also take note of Layhong's net gearings ... its extreme HIGH. Interest expense also high.

2018-09-01 10:58

As at March 2018, its cash and short term investment stood at RM15.68 million, total debt stood at RM230.52 million.

2018-09-01 11:00

But how come LayHong's gearings high at current level. If u said so ... it is a net cash company by now.

2018-09-01 11:06

robot888, wake up. If Lay Hong's cash flow good, you think you still can buy at such lower price? You can't sell the chicken and get the eggs mah.

2018-09-01 11:30

Chicken King's article showed he/she has in depth knowledge on this industry. Thanks for sharing.

2018-09-01 11:56

Kind of crazy to say this stock will trade limit up at this point. Or, shall I say sheer ignorance and stupidity?

2018-09-01 12:06

Talk is cheap. If you think you can beat the great wizard in i3, then just sell your shares if have any.

When the wizard posted his article related to hrc and crc. You still don't know what's the difference between them. I advise you, keep serious in what the writer has mentioned above and go to do some homework.

2018-09-01 14:08

wasnt that to do with QL aggressive take over threat?

Posted by shpg22 > Sep 2, 2018 03:29 PM | Report Abuse

Everyone keep thinking investors had overreacted by selling down. When in actual facts it is the reverse, they had overreacted by buying up. The stock has been overvalued for quite some time.

2018-09-02 15:30

Everyone keep thinking investors had overreacted by selling down. When in actual facts it is the reverse, they had overreacted by buying up. The stock has been overvalued for quite some time. Now it just normalized. The same goes for most poultry stock, the worst being QL.

2018-09-02 15:31

Good sharing with facts & references. Well done & thank you!

Herbert is thousands miles below the average standard, not to mention comparing him to good class articles.

Bruce88 HerbertChua again ..

31/08/2018 19:20

2018-09-03 15:53

.png)

.png)

VenFx

Hope author may scan sensitivity for their feed grain cost impact too. Tq

2018-08-31 17:16