$$$ whenever you step on the brake pedal - Donkey Stock

DonkeyStock

Publish date: Wed, 05 Oct 2016, 12:01 AM

Visit our website to get interaction with Mintye historical figures.

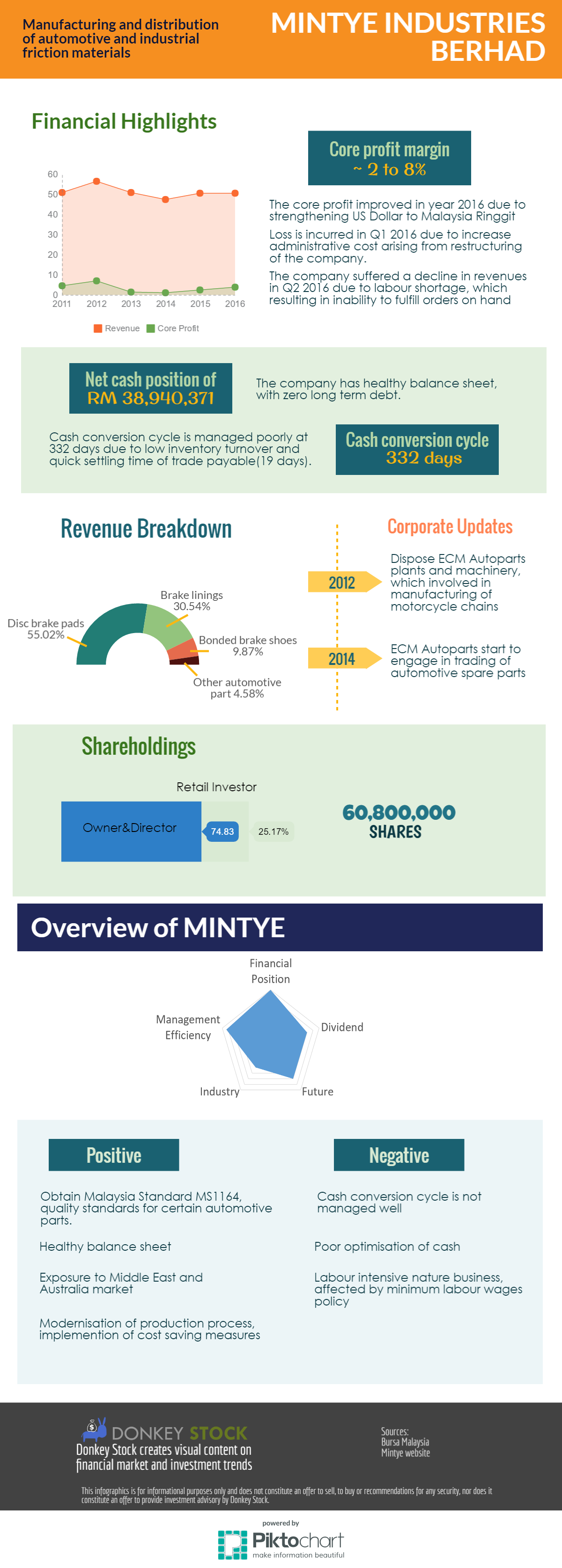

Mintye Industries Berhad is involved in manufacturing and distribution of automotive and industrial friction materials.

For the past 5 years, revenue hovers around 50 million while seeing a stagnant trend in core profit. Overall, the company manage to achieve a core profit margin of 2% - 8%. An improving core profit is seen in recent year due to strengthening USD against MYR. As for the latest 2 quarter result, a loss is incurred in first quarter due to a spike in administrative cost arising from restructuring of the company. Meanwhile, the company is facing labour shortage which result in inability to fulfil orders on hand in the second quarter.

Mintye has a net cash position of RM39 million, which translate into 61 cents per share. However, it has a cash conversion cycle of 332 days due to low inventory turnover and only 19 days of trade payable outstanding.

Manufacturing of disc brake pads made up more than half of the company revenue, followed by brake linings and bonded brake shoes. Besides serving the local market, Mintye exports its products to Australia and the Middle East market.

In 2012, the company disposed its machinery and plant which is involved in motorcycle chain manufacturing. In 2014, Mintye started to engage in trading of automotive spare parts. The company has a low number of circulated shares of 60.8 million. Among those shares, 74.83% are held by the director cum owner.

Positive

§ Obtain Malaysia Standard MS 1164, quality standards for certain automotive parts.

§ Healthy balance sheet

§ Exposure to Middle East and Australia market

§ Modernisation of production process and implementation of cost saving measures.

Negative

§ High cash conversion cycle

§ Poor optimisation of cash

§ Labour intensive nature business, easily affected by minimum labour wages policy

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Stock Infographics

Created by DonkeyStock | Jun 05, 2024

Created by DonkeyStock | May 28, 2024

Higher offer price for MPHB Capital Bhd ?

Created by DonkeyStock | May 27, 2024

DC Healthcare Bhd has delivered a worsening financial result

Created by DonkeyStock | Jan 04, 2024

Property investing by these visionary Singapore-based companies

Created by DonkeyStock | Jan 03, 2024

Discover the factors behind this surge, the challenges faced by top cocoa producers, and the ripple effect on chocolate manufacturers

Created by DonkeyStock | Aug 15, 2023

Created by DonkeyStock | May 03, 2023

Companies listed on Bursa Malaysia with an outstanding quarter results for the month of Apr 2023.

tarmizixx

IMHO: in the future, electric car will become more dominant. brake pads will be replaced less frequent due to regenerative braking system used by electric car.

2017-01-04 20:41