Stop falling into Pump and Dump Scheme. You can learn how to avoid it

DonkeyStock

Publish date: Sat, 29 Jul 2017, 12:01 AM

Visit https://www.facebook.com/donkeystock/ or http://www.donkeystock.biz/ for more infographic.

Subscribe us to get a free copy of e-book on Investment Guides all in infographics.

You may be interested in:

Value Trap: Are you falling into these traps?

Pump and Dump: How the syndicate operate pump and dump and what type of stock they will pick.

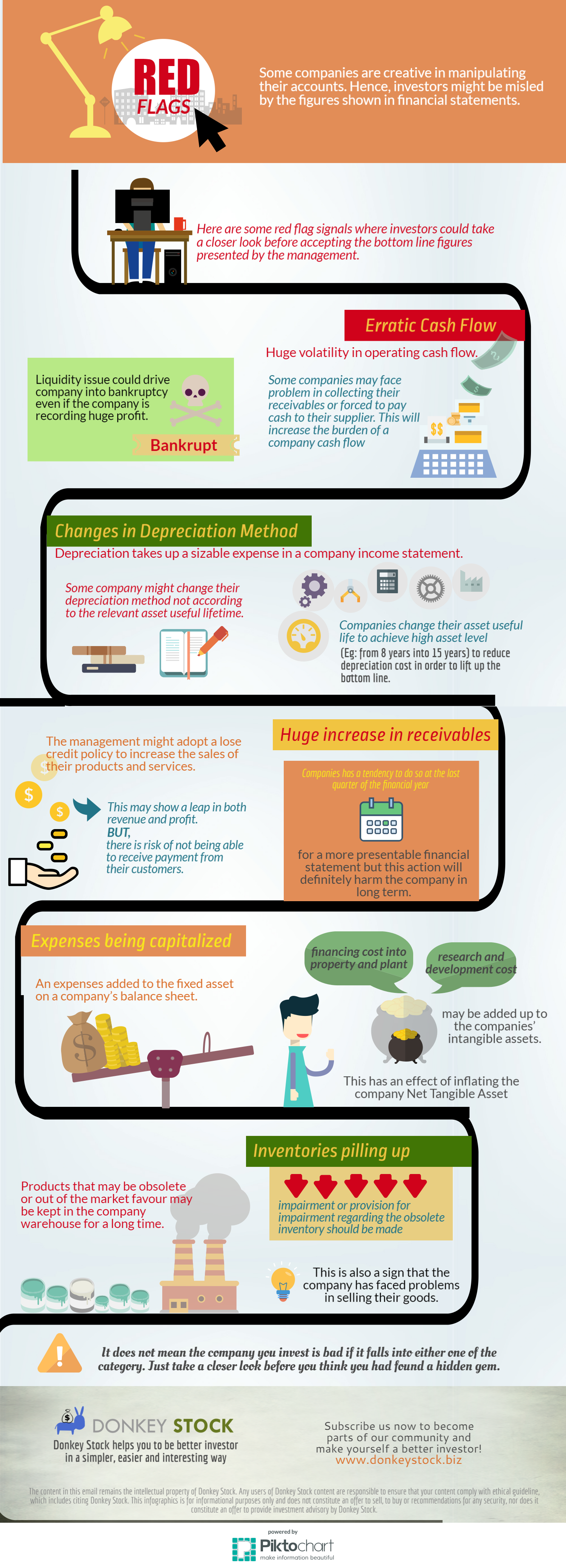

Red Flag Spotting

Some companies are creative in manipulating their accounts. Hence, investors might be misled by the figures shown in financial statements.

Here are some red flag signals where investors could take a closer look before accepting the bottom line figures presented by the management.

Erratic Cash Flow

Huge volatility in operating cash flow. This signal shows that company might have problem in managing their cash flow regardless of receiving cash or making payment to supplier. Some might face pressure from supplier due to the management creditworthiness and has a shorter payment term. This will lead the company into a death spiral where liquidity issue could drive company into bankruptcy even if the company is recording huge profit.

Changes in Depreciation Method

Depreciation takes up a sizable expense in a company income statement. Some company might change their depreciation method not according to the relevant asset useful lifetime. Companies which requires high asset level to operate may change their asset useful life (Eg: from 8 years into 15 years) to reduce depreciation cost in order to lift up the bottom line.

Huge increase in receivables

The management might adopt a lose credit policy to increase the sales of their products and services. This may show a leap in both revenue and profit but ignoring the risk of not being able to receive payment from their customers. Companies has a tendency to do so at the last quarter of the financial year in order to present a more presentable financial statement but this action will definitely harm the company in long term.

Expenses being capitalized

An expenses added to the fixed asset on a company’s balance sheet. Companies might convert some of their expenses, such as financing cost into property and plant; research and development cost may be added up to the companies’ intangible assets. This has an effect of inflating the company Net Tangible Asset

Inventories pilling up

Products that may be obsolete or out of the market favour may be kept in the company warehouse for a long time. The management should have made an impairment on the product or provide a provision for impairment regarding the obsolete inventory. This is also a sign that the company has faced problems in selling their goods.

It does not mean the company you invest is bad if it falls into either one of the category. Just take a closer look before you think you had found a hidden gem.

More articles on Stock Infographics

Created by DonkeyStock | Jun 05, 2024

Created by DonkeyStock | May 28, 2024

Higher offer price for MPHB Capital Bhd ?

Created by DonkeyStock | May 27, 2024

DC Healthcare Bhd has delivered a worsening financial result

Created by DonkeyStock | Jan 04, 2024

Property investing by these visionary Singapore-based companies

Created by DonkeyStock | Jan 03, 2024

Discover the factors behind this surge, the challenges faced by top cocoa producers, and the ripple effect on chocolate manufacturers

Created by DonkeyStock | Aug 15, 2023

Created by DonkeyStock | May 03, 2023

Companies listed on Bursa Malaysia with an outstanding quarter results for the month of Apr 2023.

Discussions

To blur most retailers by releasing press of

signing ' MOU ' with some oversea venture in ' securing ' a lucrative amount of Contract ... ( i found most newbies are crazyly buying into this kind of stories, without a second layer of thinking ).

2017-07-29 11:20

like anzo....0.60 that time...i noob was queuing 0.59 but cannot get...so give up....im so lucky =(

2017-07-29 11:31

aiyoo, you recommend all durian king, cannot afford. How you see champion? I tambah lagi.

2017-07-29 11:50

durian king, please hard sell penta also pls....so my durian tree can huat faster =D

2017-07-29 11:53

.png)

VenFx

Stop falling into Pump and Dump Scheme. You can learn how to avoid it !

Thanks to DonkeyStock ,

this is a real trick for most Crooked Bossies like to manipulate their acount .

Example :

1.transmile & knm ; they manipulate with the 'CHANGE IN DEPRECIATION METHOD'

2.LCL ;'HUGE INCREASE IN RECEIVABLE'

... they usually will deploy 2-3 tricks in manipulating it to make it less obvious ,in some cases like investment holding they are much more complication in dissection their manipulating activities .

2017-07-29 11:13