Stock Infographics

Time to watch out this precious metal and US Dollar Index

DonkeyStock

Publish date: Thu, 16 Apr 2020, 08:07 PM

Petroliam Nasional Bhd (Petronas) did a bond offering on 15 Apr 2020, raising USD 6 billion. The bond offering comprises US$2.25 billion 10-year, US$2.75 billion 30-year and US$1 billion 40-year conventional notes.

“The 10-year conventional notes were priced to yield 3.65%, the 30-year conventional notes were priced to yield 4.55% and the 40-year conventional notes were priced to yield 4.80%.

The bond offering was oversubscribed by 6.2 times. This does not only reflect the market’s confidence in Petronas’ credit strength, but it is also a sign where there is too much money seeking yield.

Time to get gold

A quick glimpse we can see that the central bank of major developed countries had decreased their interest rate to historical low value. A few years back, AUD and NZD was still the darling of carry trade trader where investors can borrow JPY at a very low-interest rate and invest in AUD/ NZD, both currencies deliver a much higher interest rate and investors can earn the interest spread.

With interest rate at near-zero and unlimited money printing activity, such an opportunity is virtually zero and everyone should start buying some precious metals. People who snubbed investing in gold claims that gold is not generating any dividends or interest income. However, when the return of holding a sovereign bond is literally zero, why should we invest in bonds but not gold?

"Gold is money. Everything else is credit." -- J.P. Morgan, 1912

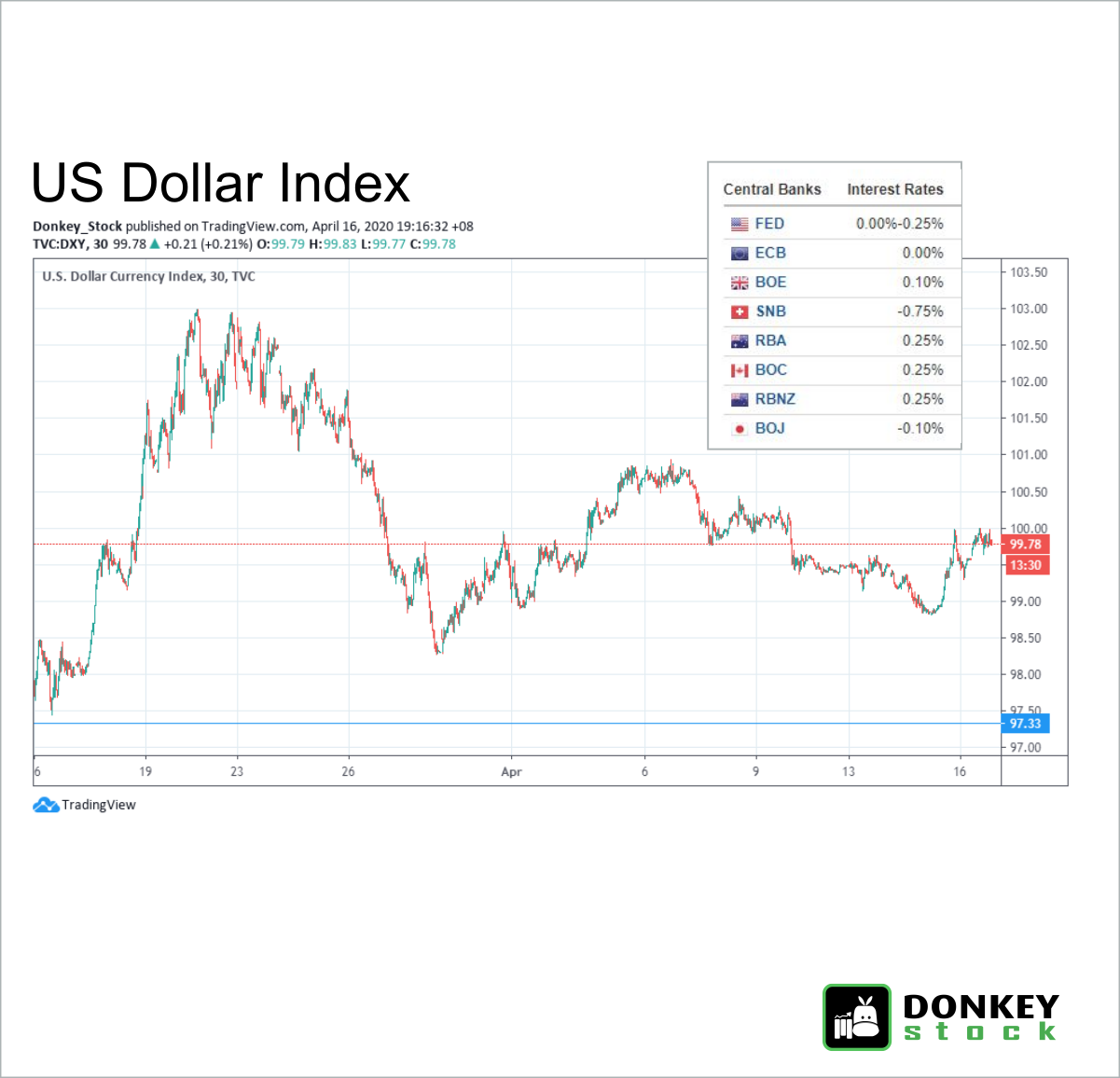

US Dollar Index as the indicator

Also, investors should keep an eye on the US Dollar Index because currencies are one of the last independent financial barometers in the market right now.

The government bond and corporate bond markets have been nationalized by central banks. While stock indexes in the U.S. are disproportionately affected by the price movement of a few technology companies and share buyback actions from the companies’ management.

The FX market is likely large enough to overcome these limitations, making currency moves an even more important source of risk signals in these unprecedented times.

More articles on Stock Infographics

Missed the Opportunity to Purchase More Shares During the Company’s Price Dip

Created by DonkeyStock | Jun 05, 2024

MPHB Capital Privatization: A Questionable Valuation

Created by DonkeyStock | May 28, 2024

Higher offer price for MPHB Capital Bhd ?

DC Healthcare’s Financial Roller Coaster

Created by DonkeyStock | May 27, 2024

DC Healthcare Bhd has delivered a worsening financial result

These investors are mastering the real estate game.

Created by DonkeyStock | Jan 04, 2024

Property investing by these visionary Singapore-based companies

Why Guan Chong Bhd share price reach Covid 19 low ?

Created by DonkeyStock | Jan 03, 2024

Discover the factors behind this surge, the challenges faced by top cocoa producers, and the ripple effect on chocolate manufacturers

The USD to RUB exchange rate might hint at an impending truce.

Created by DonkeyStock | Aug 15, 2023

Companies that delivered significant profit growth in the latest quarter

Created by DonkeyStock | May 03, 2023

Companies listed on Bursa Malaysia with an outstanding quarter results for the month of Apr 2023.

Discussions

Be the first to like this. Showing 0 of 0 comments