Coal prices are high and we have generated too much electricity using coal. This had led to sluggish TNB share prices and high electricity prices.

DonkeyStock

Publish date: Mon, 07 Feb 2022, 04:31 PM

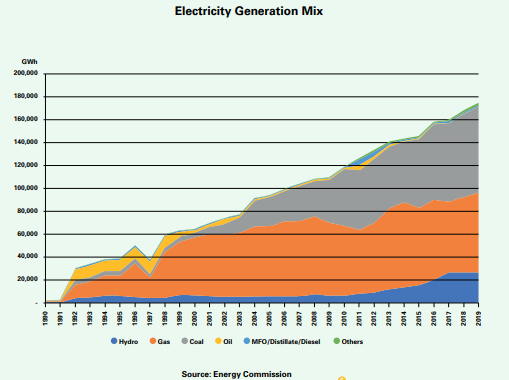

As an oil-producing nation, you probably won't get surprised that Malaysia is most dependent on natural gas to generate power.

However, despite being an oil-producing nation and a country blessed with huge solar and hydro energy potential, we are increasingly becoming dependent on coal to generate our electricity. Worse still, we don’t even produce much of our coal – 98% of the coal we burn is imported.

The Energy Commission (Suruhanjaya Tenaga) had failed to provide the public with the latest year report, hence the latest available data is till 2019. From the trend, coal-powered electricity may have become the dominant source of power in 2021.

Maybe you may argue that Malaysian are using more power and coal is a cheap source of fuel to support the economy. However, these two statements are not valid.

According to the latest annual report of Tenaga Nasional Berhad (TNB), the total generation capacity in Peninsular Malaysia is nearly 26,000MW, but the average daily capacity is below 17,000MW. Thus, the excessive power plants measured in terms of electricity reserve margin is about 35%. The optimum electricity reserve margin for Peninsular Malaysia is about 15%.

A high electricity reserve margin is a burden to the people and country. This is because the power plants' owners will receive fixed payment, although the power plants are not utilized. The people and businesses are forced to pay for the profit of the power plants owners through their respective electricity tariffs.

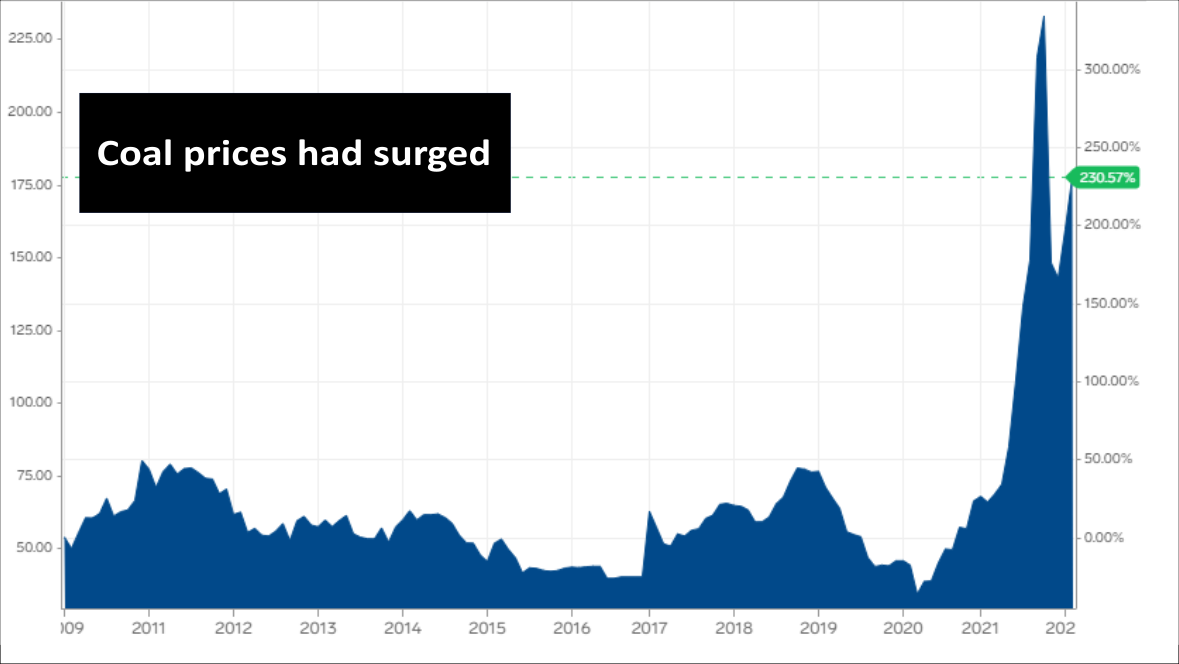

Moreover, coal is no longer a cheap fuel. Coal prices have risen by more than 300% in recent years. Banks across the globe have committed to stop financing new coal activities under the net-zero carbon emissions pledge. This will lead to a lesser future supply of coal. In traditional economics, a higher price will lead to more supply, but this theory has broken down with the lack of funds supporting the exploration and mining of new coalfield. In a foreseeable future, the supply of coal is not going to increase fast enough to depress coal prices.

In short, coal prices are high and we have generated too much electricity using coal. The solution is simple too, just phase out the coal-fired power station once the concession ends.

* Malakoff Corporation Bhd, which has two coal-fired plants, namely Tanjung Bin Power and Tanjung Bin Energy with a generating capacity of 2,100MW and 1,000MW respectively. Tanjung Bin power plant, the largest coal-fired power plant in Southeast Asia has a concession period of 25 years and will be expiring by September 2031. Hopefully, the concession will not extend anymore this time.

Source: iSquare Intelligence

More articles on Stock Infographics

Created by DonkeyStock | Jun 05, 2024

Created by DonkeyStock | May 28, 2024

Higher offer price for MPHB Capital Bhd ?

Created by DonkeyStock | May 27, 2024

DC Healthcare Bhd has delivered a worsening financial result

Created by DonkeyStock | Jan 04, 2024

Property investing by these visionary Singapore-based companies

Created by DonkeyStock | Jan 03, 2024

Discover the factors behind this surge, the challenges faced by top cocoa producers, and the ripple effect on chocolate manufacturers

Created by DonkeyStock | Aug 15, 2023

Created by DonkeyStock | May 03, 2023

Companies listed on Bursa Malaysia with an outstanding quarter results for the month of Apr 2023.

.png)