Why MYR is plunging so fast

DonkeyStock

Publish date: Mon, 25 Apr 2022, 03:32 PM

Currency depreciation can occur due to factors such as economic fundamentals (Trade Balance, Money Supply), interest rate differentials, political instability, or risk aversion among investors.

Malaysia has a good trade surplus, supported by the strong export of E&E products, energy, and palm oil, hence this is not the reason for the weak Ringgit. A weak Ringgit could even boost the competitiveness of Malaysia's export.

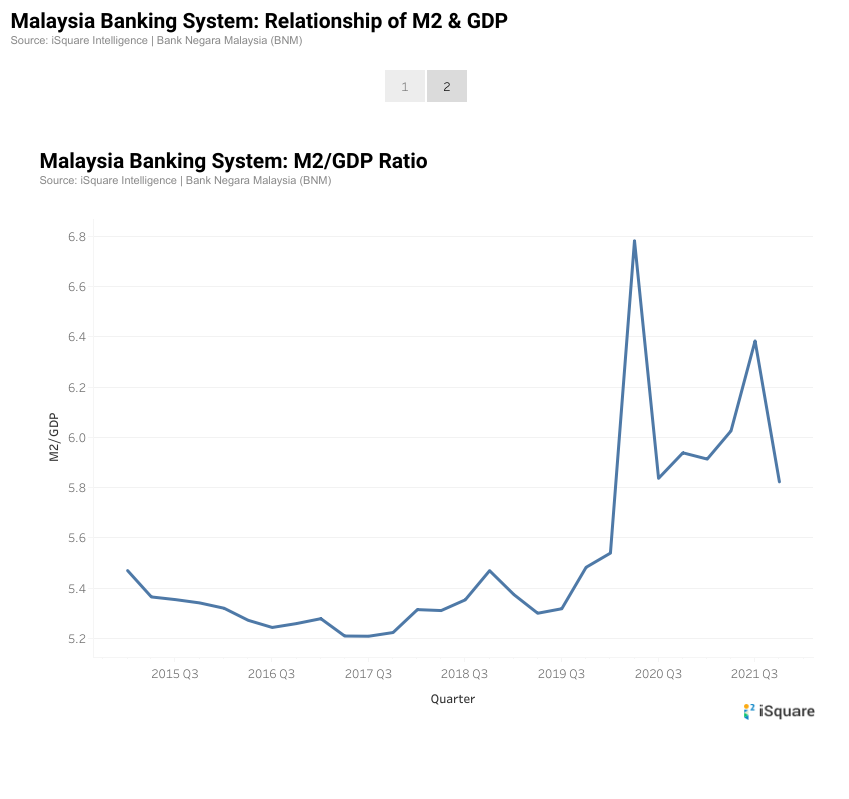

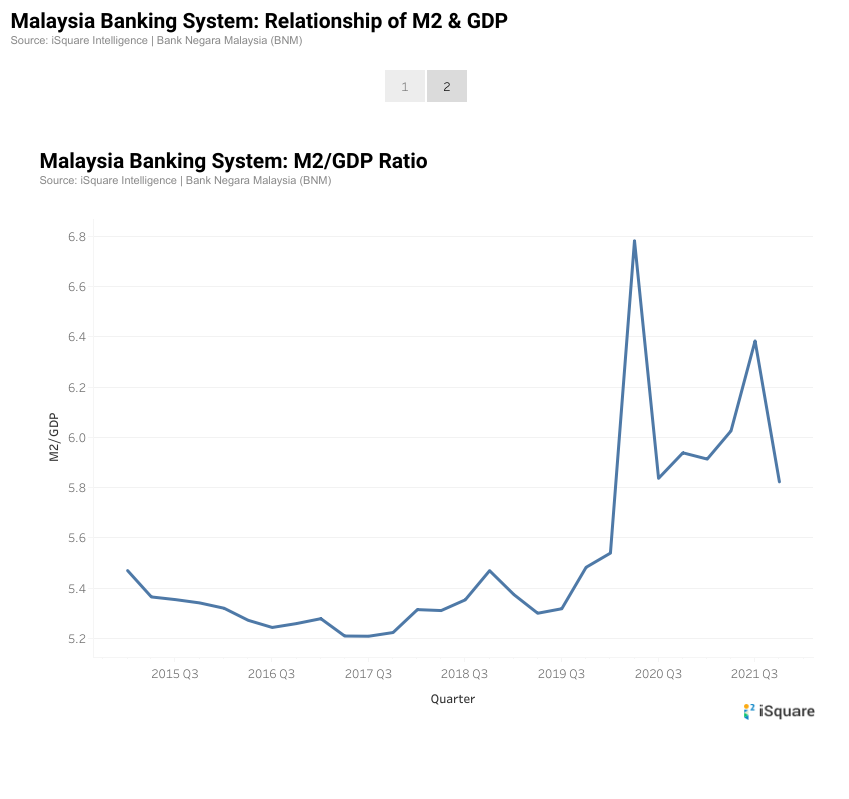

M2 is a measurement of the money supply. From the chart below, you can see Malaysia has been printing money faster than the growth of Malaysia's GDP. The M2/GDP ratio is a measurement of how much money is needed to create a single dollar of GDP. Turns out that we need a lot of money just to create a single dollar of GDP and the situation worsened during the pandemic.

Source: Malaysia M2 Stats

Interest rate differential is also an important factor. Malaysia Central Bank has not shown any intention of raising Malaysia's interest rate when the rest of the world is actively increasing their central bank rate. When a US bank is offering a 3% return for 1 year Fixed Deposit while Malaysia bank is only offering 1.75% return for 1 year Fixed Deposit, it is obvious that funds would flow out from Malaysia, dragging the value of Ringgit.

Political instability is another major factor for foreign investors' confidence. The MOU signed between the opposition party and the ruling party is going to end on 31 July 2022. Unless a general election is held prior to that date, otherwise Malaysia's policy consistency could be in doubt.

Risk aversion among investors. Previously, investors are so bullish on everything and investors will take on a higher risk to bet for a higher return. The sentiment has turned around and capital preservation has become the main goal now. Malaysia, which is a developing nation has been categorized as a risky asset, which is shunned by foreign investors.

One thing to take note of is the strong SGD. Singapore has been taking over the position of Hong Kong. The zero covid policy in China is making China citizens nervous and they are actively looking for ways to move out their money or leave the country. Singapore is a great destination for them. Once the lockdown is lifted in China, more funds will flow out from China into Singapore.

More articles on Stock Infographics

Created by DonkeyStock | Dec 05, 2024

Created by DonkeyStock | Jun 05, 2024

Created by DonkeyStock | May 28, 2024

Higher offer price for MPHB Capital Bhd ?

Created by DonkeyStock | May 27, 2024

DC Healthcare Bhd has delivered a worsening financial result

Created by DonkeyStock | Jan 04, 2024

Property investing by these visionary Singapore-based companies

Created by DonkeyStock | Jan 03, 2024

Discover the factors behind this surge, the challenges faced by top cocoa producers, and the ripple effect on chocolate manufacturers

Created by DonkeyStock | Aug 15, 2023

Created by DonkeyStock | May 03, 2023

Companies listed on Bursa Malaysia with an outstanding quarter results for the month of Apr 2023.

Discussions

Taliban govt. should impose tax on gold purchase. many black money used to buy gold. our govt. debts myr1trillion sure bring MYR to longkang fast unless revenue from add. tax imposed

2022-04-26 12:12

many things we can learn from India. 3% tax on gold in India.....no wonder India reserves increases so drastically to usd640Billion already

2022-04-26 12:23

We are fortunate enough because Malaysia has palm oil and petroleum otherwise the Ringgit could have been much cheaper.

The Ringgit can be a resemblance of a man/machine which can only be burdened with that much of weight or pressure in a given time frame.

The national debt (RM980B) is inclusive of those which are denominated in foreign currencies in addition of loans in Ringgit. These loans are needed to be serviced, say on a monthly basis, by selling the Ringgit, to obtain the foreign currencies like USD for loan repayment. The pressure of huge amount if compounded with others transactions of selling the Ringgit could make the suffering worse.

When a bank in New York increased the deposit rate, the investors may sell their investments, sell the Ringgit and buy the USD ultimately. Such an event can burden the Ringgit further.

The cost of importing products and service will disadvantage to the Balance of Payment for the country. Malaysia can initiate ways to reduce import such as foods because we have plenty of land to expand the farming activities. With more than enough to eat, we can reduce the outflow of Ringgit in the future.

2022-04-26 20:47

ahbah

On the safe side, just put a small sum of our wealth in gold bcos gold is more stable n gold no got plunges fast n also always keep its value throughout the centuries.

2022-04-26 10:41