Owning a shopping mall in Klang Valley ≠ Sitting on a gold mine

DonkeyStock

Publish date: Fri, 29 Apr 2022, 03:52 PM

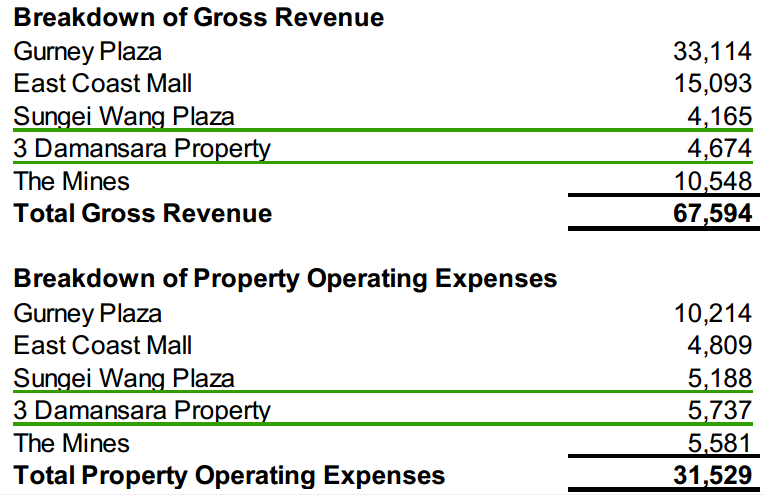

Here's a snapshot from Capitaland Land Malaysia Trust's (Formerly known as Capitamall Malaysia Trust) quarter results. It is so surprising to see that Sungei Wang Plaza and 3 Damansara are recording an operating loss. If someone owns the mall using bank financing, the monthly negative cash flow will be even higher.

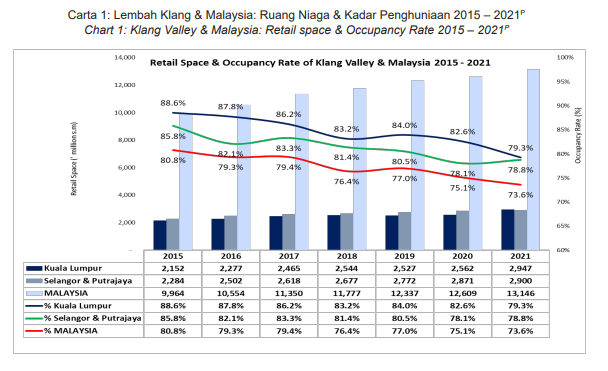

The occupancy rate of shopping malls in Klang Valley has been declining steadily since 2015. The sluggish performance of mall occupancy is not caused by Covid-19, but by some of the following reasons:

Oversupply of malls in a low-density population area. Some township developers who build their township in immature areas will build a shopping mall to provide basic amenities for the local residents. These malls are meant for the developers to sell their houses, not to make a profit from these malls.

The second type of mall that is facing a faster decline is aged malls. Low ceiling height, clogged toilets, and scary parking spaces. The management should have spent on regular maintenance and upgrading the mall every few years. These are malls managed by bad operators.

The third type of mall is a property that is well maintained but located at an awkward location. 3 Damansara is a good example of it. It is sandwiched between several highways, close to major commercial clusters, and accessible by public transport. However, the surrounding mall such as 1 Utama is siphoning all the traffic. KL Gateway Mall is also facing a similar issue where its traffic is being sucked away by Mid Valley and The Gardens.

The last type of mall that usually doesn't operate well is a strata-titled mall. Each owner is competing to get their own tenants the rental rate become so low and the quality of the tenant becomes so bad, till the tenant mix of the entire complex sucks. Imagine entering a mall where all the retailers are selling things sourced from Taobao and marking up the prices. You would not want to visit it again. Capital 21 mall, the shopping mall located in Tampoi, Johor Bahru is a great example of this category.

In short, avoid investing in these types of malls no matter how great the sales pitch is.

Source: iSquare Intelligence

More articles on Stock Infographics

Created by DonkeyStock | Jun 05, 2024

Created by DonkeyStock | May 28, 2024

Higher offer price for MPHB Capital Bhd ?

Created by DonkeyStock | May 27, 2024

DC Healthcare Bhd has delivered a worsening financial result

Created by DonkeyStock | Jan 04, 2024

Property investing by these visionary Singapore-based companies

Created by DonkeyStock | Jan 03, 2024

Discover the factors behind this surge, the challenges faced by top cocoa producers, and the ripple effect on chocolate manufacturers

Created by DonkeyStock | Aug 15, 2023

Created by DonkeyStock | May 03, 2023

Companies listed on Bursa Malaysia with an outstanding quarter results for the month of Apr 2023.