Demand for Mortgage at an all-time high

DonkeyStock

Publish date: Thu, 09 Jun 2022, 03:49 PM

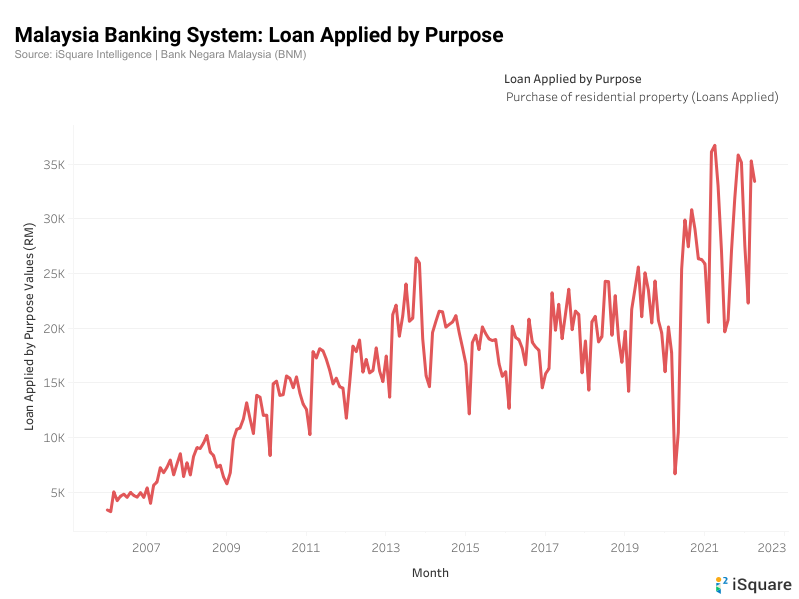

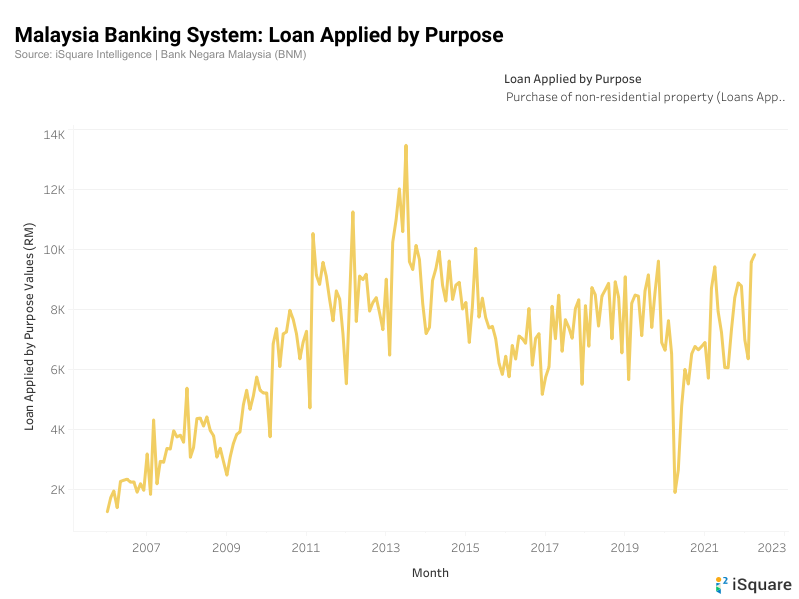

Mortgage application for residential properties is almost at an all-time high although the demand for mortgages for commercial properties remains sluggish.

Although interest rates have started to rise, loan demand for residential properties remains high.

Despite the Malaysian property market is still plagued with a high number of overhang units, properties located in good locations are still being snapped up in a short period of time. This situation has been exacerbated by the shortage of new launch properties in the market.

Higher rental rates, higher inflation rates, government subsidy (HOC Campaign), and historically low interest rates have ignited the interest in home buying for many first-time home buyers. In the next few years, Gen-Z will start to get married and have kids, this will further increase the demand for properties located close to working locations.

Follow where the money flows. The demand for loans is one of the best indicators to check out where the money flows.

More articles on Stock Infographics

Created by DonkeyStock | Jun 05, 2024

Created by DonkeyStock | May 28, 2024

Higher offer price for MPHB Capital Bhd ?

Created by DonkeyStock | May 27, 2024

DC Healthcare Bhd has delivered a worsening financial result

Created by DonkeyStock | Jan 04, 2024

Property investing by these visionary Singapore-based companies

Created by DonkeyStock | Jan 03, 2024

Discover the factors behind this surge, the challenges faced by top cocoa producers, and the ripple effect on chocolate manufacturers

Created by DonkeyStock | Aug 15, 2023

Created by DonkeyStock | May 03, 2023

Companies listed on Bursa Malaysia with an outstanding quarter results for the month of Apr 2023.