Super Property Gem Just Breakout From The Bottom

einvest88

Publish date: Tue, 23 May 2017, 08:54 AM

EWINT & EWINT WA...Super GEM

retailer or investor only start to chase stk when they c something solid happen in financial result..they will not buy in now and wait for long term...even 6 mths or 1 yr+...However this super darling EWINT esp the warrant, EWINT WA worth to lock in now when it is selling almost at breakeven IPO price. The downside risk is very minimum but with huge upside

Let compared with some of the well managed property company like Matrix. If Matrix sales order is 1b+ with shr issued of 574m...px is now at historical high of above 2.80..what will happen to ewint px with sales order 6.5b with shr issued 2.4b? Mathematically, future px s/b 6.5/1 *1.17=7.60...even u chop by half still ard 3.80+...current px is only 1.17?...I dunno when ewint will hit that..but d ewint wa is super delicious at the moment.

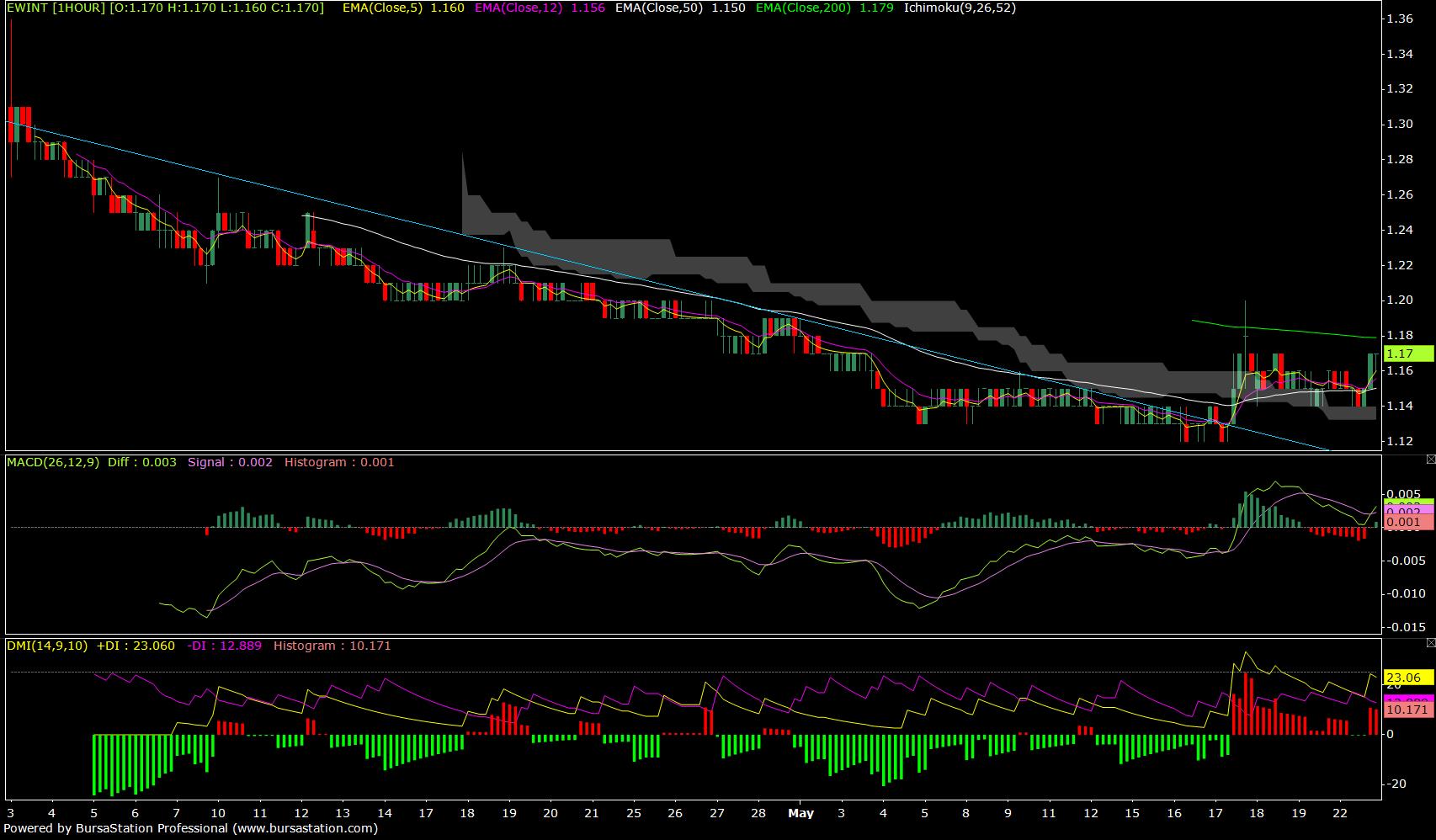

From chart, EWINT has breakout from current downtrend line with immediate tp of back to 1.36

Clearly see from the chart, banker volume is increasing indicating the uptrend is just begin. The MACD cross above zero also another positive signal for the price to climb higher.

EWINT WA also see the similar feature like EWINT.

Here is some of teh comment of EWINT future financial result

绿盛世国际

2019年净利料涨92%

1)绿盛世国际至今已取得逾65亿令吉产业销售额,由于须在交付产业单位后才确认营收,分析员预期,该公司在2017财政年将仍蒙受亏损,但将从2018财政年起取得高额盈利。

联昌研究预料,绿盛世国际旗下产业发展计划将在2018至2021年财政年完成。由于它在交付产业单位时才确认营业额,使它在2017财政年将蒙受1亿3200万令吉净亏损,主要花费在行政及销售开支

该行预期绿盛世国际在2018财政年可取得2亿7580万令吉净利,2019年净利将进一步跃升92%至5亿2950万令吉。

目前绿盛世国际通过持有75%股权的英国联营公司持有3项产业发展计划,发展总值达22亿英镑(约120亿令吉)。该公司通过独资子公司,在澳洲悉尼拥有一项产业发展计划,发展总值为3亿1500万澳元(约10亿令吉)。

截至2017年1月,绿盛世国际总共售出约65亿令吉的产业单位,其中在伦敦已售出10亿2300万英镑产业单位,悉尼销售额则为2亿4900万澳元。

绿盛世国际甫于今年4月10日宣布,该公司收购一家产业发展公司80%股权,后者在澳洲墨尔本商业区边缘拥有一块占地0.5英亩土地,预料其发展总值达2亿1800万澳元(约7亿3000万令吉)

Another big boost to EWINT is the parent company of Ecoworld...From chart, price yesterday made a major breakout from long term downtrend line at 1.60. Immediate target likely to visit last high of 2.28. This will certainly pull along EWINT.