Fundamental Pick: Cocolnd

hlchang

Publish date: Wed, 07 Jan 2015, 02:54 PM

Cocoaland is famous of its gummy products which carries the Lot100 brand. It has a niche segment with significant market share that has little or no competitions. I haven’t come across any gummy products that come close to Lot100 in terms of flavour and texture.

The company operates through Malaysia and China geographical segments. Its activities also include the manufacture of fruit juice and foodstuffs; distribution of all kinds of beverages, and; wholesale, import, and export of gummy products.

The stock is last traded at RM1.60 which is 12.45 times P/E, falling short of 16.67 times average P/E of Consumer Product category. the stock has been trading range-bound between RM1.4 and RM1.83 over the last 5 months. It has recently rebound from its low of RM1.4 and managed to trade above its 20 Days Simple Moving Average and also 50 Days Simple Moving Average. This indicates short term uptrend for this stock. Medium to long term trend has to be confirmed by the 100 days and subsequently 200 days moving average. I would say a climb above RM1.83 will confirm bullish momentum for this stock over the long term.

MACD has recently seen blue line crossing above red line, indicating uptrend. But MACD trend is still below 0 level which hasn’t confirmed a return of bull. I estimate the stock needs to trade above RM1.83 for the MACD to cross above 0 level.

RSI shows the stock is below 70% which means it is not overbought yet. Same applies to Stochastic.

Fundamentally, the stock is a good candidate for people looking at good long term growth. These are my summaries for findings based on a few fundamental indicators:

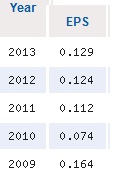

1) Earning Per Share (EPS)

Except for year 2009-10, EPS for Cocolnd has rose in a steady pace. For financial year 2012 to 2013, the EPS grows 4.03%. It fulfills the EPS growing Year-on-Year criterion for this matter.

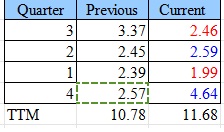

On Quarterly basis, the latest quarter showed EPS dropped from 3.37 sen to 2.46 sen but it has recorded better quarters for Q2, and Q4 last year. Its 2014 Q4 result which will be released end Feb-15 will obviously be higher than Q3 due to festive seasons but only time will tell if it will ever exceed 4.64 sen recorded last year.

2) Shareholding

Leverage Success Sdn Bhd remains the majority shareholding company with 38.04% shareholding.

F&N bought into Cocolnd in 2010 and maintains a 27% interest in Cocolnd. F&N’s partnership with Cocolnd was seen as biggest catalyst in its 2010-2013 stock rally which at one time hits its highest of RM2.83. There was rumors since earlier last year that F&N might dispose its share of Cocolnd but nothing has been materialized.

Shareholdings as a whole are healthy with F&N being a reliable business partner which compliments Cocolnd’s beverage businesses. The only drawback is that the stock is too tightly held by internal party with a balance float of only 14% which draws concern on its liquidity. But, if you are holding it for investment purposes and hoping to growth the value with the company, this might not be the biggest concern of your entire investment.

3) ROE (Return on Equity) is standing at 9.27% which is quite decent among the consumer product segment.

4) Good balance sheet: It has healthy net current asset of 66 mil, and long term assets of 147 mil. It has very little long term debt of only 5 mil compared to net profit of 22 mil. It has no issue at all to pay off its liability.

5) Net Cash from Operation: From Income Statement, it shows a 38 mil cash flow from operation compared to 10 mil and 3.3 mil for year 2012, and 2011 respectively. This shows that it managed to grow its income from operation quite substantially using its existing assets.

6) Dividend Payout: Dividend payout has been consistent and steady over the years. It paid 6.5 sen in year 2013, slightly better than 6.3 sen in year 2012. For year 2011, and 2010, it paid 5.5, and 4.4 sen respectively. 6.5 sen represents a dividend yield of 4.06% which is a decent payout.

Conclusion: The recent range-bound provides a good opportunity to enter into Cocolnd with entry price around RM1.60. It has good chance of testing RM1.83 which is the a indicating long term bullish. In the contrary, one should consider cutting loss if it falls below RM1.40.

Disclaimer: None of the strategies, stocks or information discussed or presented are financial or trading advice or recommendations. The author assumes no liability including for errors and omissions. Everything presented are the author’s ideas and opinions only. The author may or may not at any time be holding securities discussed. Trade at your own risk

More post at: http://financial-savvy.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Financial Savvy

Discussions

Thanks for pointing this out. Yes, Cocolnd does have -ve FCF over the past 3 years due to increased in Capital Expenditure. However, the heavy Capex has positive effect on its ability to generate more operating cash flow. The impacts on capex should be seen in the longer term perspective and not in isolation. Future will proof if bottom line does improve as an effect of increased expenditure, just my 2 cents.

2015-01-07 23:38

CFTrader

EPS is useless, tell me FCF .

2015-01-07 15:31