Technology Hidden Gem PART 1

Daz Ng

Publish date: Mon, 05 Oct 2015, 02:35 PM

TECHNOLOGY HIDDEN GEM: GENETEC – PART 1

I came across this company accidentally when i pay visit to my customer in Bangi, they had a big factory, a group of company called KVC & GENETEC. My customer told me that they had been very busy lately, and i replied what?? business is very slow nowadays and with gst.....?? So i decided to dig deeper and do some findings.

I guess most of us had not heard of this company, but they had been in technology sector for nearly 20 years.

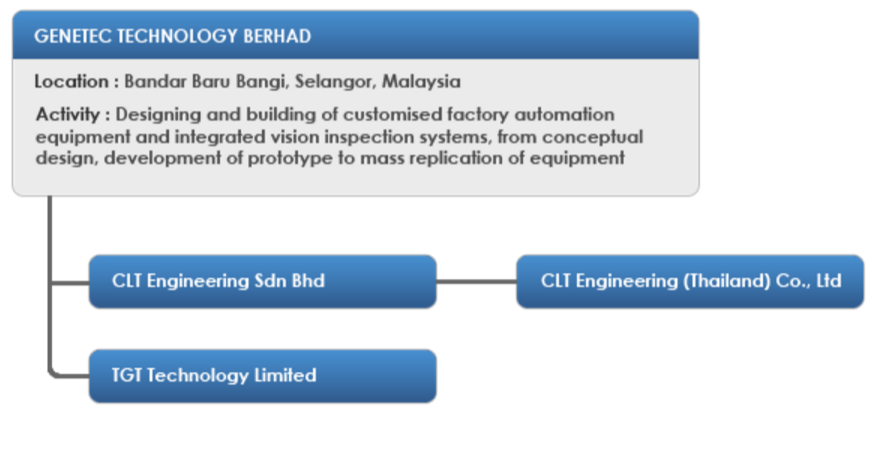

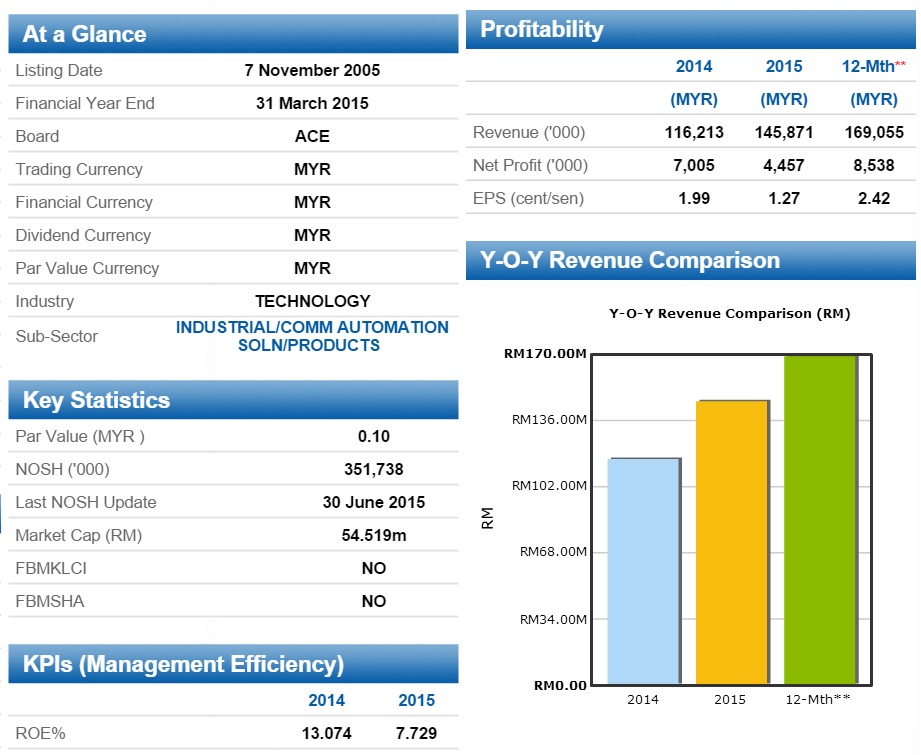

Genetec Technology Bhd (“GTB”) is mainly involved in the design and sales of industrial automation equipment. The revenue from our core industry segment, i.e. Hard Disk Drive (“HDD”) Industry, has increased significantly, contributing about 84% (2014: 52%) of the Group’s revenue. This was mainly due to strong demand for replication of prototypes developed by Genetec from its customers. Meanwhile, the revenue from Automotive Industry contributed about 9% (2014: 37%) to the Group’s revenue. The remaining 7% was generated from industries such as pharmaceutical and semiconductor. Recent corporate exercises have more than doubled GTB’s revenue and profits and will give them additional capacity to meet new orders from Western Digital. The company was formed in 1997 and converted to a public limited company in 2004, prior to listing in 2005.

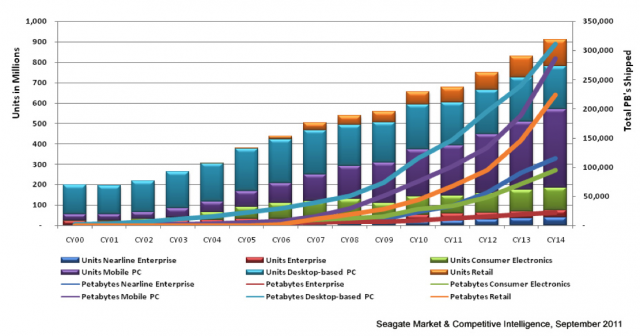

Right now you must be wondering HDD market is already die lar!! Now is all about SDD!! Why bother to look at this stock???? Well, please hear me out for the following facts: TechNavio Report Global HDD Market 2011-2015 predicted an 8.1% annual growth rate for the global HDD through 2015, Why there is an increase in growth?

1) ENTERPRISE STORAGE/CLOUD DATA: According to Western Digital Latest Quarterly Report: Western Digital is focusing on the enterprise side which offers higher-margin business opportunity. Storage for enterprises is a key growth area in the information technology sector. SSD is a good solution when it comes to accessing emails but SSD is still too costly when it comes to storage. That’s why it had a hybrid drive that only needs 6GB to 10GB for accessing emails and when you want to store something you can ship the information to hard drives. Anticipating a potential acceleration in cloud deployments backed by exponential growth in cloud data storage, Western Digital has stepped up investment in high-capacity storage devices to support the expansion of cloud infrastructure and applications. The explosive growth is being driven by digitized media - streaming movies and TV from Netflix and Hulu, YouTube clips, downloading MP3s from iTunes, recording TV shows onto DVR, taking mobile photos and videos, growth in internet traffic, sending emails, growth in social media (Facebook, Twitter, etc), and cloud storage (iCloud, Amazon Cloud Drive, Google Cloud Storage, Dropbox, Sugarsync, etc. etc). Content creation and consumption per user is growing as are total users.

According to Huberty's research, the Cloud space is expected to experience a 20 percent growth rate in 2015, based on a combination of some of the largest companies guidance and her own estimates.

Key drivers of the investment case

2) HDDs are not in secular decline.

This is the area of greatest controversy and misperception. Consensus opinion is terrified by the thought that HDDs could be completely obsoleted in a few short years by Flash memory, which sounds scary until you think analytically about it. It’s an impossibility for Flash to totally displace HDDs. We’d agree that Flash memory will continue to take share, but that does not mean HDDs cannot grow modestly. This is a very contrarian viewpoint, but one we can support with logic:

a) Information creation continues to grow and the need for storage grows along with it

b) HDDs are the lowest priced storage medium. Flash costs 10x as much per gigabyte of storage. HDDs enjoy a significant cost advantage, mainly because of the fixed cost nature of a basic hard drive. Each unit requires a controller, head, suspension, arm, platter, etc, regardless of capacity size. As the size of the drive increases, the incremental cost to build a larger HDD declines meaningfully. The incremental cost to build a 1TB drive vs. a 500GB may only be a ~25% difference, an additional 1-2 discs plus 1-2 heads, yet has 2x the capacity. Flash operates closer to a linear cost curve, with the cost to produce 256 GB ~2x the cost to produce 128 GB.

c) Cannibalization of mobile is partially offset by growth in Cloud storage. In olden days one’s digital media – photos, music, etc, would get stored on their desktop HDD. The enormous growth of mobile computing with much lower storage capacities (500GB desktop hard drive vs. 32GB tablet, for instance) is requiring a secondary source of storage. Presumably data that does not (or cannot) get stored on an 8GB iPhone (photos, video, MP3s) is getting stored somewhere in the Cloud. Proof is the proliferation of Cloud-based storage services – iCloud,Amazon Cloud Drive, Google Cloud storage, Dropbox, Sugarsync, etc, and that’s good for HDDs because they buy HDDs, the cheapest solution. Demand from cloud storage will likely be a very significant driver of demand for HDDs.

d) Hybrid drives could be a realistic competitor to Flash in certain mobile applications. A hybrid drive, comprised of both an HDD and Flash memory, offers the best of both worlds – much higher storage capacity and more comparable performance in terms of speed and power consumption, relative to pure Flash, while costing considerably less.

e) Desktop PCs, are not dead yet, exhibiting very modest growth. Clearly in western countries desktops are struggling to show any growth, but that’s a very Western-centric view that overlooks growth in emerging countries where desktops, because of price, are the cheapest computing option. As the cost of notebooks decline their adoption will increase, but that will take time to play out.

f) There is simply not enough Flash capacity in the world to cannibalize 100% of HDD supply. If the incremental demand for data storage in 2012 is 338 exabytes (50% data growth at a 12.5% storage rate), that’s 12x the estimated Flash capacity in 2012. It’s physically impossible for Flash to meet that demand and eliminate the role of HDDs.

g) The cost of adding new greenfield Flash capacity is prohibitively expensive. Samsung recently completed building the world’s largest fab, the 300mm Fab 16, capable of producing 5 exabytes of storage per year, or ~20% of the industry capacity pre its birth. The cost of Fab 16 was $10 billion, or $2 per gigabyte of capacity ($2 billion per exabyte). To match HDD capacity, Flash OEMs would need to build 279 exabytes of capacity, or 10x their current production, at a cost $558 billion (279 exabytes x $2 billion per exabyte). The industry doesn’t have that kind of money.

h) The threat of virtualization has already occurred. Servers and storage equipment have been getting ‘virtualized’ for 10+ years, this is not new, and has mostly played out, yet the HDD industry was able to grow through this. If today was day 1 of virtualization, I would have a different opinion.

3) PERSONAL BACKUP: No doubt, everyone want their laptop/notebook to be as slim as possible but did you notice that everyone will buy an external HDD for BACK UP because the storage space on SDD is limited and if opt for large SDD, then the price is way too hefty. Here is another fact:

-

Download HD Movie & Song

-

Large Pixel Photo = Large File

-

Personal Video

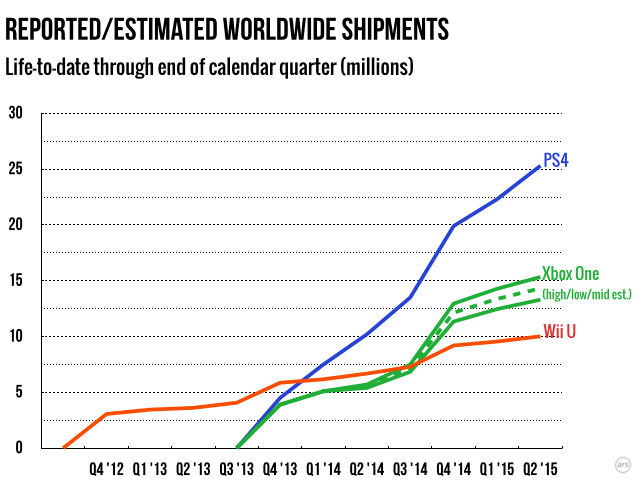

4) GAMING: All Gaming device (include PC) now need large storage, PS4, XBOX.

By Vald Savov on September 7, 2015 10:51 am

Acer, Asus, and Lenovo are on a charm offensive at IFA this year, and their target demographic is that reliably spendthrift group we know as gamers. Collectively, these three companies account for a third of global PC shipments, and they represent an industry-wide trend toward promoting more gaming gear. The hope is that slumping PC sales can be rejuvenated by appealing to the class of users who upgrade their hardware most often and spend most lavishly.

The PC gaming market produced $21.5 billion in hardware sales last year, according to data from Jon Peddie Research, which is more than double the revenues derived from console sales. More notably, unlike the broader PC market, which continues shrinking, gaming PC sales are projected to increase over the next couple of years. The JPR analysis suggests the biggest chunk of gaming PC revenue — somewhere in the vicinity of 44 percent — comes from the so-called enthusiast segment, which the researchers identify as "very performance and style oriented, much like sports car owners."

5) SECURITY CCTV & ASTRO need HDD storage and the with HD quality, storage size can only get bigger.

The global video surveillance industry can defy conventional market logic, resist product commoditization and still grow by more than 10 percent in 2015, according to a new white paper from IHS Inc.

The global market for video surveillance equipment was worth an estimated $15.0 billion by the end of 2014, up from $13.5 billion in 2013. By 2018, worldwide revenue will reach a projected $23.6 billion, as shown IHS' market figures, equivalent to a five-year compound annual growth rate of 12 percent.

As for Astro,

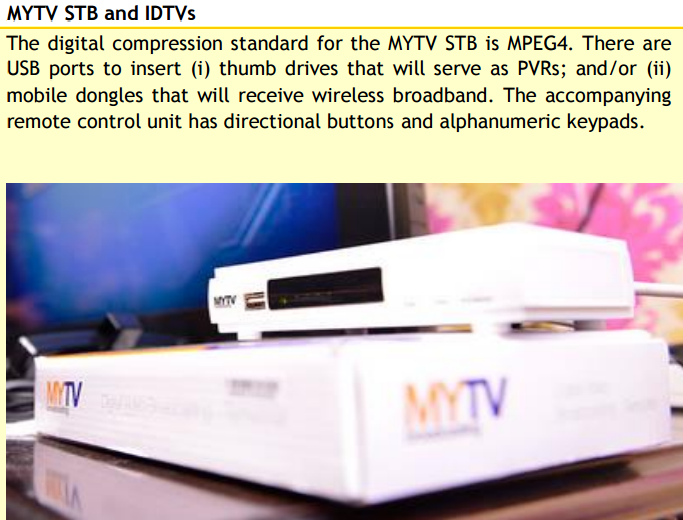

The MCMC conceived the National Digitalisation Master Plan in 2004. The plan was to migrate the terrestrial TV broadcasting platform from analogue to digital. Puncak Semangat (PS) was awarded the concession to build, operate and manage the infrastructure for 15 years in 2014 following a tender in 2012. Digital terrestrial TV broadcasting (DTTB):-

supports high-definition (HD) resolution TV channels and multichannel sound,

frees up frequency spectrums for more TV channels,

supports interactive services (e.g. news, VOD, games, T-commerce),

is compatible with mobile phones and other portable devices,

frees up frequency spectrums for 4G services such as LTE broadband.

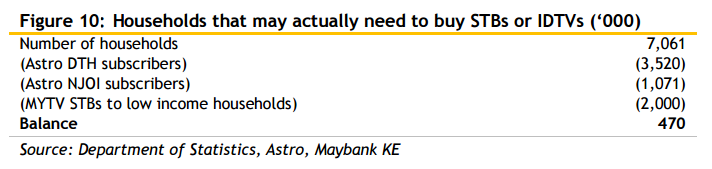

PS established MYTV Broadcasting (MYTV) to undertake the role of common integrated infrastructure provider (CIIP). Thereafter, PS transferred the concession to MYTV. MYTV commenced operations on Feb 2014 and has budgeted MYR4.5b to be expended over 15 years (MYR2.5b for opex and MYR2b for capex). The DTTB rollout commenced in Apr 2015 and Malaysia must be ASO (analogue switch off) ready by 2018 at latest. However, MYTV is targeting an earlier timeline for ASO by late 2016/early 2017. The threshold for ASO is 90% of the 7m Malaysian households adopting set-top-boxes (STB) or integrated digital tuner TVs (IDTV). The roadmap comprises:-

(i) Phase 1 - Targets to cover 85% of the population, focusing on the East Coast of Peninsular Malaysia such as Kelantan, Terengganu and Pahang. Testing commenced in Apr 2015 with 20,000 set-top-boxes (STB) and the coverage is expected to be achieved by Oct 2015.

(ii) Phase 2 – Targets to cover 98% of the population including the remaining states in West Coast of Peninsular Malaysia as well as East Malaysia. Testing commenced in Aug 2015 with 1,500 STBs and the coverage is expected to be achieved by Jul 2016.

6) HOSPITAL DEVICE/EQUIPMENT (Large) and with the initiative of paperless operation in government sector.

Have you check out the financial performance of JCY, DUFU, VITROX. The revenue & profit growth is significant! But i prefer GENETEC, WHY? Stay Tune for PART 2 soon.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Technology Hidden Gem or Germ

Discussions

MQTECH is in HDD business too. In fact is among the pioneers.

No wonder the price moving up none stop...

http://klse.i3investor.com/servlets/stk/0070.jsp

2015-10-05 18:57

HDD may not be in terminal decline, but it is not growing much either. The main reason is PC sales has slowed and even if there is growth, it is very sluggish. That's because more and more people are migrating to smartphones/tablets, and the latter does not use harddisk. Look at China, many new smartphone users have completely bypass PCs. So, while HDD may not be vanishing anytime soon, don't expect much growth either.

2015-10-05 19:07

JCY after so long still below 0.70, many other semi conductor related stocks oredi up kao kao.

2015-10-05 19:40

You. If the argument is HDD still sustainable, then why not buy jcy? Low debts, improving results, next few yrs going to automate more process!

2015-10-05 19:43

Hi sosfinance, it is one time write off for subsidiary in U.S, which they exit & close the manufacturing plant in 2013

2015-10-07 17:53

commercial hardisk will be replaced by Nand flash memory which is faster,reliable and smaller size compare to hardisk. Cost wise just matter of time to bring down.

I still remember my 8GB hardisk 15yrs ago is the same price as current 1TB HDD.

2015-10-07 22:32

stupid HDD not only for pc its for server also you have to understand that server demand

keep increasing every year especially we live in big data generation

2015-10-08 19:40

when running apps , website , data backup all need hdd ssd server to store & run .

2015-10-08 19:42

@daz, seems like there is trend that the directors are selling off their shares? does it concern u?

2015-10-09 15:27

agree with paperplane.......

why not buy industry leader JCY instead of also rans?

smaller and easier to goreng?

2016-02-13 13:49

sosfinance

@daz, thanks for such a detail write-up. Must have taken some time and effort

for the research and the write up. Do you mind to share a few years back, what was the reason the company made about RM25 million losses?

2015-10-05 18:39