VIETNAM BOT PPA SECRET REVEALED !

Gotyou

Publish date: Fri, 27 May 2022, 10:03 AM

Why is Jaks Hai Duong Power Plant (JHDP) under BOT contract in Vietnam guaranteed to make consistent profit over the concession period ?

The magic lies in the secret power purchase agreement (PPA) !

I was fortunate to come across one of the offer document of Mong Duong II which owns a 1,200MW coal fired power plant in Vietnam, Its BOT contract was awarded to AES Corporation in the same period as the 1,200MW Jaks Hai Duong Power Plant was awarded to Jaks Resources.

Below are extracts from the document which stipulates some of the critical terms and conditions in the PPA.

Electricity Tariffs

Payments under the PPA are denominated in USD and made in VND, using the US$/VND exchange rate provided by HSBC Vietnam one working day before payment by EVN is made. The Capacity Charge is paid based on availability guarantee, regardless of actual net generation. The Energy Charge and Supplemental Charge are paid based on actual net generation and other incurred charges, respectively.

The Capacity Charge is calculated by multiplying Dependable Capacity and the sum of Fixed Capacity Charge, Fixed O&M Charge and, for the first 13 years after COD, Supplementary Interest Charge. The Dependable Capacity is the amount of electrical generating capacity measured in kW that the BOT Company is capable of making available to EVN, as determined by annual Dependable Capacity Test in accordance with the PPA. The Fixed Capacity Charge (in US$ per kW per year) is a pre-agreed amount for each Contract Year. The Fixed O&M Charge, which includes a foreign and local component, comprises pre-agreed amounts (in US$ per kW per year and VND per kW per year, respectively) for each Contract Year. Each component is indexed to inflation in the United States and Vietnam, respectively. The Supplementary Interest Charge is a tariff adjustment to reflect the fluctuation in long term interest rates between the negotiation of the PPA and the financial close. The Supplementary Interest Charge is US$1.69 per kW per year multiplied by the ratio between current Contract Year Fixed Capacity Charge and first Contract Year Fixed Capacity Charge.

The Energy Charge comprises the Variable O&M Charge, the Fuel Charge and the Start-Up Charge. The Variable O&M Charge includes foreign and local components. They are equal to pre-agreed numbers (US$/kWh and VND/kWh, respectively), adjusted for inflation in the United States and Vietnam, respectively. The USD value of these components is then multiplied by the Net Energy Output delivered to EVN. The Fuel Charge is the multiplication of Net Energy Output and the sum of Coal Charge and Secondary Fuel Charge. The Coal Charge is equal to the Contract Heat Rate (in BTU/kWh, corrected for load, ambient air temperature and cooling water temperature) multiplied by the actual Coal Energy Rate (in VND per BTU) invoiced by the fuel supplier. The Contract Heat Rate is a pre-agreed number ranging from 9,405 BTU/kWh in the first Contract Year to 9,560 BTU/kWh in the later Contract Years. The Secondary Fuel Charge is equal to the Heat Rate for Secondary Fuel (a pre-agreed amount of 2,783 BTU/kWh, corrected for load, ambient air temperature and cooling water temperature) multiplied by the Secondary Fuel Price (in Dong per Kg) as invoiced by the fuel supplier, and multiplied by 0.000025. The start-up charge is payable for start-ups in excess of the yearly number of free start-ups. The start-up charge is equal to a pre-agreed number (in US$) for cold, warm or hot start-up and indexed to fluctuations in the price of heavy fuel oil and import electricity.

The Supplemental Charge is payable by EVN to account for any billing errors, adjustments for late payment, exchange rate, inaccurate metering, and any costs and charges payable to or by the BOT Company

Capacity, Availability and Heat Rate of our Plant

The terms of our PPA provide us with both capacity payments and electricity payments. A large portion of our revenue comes from the Capacity Charge, which is set at a level sufficient to cover fixed costs, debt service, taxes and to provide an adequate return to the Sponsors. The Capacity Charge is paid based on our maintaining availability of 1,120 MW. Our availability rates have exceeded the PPA target in every Contract Year since operations commenced, with an average availability of 91.8% during the first three Contract Years, compared to the 89.1% availability requirement specified in the PPA for those Contract Years. Under the PPA, we are given a certain allowance for outages in each Contract Year so outages do not affect the availability calculation for the Capacity Charge, except that we will be liable to pay liquidated damages to EVN if the sum of forced outages, maintenance outages and scheduled outages exceeds the yearly allowance for outages. We also intend to increase planned maintenance and reduce operating expenses by minimizing the excess availability above the PPA target.

The Contract Heat Rates determine the amount of fuel costs to be passed through to EVN. Our actual heat rates in Contract Years 1 and 2 were higher than the later Contract Heat Rates (corrected for load, ambient air temperature and cooling water temperature) due to challenges of optimizing combustion in the boilers and power usage of auxiliary equipment. In the case where our actual heat rates are higher than the Contract Heat Rates (corrected for load, ambient air temperature and cooling water temperature), the additional resulting fuel cost is borne by us.

Dispatch

The Energy Charge component of our tariff, which is earned only when the plant is dispatched, is designed to cover our variable costs and fuel cost and provides for adequate adjustments for ambient conditions and dispatch levels. EVN has full control over our dispatch, which drives our load factor. Being a coal-fired plant, our Power Facility is dispatched as a base load plant.

Under the PPA, when the plant is not dispatched by EVN (for example, if there is a reserve shut down at the request of EVN) or the plant is dispatched at less than the net Dependable Capacity, we are still paid the Capacity Charge component of the tariff and only the Energy Charge component is reduced since the Energy Charge is effectively a pass-through of the fuel cost and other variable costs incurred by actual operation. However, as we do not generate electricity for internal use during the reserve shut down period, we must purchase electricity for production, which will increase our cost of rendering of services.

Exchange Rate Fluctuations

The U.S. dollar is our functional and presentation currency. Payments under the PPA are made in VND, using the US$/VND exchange rate (“Project Exchange Rate”) provided by HSBC Vietnam as converting bank one working day before payment by EVN is made for the portion denominated in US$. The Project Exchange Rate is determined by reference to relevant exchange rates published by Vietcombank, Vietinbank and BIDV. We use a portion of the VND received to pay amounts owed to Vinacomin for coal and to meet other local expenses. We are entitled to convert the remaining VND into US$ in accordance with the Foreign Currency Regime, which is guaranteed under the Government Guarantee and Undertaking. The conversion occurs at the Project Exchange Rate that was used to convert the U.S. dollar denominated Tariffs into VND prior to the issuance of each monthly invoice. This has reduced the effect of exchange rate volatility on our results of operations. Portions of our Energy Charges under the PPA are denominated in VND but are pass-through payments for the VND-denominated coal costs and certain other local expenses and thus provide no foreign exchange exposure. As a result, we believe that our ability to convert VND into US$ under the PPA, as guaranteed under the Government Guarantee and Undertaking, provides a significant effective hedge against most adverse foreign exchange movements between the U.S. dollar and VND.

Taxation

The BOT Contract sets out the taxation regime applicable to us, including certain incentives, including that we are exempted from corporate income tax for taxable profit from the production and sale of electricity for the first four profit-making years, after which we will be subject to a 5% corporate income tax rate for the following nine years and a 10% corporate income tax rate thereafter. In addition, we are exempted from certain taxes and duties, including tax on technology transfer and withholding tax on interest payments.

Distribution

Our distribution policy is to distribute all available cash to our shareholders, subject to our financing agreements (including the BOT Company Loans). Pursuant to the foreign currency regime and the permissible payments thereunder contained in the Project Agreements, we are entitled to make quarterly and annual profit distributions to our shareholders, and are not limited to only annual profit distribution as ordinarily applicable to Vietnamese companies.

The Coal Supply Agreement

The coal supply agreement does not give us exclusive rights to coal from the nine mines, and Vinacomin may also use these reserves to supply other customers, provided that in a shortfall situation, delivery to the BOT Company must be prioritized over coal exports and supply to the BOT Company cannot be discriminated against as compared to supply to EVN or any other customers. If the reserves are insufficient to supply the Project, there are various mechanisms under the Coal Supply Agreement that are intended to ensure that our supply can be met, including an obligation of Vinacomin to, firstly, source from other mines or, secondly, supply higher grade coal at an agreed price. In certain cases of delivery failure by Vinacomin, we have the right to buy coal from other sources and obtain reimbursement from Vinacomin.

In addition, a failure by Vinacomin to supply coal will be a “Government Event” under the force majeure regime under the Coal Supply Agreement, the PPA and the BOT Contract (unless the failure is due to BOT Company breach, a Natural Force Majeure Event or a Foreign Political Event). In such circumstances, pursuant to the BOT Contract, the BOT Company will continue to receive the capacity charge and related tariff payments from the MOIT at the same level as were being paid by EVN under the PPA immediately prior to the occurrence of the Government Event.

Price and Payment Commitments

The Coal price is established on the basis of a Netback Contract Coal Price with adjustments for transportation and handling charges as well as standard moisture and quality adjustments. The Netback Contract Coal Price shall be the prevailing Government Coal Price (while coal prices are regulated for the electricity industry in Vietnam) or the prevailing Vinacomin Coal Price (when such regulation ceases). At all times this price shall not be higher than the price of coal of the same quality sold to any other power plants of EVN. The Prevailing Contract Price is calculated as the sum of the Netback Coal Contract Price, the Transportation Charge (7% of the Netback Coal Contract Price) and the Handling Fee (0.35% of the Netback Coal Contract Price), and adjusted for variations of moisture content, ash content, sulfur content and volatile matter.

Coal payments shall be invoiced monthly with payments due in Dong. If a failure by the BOT Company to pay an invoice is due to a failure by EVN to pay the BOT Company, in breach of the PPA, then the BOT Company can claim that a Government Event exists.

Replacement Coal

In certain cases of delivery failure, the BOT Company has the right to buy coal from other domestic or foreign sources. Such purchase is subject to the prior approval of MOIT which is not to be unreasonably withheld. Vinacomin shall pay to the BOT Company the difference between the Prevailing Contract Coal Price, had it purchased such coal under the CSA, and the price paid by the BOT Company (the “Differential Cost”). The total Differential Cost payable by Vinacomin in any Contract Year shall not exceed a maximum of 3% of the total payment receivable by Vinacomin from the BOT Company for such Contract Year.

Joint Venture Agreement

Certain actions and decisions require the unanimous vote of all Voting Representatives attending a quorate Members’ Council meeting. The list of Unanimous Reserved Matters is relatively long and includes without limitation:

- dissolving, liquidating or petitioning to wind-up the BOT Company;

- amending or supplementing the BOT Charter, or changing the objectives of the BOT Company;

- approving the sale and acquisition of assets of the BOT Company the value of which is equal to or exceeds fifty percent (50%) of total assets of the BOT Company;

- approval of the annual business plan of the BOT Company and the Budget;

- entering into related party transactions in excess of US$1 million (or in a yearly aggregate in excess of US$2 million) by the BOT Company with a Member or Member Affiliate, and any shareholder loan;

- waiver of any right of the BOT Company under any agreement entered into with a Member;

- agreeing to the sale, transfer, lease, assignment or disposal of any material part of the BOT Company’s assets or interests in excess of US$25 million, other than in the ordinary course of business;

- retention of earnings instead of distribution of profits when the BOT Company has Cash Available for Distribution;

- repurchase of the BOT Company’s own Interests or other return of Charter Capital to the Members or any other increase or reduction of the Charter Capital (or comparable creation of equity interest in the BOT Company);

- approval of the audited accounts of the BOT Company, or agreeing a change of the Financial Year;

- any merger, spin-off, reorganization or acquisition by the BOT Company or entry into any joint venture, partnership or collaboration;

- appointment, dismissal or replacement of a Representative, the CEO, the CFO, an Inspector or other executive positions pursuant to the JVA terms;

- entry into any material contracts or commitments, or variation, waiver or amendments of the Project Contracts, in each case in excess of US$25 million, other than in the ordinary course of its business;

- the commencement or settlement of any litigation, arbitration or other proceedings which are material in the context of the Project or the BOT Company;

- the granting of guarantees or indemnities for or that otherwise secure the liabilities or obligations of any person, or the creation of any security interest, except in the ordinary course of business or under the Financing Documents; or

- entering into any loan to a third party.

Any matter which is approved in a Budget and has a value equal to or less than US$15 million (subject to inflation), shall not require a separate further approval as a Unanimous Reserved Matter.

Management Control of BOT Company: The AES Investor, as the Member holding the largest Interest, is entitled to appoint the CEO and the Chairman of the BOT Company and POSCO, as the Member holding the second largest Interest, is entitled to appoint the CFO of the BOT Company. The day to day affairs of the BOT Company shall be managed by the CEO in accordance with the BOT Charter, the BOT Contract and the JVA.

These terms and conditions of the PPA shows that power plants awarded under BOT contracts by the Vietnam Government are most certain to generate consistent revenue for the operator during the 25 years concession period as what DK sifu has always been trying to tell the i3 forum.

I leave it to you to do the interpretation. For me, I m convinced that JHDP's future income stream is GUARANTEED regardless of operation as long as the power plant is kept in good working condition.

Is Jaks Resources too cheap to ignore ?

Jaks Resources owns 30% of 2 x 600MW coal fired Jaks Hai Duong Power Plant (JHDP) in Vietnam costing USD1.87 billion under BOT contract (Build-operate-transfer) for 25 years. Jaks has the option to increase its ownership in JHDP to 40% within 3 years of commercial operation.

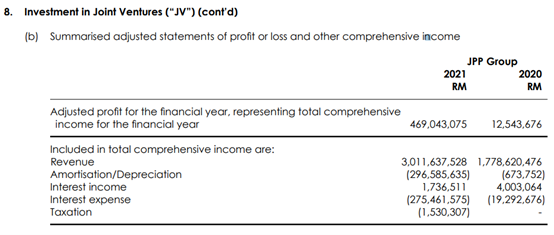

Unit 1 and 2 of the power plant achieved commercial operation in Nov 2020 and Jan 2021 respectively. The results of its operation were reported in the 2021 Annual Report as below.

Jaks’ 30% share of the profit in 2021 was RM141m (RM469m x 30%) with an annual free cash flow of RM230m (add back depreciation of RM296m x 30%). After Jaks increased its ownership in JHDP to 40%, the share of profit and free cash flow will be RM187m and RM306m respectively.

Does a company with annual free cash flow of RM300m for 25 years worth merely RM570m (current market capitalisation) !?

At current price of RM0.28, RM187m profit over 2 billions outstanding shares gives an EPS of 9 cents and a forward PE of 3 times. Given Malakoff's 10 times PE , Jaks should be trading at RM0.90.

Decision is entirely yours.

Happy investing!

Thank you

PS we shall see if JHDP will continue to deliver consistent profit in the coming results announcement amid the high cost environment as proof of protection provided by the PPA.

Disclosure : The writer has just bought Jaks

This article is purely for educational purposes. This is not a buy or sell recommendation ! You should consult your dealers or remisiers before making any decision.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Please Explain !

Created by Gotyou | Aug 10, 2023

Created by Gotyou | Jul 19, 2023

Created by Gotyou | Jan 03, 2022