PLEASE EXPLAIN THE DISCREPANCY !

Gotyou

Publish date: Sat, 12 Jun 2021, 10:45 PM

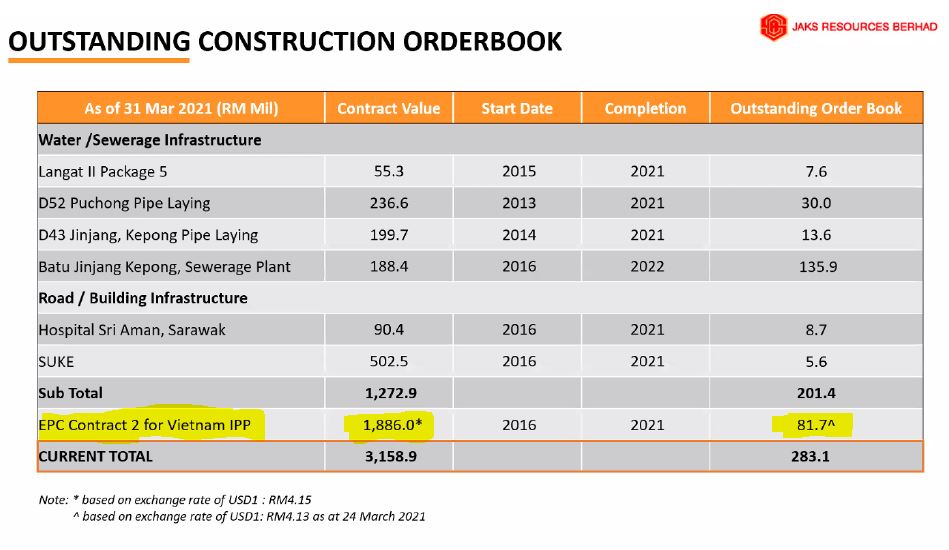

This article is about Jaks Resources' outstanding order book.

I attended the webinar hosted by Rakuten Securities with the CEO and CFO of Jaks Resources on 10th June 2021. I came out of the webinar with one question and a skeptical answer.

QUESTION : The sum of Vietnam EPC contract revenue recognised was RM1.7 billion as stated in the 2020 Annual Report, hence balance of order book should be RM186 million (RM1,886m - RM1,700m). Why is the oustanding order book from EPC contract 2 for Vietnam IPP only RM81.7 million as per the presentation slide?

ANSWER : Could be due to the fact that the revenue recognised was at different forex rates at the point of recognition.

I decided to look into it .....

Source : Jaks' presentation slide during webinar with Rakuten Securities at 8:00pm on 10th June 2021

Checking on Contract value of EPC Contract 2

Source : Circular to shareholders dated 28th August 2015

https://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=171520&name=EA_DS_ATTACHMENTS

USD454.5 million x 4.15 = RM1,886 million (Tally with management presentation)

Compiling Revenue recognised under EPC contract 2

For Year 2016

Source : https://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=195054&name=EA_FR_ATTACHMENTS

For Year 2017

https://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=199932&name=EA_FR_ATTACHMENTS

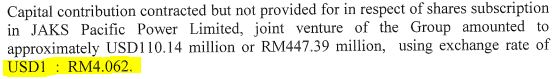

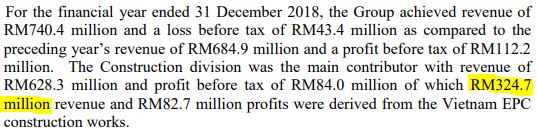

For Year 2018

https://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=204417&name=EA_FR_ATTACHMENTS

For Year 2019

https://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=208826&name=EA_FR_ATTACHMENTS

For Year 2020

Source : 2020 Annual Report page 16

https://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=208933&name=EA_DS_ATTACHMENTS

https://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=213646&name=EA_FR_ATTACHMENTS

As the EPC contract 2 was awarded in USD, the revenues recognised in MYR are translated to original USD amounts to compute the oustanding order book in USD.

Method 1

The revenues recognised are translated to USD using the year end forex rates adopted by Jaks in the respective years to derive the oustanding order book in USD.

|

Year |

Revenue (RM’m) |

Exchange Rate |

Revenue (USD’m) |

|

2016 |

150.1 |

4.486 |

33.46 |

|

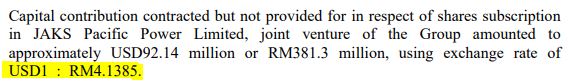

2017 |

251.2 |

4.062 |

61.84 |

|

2018 |

324.7 |

4.1385 |

78.46 |

|

2019 |

817.6 |

4.0925 |

199.78 |

|

2020 |

159.1 |

4.013 |

39.65 |

|

Total |

1,702.7 |

|

413.19 |

Total contract value = USD454.5m

Less : Total revenue recognized = USD413.19m

Total Outstanding order book= USD41.31m (RM170.61m)

Method 2

Another way is to translate the revenues to USD using the average forex rates of the respective years to derive the oustanding order book in USD.

Average exchange rate of Malaysian ringgit (RM) to U.S. dollar (US$) from 2014 to 2020

Source : https://www.statista.com/statistics/863826/malaysia-exchange-rate-between-ringgit-and-us-dollar/

|

Year |

Revenue (RM’m) |

Exchange Rate |

Revenue (USD’m) |

|

2016 |

150.1 |

4.15 |

36.16 |

|

2017 |

251.2 |

4.3 |

58.42 |

|

2018 |

324.7 |

4.04 |

80.37 |

|

2019 |

817.6 |

4.14 |

197.48 |

|

2020 |

159.1 |

4.25 |

37.43 |

|

Total |

1,702.7 |

|

409.86 |

Total contract value = USD454.5m

Less : Total revenue recognized = USD409.86m

Total Outstanding order book= USD44.64m (RM184.36m)

Note that the total revenue recognised in MYR term of RM1,702.7 million concurs with the figure stated in the 2020 annual report.

To conclude, it seems unjustifiable to explain the large discrepancy in the context of forex differences. Jaks' management should provide more clarity on the apparent "missing" order book of around RM100 millions especially in the light of recent developments in the corporate malaysia.

Thank you.

A concerned shareholder

This is not a buy or sell recommendation ! You should consult your dealers or remisiers before making any decision.

|

Year |

Revenue (RM’m) |

Exchange Rate |

Revenue (USD’m) |

|

2016 |

150.1 |

4.486 |

33.46 |

|

2017 |

251.2 |

4.062 |

61.84 |

|

2018 |

324.7 |

4.1385 |

78.46 |

|

2019 |

817.6 |

4.0925 |

199.78 |

|

2020 |

159.1 |

4.013 |

39.65 |

|

Total |

1,702.7 |

|

413.19 |

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Please Explain !

Created by Gotyou | Aug 10, 2023

Created by Gotyou | Jul 19, 2023

Created by Gotyou | Jan 03, 2022

Discussions

The total contract value of the EPC, as per the presentation, still remain at RM1886m indicating that there is no contract variation.

2021-06-13 09:28

only invest in a company's business that you can understand. Stay away from those complicated matters and euphoria bandwagon like the steel companies(except tin mining) currently.

2021-06-13 10:04

Just88

Due to contract variation ?

2021-06-13 09:25