JAKS RESOURCES - ANOTHER RIGHTS ISSUE ?

Gotyou

Publish date: Wed, 14 Jun 2023, 07:10 PM

Does Jaks need to make another cash call to subscribe for additional 10% ownership interest in JHDP which costs around USD50 - 55 millions (RM230 - 250 millions) ?

Background :

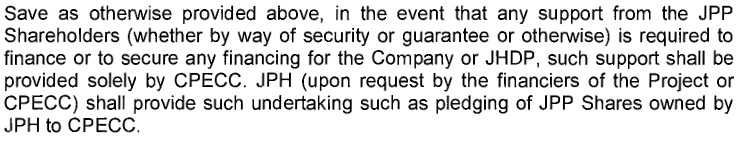

Jaks has the option to purchase 25% of the RCPS from CPECC when all the RCPS is due for conversion into 40% equity ownership 3 years from the commercial operation date on 25th Jan 2024. 25% RCPS will convert into additional 10% ownership in JPP for JAKS. The purchase price was agreed at costs plus holding costs. 25% RCPS costs USD46.71 millions plus 3 years of interest costs at estimated 5% per annum sums up to around USD54 millions.

当地时间1月25日0时,由中国能源建设集团投资公司投资建设,西南院和中国能建国际公司总承包,安徽电建一和安徽电建二公司承建,科技发展公司负责调试运维一体化的越南海阳2×60万千瓦燃煤电站2号机组,正式投入商业运行。

The short answer is “Very Likely”

Base on Jaks' RM156 millions earnings from 30% interest in JHDP for Year 2022, 10% ownership interest will yield around additional RM50 millions earnings to Jaks. As the capital payback period is less than 5 years, there is no reason to let the option lapse in Jan 2024. The only question is the source of funding. I believe another cash call is highly likely due to the reasons below.

Reason 1 : Jaks has no unrestricted cash balances.

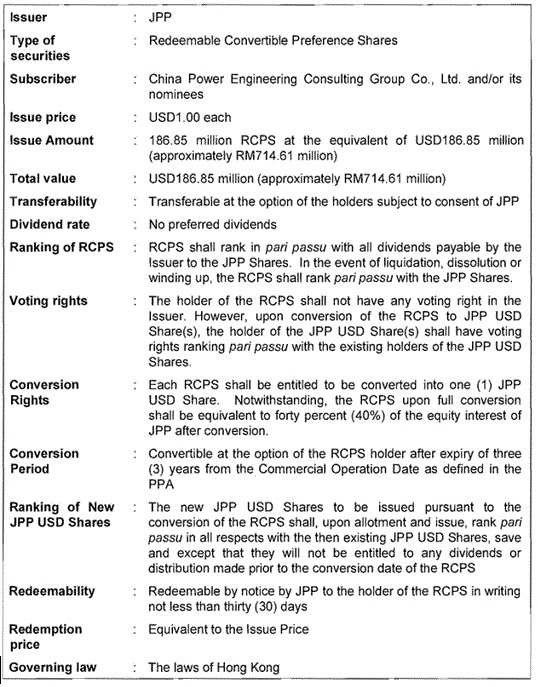

Cash and bank balances as at 31st March 2023 (RM’000)

Dividend received from JHDP of RM70 millions in Q4 2022 has been fully utilised mostly for the LSS4 solar project, working capital and repayment of bank borrowings.

The cash and bank balances of RM54 millions were held as security or reserved for specific purposes.

Reason 2 : Jaks has negative cash flow for many years.

Just to name a few cash outflow items in year 2022 which are likely to continue into year 2023,

As disclosed in the 2022 annual report,

· Jaks has operation loss of around RM17 millions

· Interest payment of RM21 millions

· Term loan amounting to RM18 millions due within next 12 months

· Solar LSS4 project accumulated cost as at 31st Dec 2022 was RM142 millions at 77% completion. 23% balance work will require additional RM42 millions. RM31 millions were spent on the project in Q1 2023. Therefore, LSS4 project requires additional RM11 millions to complete.

A private placement was carried out in May 2023 and raised around RM24 millions.

To sum up, at least additional RM43 millions is still needed for operation in year 2023. This has not included other items such as working capital requirements and the additional interest expenses due to higher interest rate.

Reason 3 : Further large bank financing is unlikely.

Bank borrowings as at 31st march 2023 (RM’000)

Around RM132 million bank financing was obtained in year 2022 for the LSS4 solar project and another RM8 millions revolving credit was taken for working capital purposes.

As disclosed in the 2022 annual report, total bank borrowings as at 31st March 2023 was RM500 millions. Except freehold buildings (RM67 millions) which are in the progress of issuance of strata titles, all Lands, solar assets, investment properties including the malls, business center, condominiums, and the car parks as well as their present and future cash flows have been pledged for bank borrowings.

Even certain directors have offered personal guarantees. Generally, directors are reluctant to provide personal guarantee for company's loans.

Source : Annual report 2022

The term loans, bill payables, trade commodity financing, revolving credits, factoring payables and bank overdrafts of the Group and of the Company are secured by the following:

(i) fixed charges over certain agricultural land and investment properties as disclosed in Note 4 and Note 5;

(ii) legal assignment of all cashflows, sale or tenancy agreements, insurance policies, construction contracts, construction guarantees and performance bonds in relation to a project developed by certain subsidiary companies;

(iii) fixed and floating charge over the present and future assets of certain subsidiary companies;

(iv) first legal charge over the equity acquired in a subsidiary company;

(v) facilities agreements together with interest, commission and all other charges thereon;

(vi) assignment over proceeds under certain invoices, contracts, Letter of Notification and Letter of Instruction;

(vii) assignment of all dividends and/or distribution from a subsidiary company’s shares;

(viii) negative pledge over certain subsidiary companies’ assets both present and future;

(ix) corporate guarantees provided by the Company, a subsidiary company, and a non-controlling interest;

(x) personal guarantee by certain Directors of subsidiary company;

(xi) deposits, debt service reserve, housing development account, project development account, esrow, operating account and revenue account as indicated in Notes 18 and 19;

(xii) specific debenture by way of fixed and floating charge over investment properties as disclosed in Note 5;

(xiii) lodgement of private caveat over strata titles of the investment properties as disclosed in Note 5;

(xiv) legal assignment of the present and future proceeds from the car parks’ and investment properties’ rental income of certain subsidiary companies; and

(xv) first legal charge over all its unencumbered shares of a non-controlling interest of a subsidiary company.

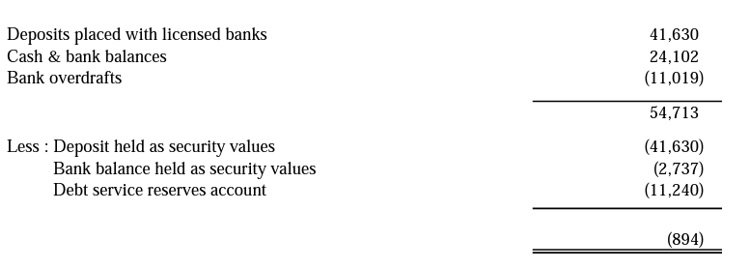

Source : Circular to Shareholders 2015

CPECC was solely responsible for securing project financing for JHDP and hence mostly likely would have required Jaks to pledge its shareholdings in JPP to CPECC as collateral.

Therefore, it seems that Jaks has very limited unencumbered assets to pledge for further substantial borrowings.

Globally, banks are currently facing rising problems with their commercial property loans portfolio. Higher loan loss provisions are expected going forward. Hence, additional borrowings with commercial properties would be difficult in the near future.

Reason 4 : Very difficult to leverage on the future dividend stream from JHDP for bank financing due to ESG concerns and cross border lending regulations.

With potential RM150 millions to RM200 millions of prospective dividend from JHDP, Jaks could easily obtain bank financing by pledging its future dividend from JHDP.

However, the complexity in obtaining lending approval for acquisition of cross border coal based assets may be a big deterrent for the management. Just look at Toyoven which has already waited for more than half a year trying to get Exim Bank Malaysia to finance its 2000MW coal power plant in Vietnam and yet now still waiting.

The ESG concerns on coal fired power plants are putting a lot of banks on the fence.

Current high interest rate is another factor to consider for bank financing.

Reason 5 : Dividend from JHDP in year 2023 is unlikely to be sufficient.

Retail investors have high hope that the future dividend distribution from JHDP will provide sufficient financial resources to subscribe for the 10% option. Lets see whether that is feasible.

Source: Mong Duong II JV agreement

Joint Venture Agreement : Certain actions and decisions require the unanimous vote of all Voting Representatives attending a quorate Members’ Council meeting. The list of Unanimous Reserved Matters is relatively long and includes without limitation:

· retention of earnings instead of distribution of profits when the BOT Company has Cash Available for Distribution;

The JV agreement between CPECC and Jaks on the distribution of earnings is such that unless unanimously agreed by all the directors of JPP, all unrestricted cash shall be distributed.

It is also in the best interest of CPECC to ensure maximum distribution before Jaks acquired additional 10% ownership as all remaining cash shall be distributed according to the new economic interest of the shareholders.

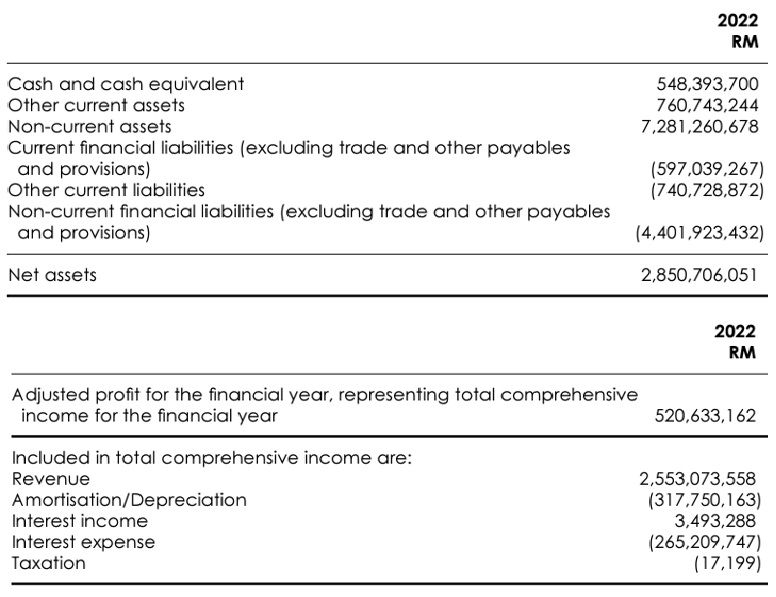

Based on Jaks’ 2022 annual report, JPP has a cash balance of RM548 millions. How much of the cash balance is available for dividend distribution?

The cash balance of RM548 million as at 31st Dec 2022 is mainly reserved for repayment of bank instalments and working capital purposes. Based on Mong Duong II coal fired power plant loan agreement, the borrower needs to retain 6 months of bank repayment instalments at all time.

JPP has current liabilities excluding trade and other payables of RM597 millions which is likely to be the amount of bank instalments payable within 12 months. The interest expense for year 2022 was RM265 millions and it is expected to be around the same amount for year 2023. The total bank repayment and interest payable in 2023 is expected to be RM862 millions. Hence, the cash reserve for 6 bank instalments is RM431 millions.

Thus, there is a balance cash (after instalment reserve) of RM117 millions in JPP to meet working capital requirements. Idle cash available for distribution, if any, will not be significant.

Therefore, when JPP distributed a total of RM233 millions (RM70 millions to Jaks) dividend in Q4 2022, it is in line with the dividend policy to distribute all unrestricted cash balance to shareholders.

As the option expires in Jan 2024, there is potential distribution of power plant earnings generated in year 2023. Taking earnings of RM28 millions for Q1 2023 as a guide, Jaks’ potential dividend from JHDP before Jan 2024 could be up to RM112 millions (RM28m x 4). The lower projected earnings for year 2023 is due to higher USD interest rate as cited by the management in its first quarter results.

Conclusion :

Jaks may require up to RM290 millions for its current year’s expenditure and to take up additional 10% ownership in JHDP.

Given the potential dividend of RM112 millions from JHDP as the only source of business income, cash calls seem a very likely option for Jaks to make up the shortfall.

Given the magnitude of the cash requirements, a rights issue may be in the pipeline.

On second thought :

Even if bank financing for the 10% option is feasible, Jaks may still opt for cash call because;

1. It is interest and obligation free money,

2. With JHDP as the only source of cash inflow, It is risky to further increase bank borrowings,

3. It is balance sheet positive as it increases net asset value, lower gearing, and improves cash flow,

4. It has good grounds for making cash calls – for earnings expansion, and

5. It provides opportunities for those who wish to increase shareholding at lower prices.

Why is a large cash call via rights issue a nightmare for minority shareholders ?

1. There are retail investors who do not have excess money to take up the right issues. Hence, they will have to sell their shareholdings at least partially to raise funds for the right issues. Otherwise, their interests will be diluted substantially. This will result in substantial downward pressure on the share price.

2. The drop in share price will in turn lead to certain retail investors facing margin calls in their pledged securities accounts. Force selling will lead to further downward pressure on the share price.

3. Rights issues are normally done at prices substantially lower than current market price to attract shareholders to subscribe. This will push Jaks' share price deeper into the territory of penny stock.

4. During the renounceable rights trading period, some rights holders might decide not to subscribe and sell the subscription rights in the open market. This will create selling pressure on the mother shares as some shareholders may sell their mother shares and buy the subscription rights for arbitrage gains especially if the rights issue comes with free warrants.

Therefore, minority shareholders have to be prepared for a substantial drop in share price from the day the rights issue is proposed until the day it is completed. Normally, it takes up to 6 months to complete a right issue exercise.

For illustration purposes only;

Rights shares are generally offered at a discount of around 30% to theoretical ex-right price (TERP) to attract subscription.

For example, if the Volume weighted average price (VWAP) of Jaks share at the price fixing date is RM0.18, a 1 for 1 right issue will fix the offer price at RM0.1 being 28.6% discount to the TERP of RM0.14. This will raise a proceeds of around RM220 millions.

However, if the VWAP is lower at RM0.15, a 3 for 2 rights issue at RM0.07 subscription price (31.3% discount to TERP of RM0.102) will raise around RM230 millions.

This article merely provides a general analysis of the prevailing circumstances which may not be conclusive, and the conclusion derived may be circumstantial. Readers are strongly advised to exercise due diligence as well as seeking professional advices before making any decision.

I do not own any share in Jaks at the time of writing and this article is intended to give a heads up alert to investors. I have no intention to cause panic.

Thank you for reading.

GOTYOU

PS: Special thank to Sifu DK for his validation and contribution to this article.

This article is purely for educational purposes. This is not a buy or sell recommendation ! You should consult your dealers or remisiers before making any decision.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Please Explain !

Created by Gotyou | Aug 10, 2023

Created by Gotyou | Jul 19, 2023

Created by Gotyou | Jan 03, 2022

Discussions

Thanks Gotyou, really appreciate your effort to explain in depth the cash situation of Jaks.

2023-06-16 16:56

It's Compounding, you're welcome. Jaks cash management is very poor thus had to carry out multiple equity funding raising exercises. This is detrimental to minority shareholders having their shareholding diluted many rounds. Jaks' share price has fallen to less than RM0.20, another round of large equity rights issue will likely halves the market price.

2023-06-16 17:31

Gotyou

Thanks for your detail figure particular on information related to power plant financial report and possible right call due to detail in restricted on retain earning which make jaks insufficient to subcribe 10% stake. I have tried many time to cut at 19sen, but ended cut all at 18.5sen to free up capital

2023-06-20 22:39

Apa speculation u on what are in the other current assets 760k?

U ada anything on how fast EVN is suppose to pay JPP? 1 2 3 4 5 bulan?

Oso ada ka EVN has been paying JPP tepat pada masa nya mengikut tempoh?

2023-06-23 09:57

Gotyou

I think Jaks management should clarify on the source of funding for the 10% optional interest in JPP.

2023-06-14 19:55