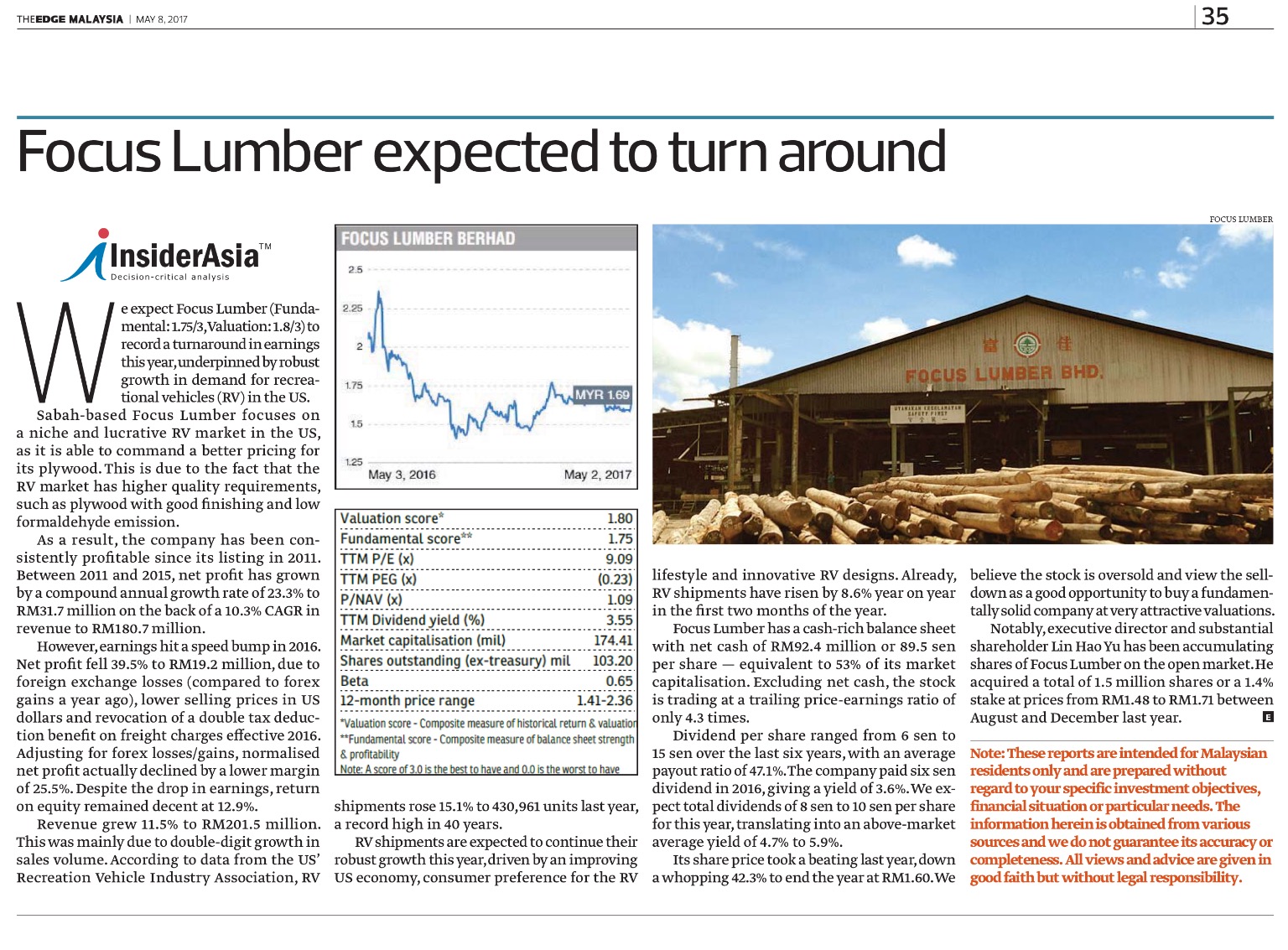

Insider Asia: Focus Lumber expected to turn around (The Edge weekly)

greatnz

Publish date: Sun, 07 May 2017, 01:45 PM

In The Edge magazine today!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

Discussions

Fengsui master said tis year no good for timber n wood related counters... It is realy true cos none of the timber or wood related counters moving.. All dead

2017-05-07 14:56

"At RM1.72 now, I think Focus Lumber is a great value stock to invest for long term. But why is there no interest in this stock? Once bitten twice shy?" -Master sifu kcchongnz

2017-05-07 15:43

Lets prove fengshui master oversight........

His vision blocked by the trees in the woods.....

Strong winds and rains......now the clouds clear....

Timber and wood stocks in great demand and prices are now excellently good!!!

Selling for good USD ......

2017-05-07 15:48

Flbhd is awakened and will challenge its previous highs

thank god oldman is no longer a significant shareholder

2017-05-07 15:50

If no oldman, susah to go up... Timber stocks in great demand? Look at taann.. The taiko of timber.... Stagnant

2017-05-07 16:08

Top 30 shareholders, no kyy, no instituional funds.. Less than 60% take up, how to go up?! Hsrapkan ikan bilis, nai 10sen oredi sell like no tomorow

2017-05-07 18:27

Wah mr tong buy a lorry load......? Sure grill time dun know when mr Lin also buying all the best

2017-05-07 19:54

This Focus lumber has been so long exists as a strong fundamental company.

market now damn funny, when articles being released only people come into goreng .

no wonder so many articles nowadays simply just to push the counters that the author bought at low

2017-05-08 20:24

I have been buying value stocks temporarily as growth stocks like JHM and Pentamaster seem expensive now. Value stocks have not been popular this year,so they are very cheap now. Value stocks like Hexza and Engtex are good buys.

Additionally, you should buy export-oriented stocks.

2017-05-08 23:25

Agreed. all aim on Goreng , later u tell them dont goreng, they shoot you show off their gains, when get trapped, then they complaint to you.

LOL

Goreng is like Gambling, this year you earn 1m in goreng, next few years you lose back 10m in goreng.

2017-05-08 23:48

Expensive growth stocks are very vulnerable to risk-off sentiment. That's why you need to be careful. 20-30% of price correction is possible. You can buy those expensive growth stocks when risk -off sentiment prevails. In contrast, value stocks are not valunerable to risk-off sentiment.

2017-05-08 23:53

Even Wall Lone Bufett admits his mistake

You i3 value investors have not admitted to your mistakes yet.

This FL, not sexy, and when lumber runs out, it is end .

compare this to a good technology stock.

2017-05-09 00:11

lets say you buy 2 technology stocks now.

One up 300% by year end

one goes to zero

You are still better than buying 2 FL.

smart people knows this equation long long time ago.

2017-05-09 00:25

manny showed its dumb thinking here again...sien. macam moral teacher saya. boring la uncle.

2017-05-09 00:30

Remember, technology stocks is a hype for now, not all have substance. . Can you foresee their revenue and profit? Their earnings are mostly not consistent. Once the music chair stops, there goes your investment

As for flbhd, you can see the cash is there, the revenue and profit consistent, hard to go wrong

2017-05-09 00:32

I forgive you, dumb dumb.

One life time of bad habits not easy for you to change......

hahahahahahaha

But even Wall Lone Buffalo admitted this week end he was wrong.

2017-05-09 00:39

For manny, on early part of his life maybe perhaps he miss lots of G spot. Now keep on mentioning X factor. Actually, he mix up both as himself is not able to explain it properly. Well, miss is a miss. Move on. Dont keep harping on that thing. Not good for you, uncle.

2017-05-09 00:42

X factor is not lucky shot. It is hard work...and IQ.

Cockcroach > May 9, 2017 12:32 AM | Report Abuse

Remember, technology stocks is a hype for now, not all have substance. . Can you foresee their revenue and profit? Their earnings are mostly not consistent. Once the music chair stops, there goes your investment

2017-05-09 00:46

I want you to figure out the X factor...that way, you will benefit more.......I very generous one.

cheoky > May 9, 2017 12:42 AM | Report Abuse

For manny, on early part of his life maybe perhaps he miss lots of G spot. Now keep on mentioning X factor

2017-05-09 00:48

Anyone interested in Franklin Templeton talking about Dynamic Investing??

Franklin Templeton's Perks' Dynamic Approach to Investing

12:24 AM MYT

May 9, 2017

Share on FacebookShare on Twitter

Ed Perks, chief investment officer of FT Investment Solutions at Franklin Templeton's multi-asset group, discusses investing in the current political and economic climate. He speaks on "Bloomberg Markets" on May 5. (Source: Bloomberg)

2017-05-09 00:52

moneySIFU

Like

2017-05-07 14:27