SCGM: Growth Not So Sure

HauToInvest

Publish date: Tue, 29 May 2018, 06:07 AM

- Sales in the last three quarter flatten while productive assets is historically high

- Historically low asset productivity (EPM assets turnover is estimated to be 3.73 only)

- Something is very wrong and SCGM management should tell us more about this

Much discussions on recent financial results of SCGM have been focused on material costs and gross profit margin. While these metrics are very important in measuring financial performance, they are not really under control by the management in the short run. In the long run, material cost increase will gradually pass to the consumers. When Maersk Line raises shipping rate driven by bunker price surge, consumers have to prepare to pay more for their goods. Rather, I would concern more on sales growth of SCGM.

Sales growth not materialized

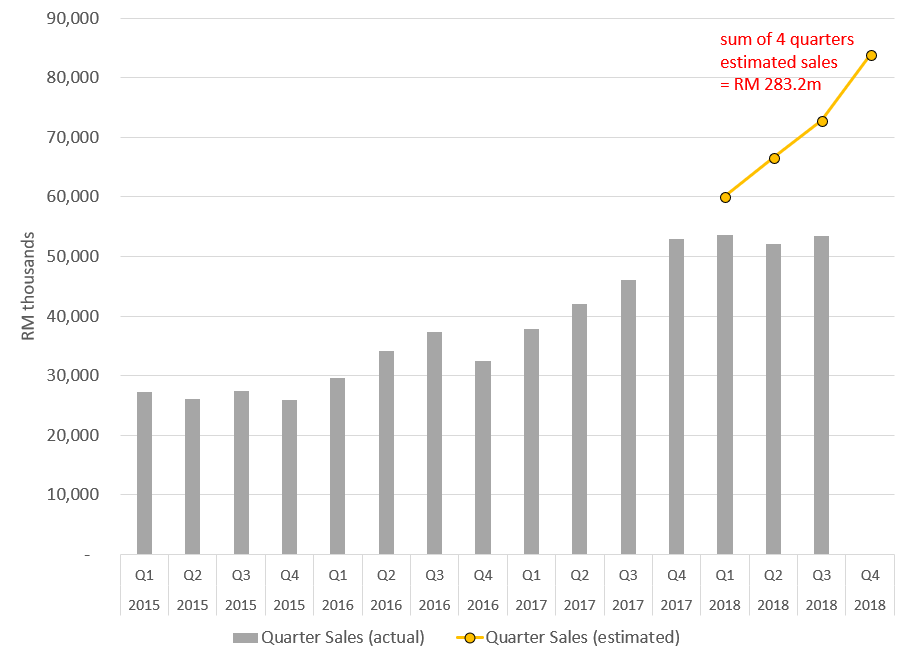

Last summer, I applied a capacity-led growth model and attempted to project future sales of SCGM based on its guidance on capital expenditure on equipment, plant and machinery (EPM). The estimated sales of FY2018 is RM 283.2m. Since then, three quarters have passed and its sales did not pick up as projected. Something is very wrong. But what is it?

Historical low EPM assets turnover

Sales was projected based on a simple relationship. In particular,

Sales (FY2018) = EPM assets (FY2017) * EPM assets turnover

From the balance sheet of FY2017, EPM assets was RM 57m. For EPM assets turnover, Hau’s view assumed it to be 5.0 in last July. Accordingly, sales was projected to be RM 283.2m. However, the last three quarter sales flatten; if this trend continues, EPM assets turnover would be estimated to be 3.73 only! It is much lower than the historical low of 4.48 in the past ten years.

We can expect SCGM management should tell us more about what has happened in the coming final results announcement. Meanwhile, I will try to analyse and list the possible causes of so low asset productivity in my next post.

Disclaimer

All articles in this blog are intended for research and educational purposes only. Materials in these articles including, but not limited to, graphs, tables and screen shots featuring investment data are not recommendations to buy or sell. The investment analysis, information, and related comments may be out-of-date when you read them. You should do your own due diligence into any investment before making the decision to buy or sell. While we aim to provide accurate data to assist you in performing your stock valuation, we do not take responsibility of any inaccurate or omitted data. Please verify them. We are not liable for your investment losses.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Hau To Invest (Malaysia)

Discussions

@ Itg100y, considering the volume data in since August 2017 to the present, there was not really significant numbers of shares traded compared to 2014.

2018-05-31 17:18

Hi Mr Lau

I am Dave from SCGM Bhd. Kindly email me at davidcheng@scgmbhd.com

I would like to meet you to discuss and feedbacks our commemt

Thank you

2018-06-02 13:23

ltg100y

Looks like quite many people have the same concern, why SCGM capacity increase so much but sales didn't improve. If lunch box's sales is increasing, but overall sales maintain, is it means that other products sales volume drop or market share drop?

if look at the past few months share price collapse, it means that some funds already know the problems of SCGM so sold out but the management still not tell the truth to retails shareholders?

2018-05-29 20:04