SCGM: An Educated Guess

HauToInvest

Publish date: Sun, 10 Jun 2018, 08:30 PM

- An educated guess is that the new productive assets might have some issues that held back production schedule

- As revealed in some figures, workers in the production lines and their supervisors were probably under high pressure

Here I attempt to make an educated guess on what caused recent low productivity. As I has proposed last year, “equipment, plant and machinery” are the productive assets that we can make use of to build a relationship with sales. By definition,

EPM Asset Turnover = Sales / EPM Assets

EPM Asset Turnover is estimated to be 3.73 for FY2018. Hau’s view expected 5.0 in last year assessment. So, this estimate (3.73) is roughly 25% lower than expected (5.0). How to explain this 25% shortfall?

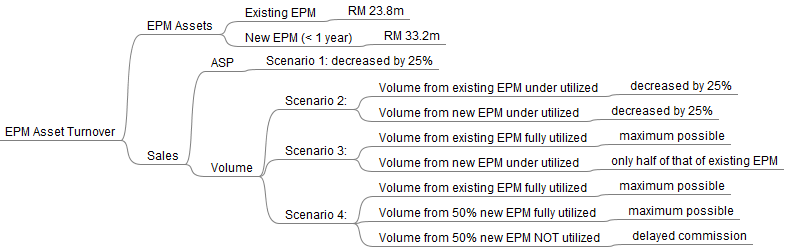

Production volume from new EPM asset might be the cause

Under this simple framework, I create a mindmap as shown below to analyze the cause and list four possible scenarios. From the balance sheet of FY2017, it is known that the existing EPM has book value of RM 23.8m after accounting for depreciation and new EPM added in FY2017 has book value of RM 33.2m, totally RM 57m. This is clear.

What is less clear is sales. Sales can be decomposed into average selling price (ASP) per unit and volume; that is:

Sales = ASP x Volume

Under sales, there are at least four possible scenarios.

Scenario 1: ASP is decreased by 25% while volume is unchanged

Scenario 2: Volume from both existing and new EPM was decreased by 25% while ASP is unchanged

Scenario 3: Volume from existing EPM is maximum (as reported by PublicInvest) and volume from new EPM is only half of that of exiting one

Scenario 4: Volume from existing EPM and 50% of new EPM are maximum and the remaining 50% of new EPM has not yet started production

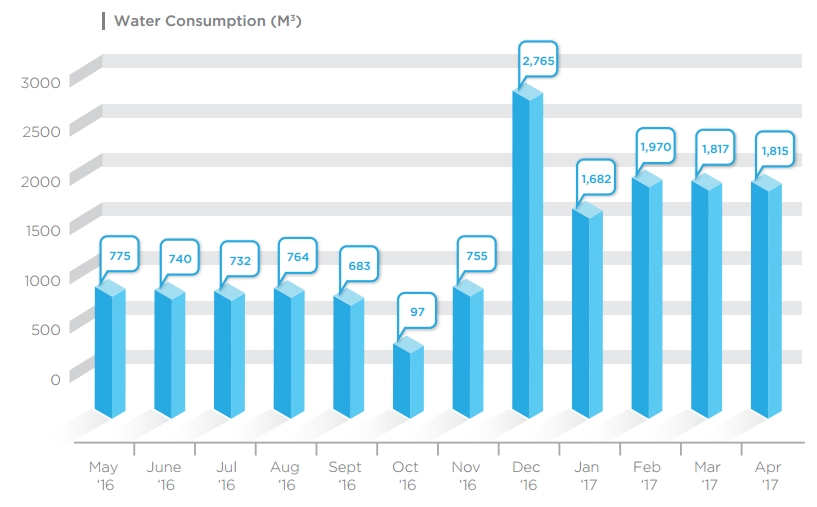

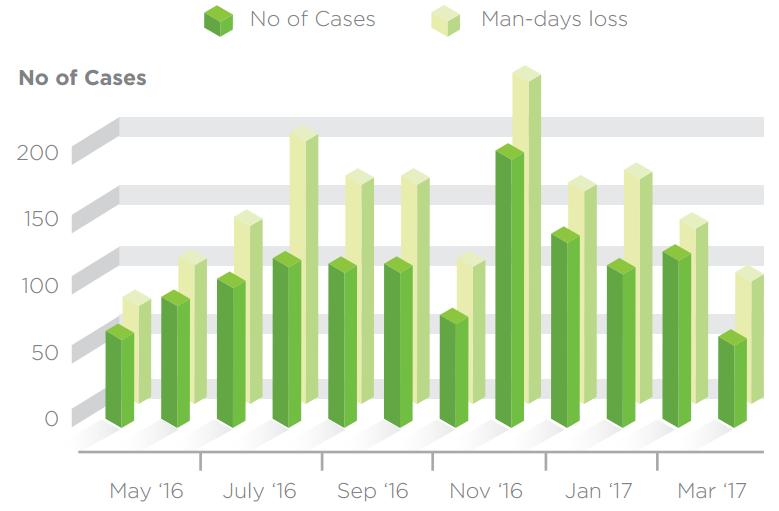

From the above scenarios, I tend to believe that the new EPM has some issues that held back production schedule. With limited disclosure on non-financial data, it is really difficult to figure out what actually happened. Only two figures from SCGM Sustainability Report 2017 are relevant. The first is water consumption figures in FY2017. It is obvious that it has a rapid increase in December 2016 and then tends to become lower and steady again in the next four months. My interpretation is that there were a lot of testing and tuning of the new production machines in December 2016. Not surprisingly, the corresponding number of medical aid cases jumped sharply in December 2016 as well; it reveals that the workers in the production lines and their supervisors were probably under high pressure. Nevertheless, we investors should appreciate SCGM management for this kind of reporting; this could holdthemselves accountable on environmental, safety and health impact from their businesses.

While value investors accept production schedule delay as normal business risk and do not mind its short-term negative impact on profits, it is a reasonable expectation that SCGM management would give us some details about this in the coming final result announcement.

Disclaimer

All articles in this blog are intended for research and educational purposes only. Materials in these articles including, but not limited to, graphs, tables and screen shots featuring investment data are not recommendations to buy or sell. The investment analysis, information, and related comments may be out-of-date when you read them. You should do your own due diligence into any investment before making the decision to buy or sell. While we aim to provide accurate data to assist you in performing your stock valuation, we do not take responsibility of any inaccurate or omitted data. Please verify them. We are not liable for your investment losses.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|