Traders Brief - KLCI Could be Due for Overbought Pullback

HLInvest

Publish date: Thu, 19 Jul 2018, 09:11 AM

MARKET REVIEW

Asian bourses ended mixed after enjoying a positive morning sessions following the upbeat remarks from Fed Chairman Powell during his congressional testimony. China stocks extended losses, with the SHCOMP slipping 0.35% to 2788, marking its fourth day of decline.

Bucking the mixed regional markets, KLCI soared 15.8 pts or 0.91% to 1753.1, chalking its 8th winning streaks following the resumption of 2nd foreign inflow since the last buying on 29 June, led by active buying interests in TM (+22 sen to RM3.93), AXIATA (+17 sen to RM4.40), CIMB (+18 sen to RM5.85), IOICORP (+8 sen to RM4.48) and GENM (+9 sen to RM5.15). Trading volumes and value rose 12% and 1.4% to 2.63bn shares worth RM2.17bn respectively, supported by firm market breadth with 594 gainers vs 295 losers.

Upbeat earnings from railroad CSX Corp and airline United Continental coupled with Morgan Stanley helped the Dow climbed for a fifth session (+79 pts to 25199), as solid earnings boosted financial and industrial stocks and reinforced expectations for a strong 2Q18 reporting season. S&P 500 earnings are now expected to have increased 21.4%, up from an estimate of 20.7% on 1 July.

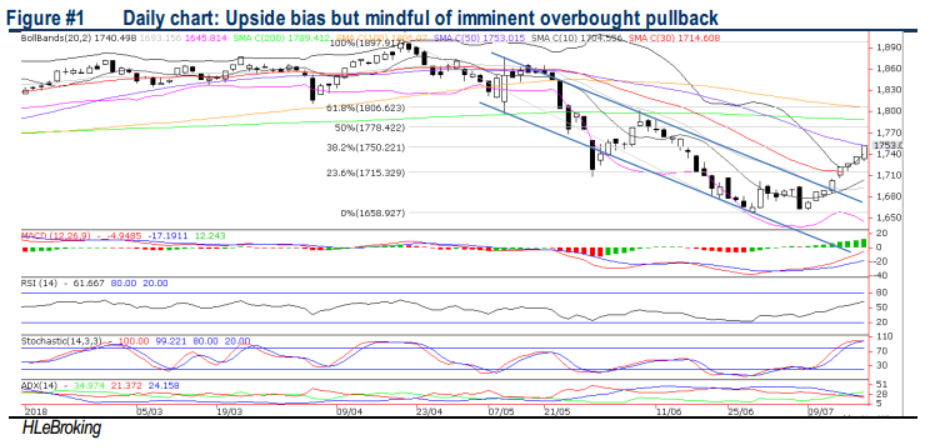

TECHNICAL OUTLOOK: KLCI

The KLCI managed to record its 8th straight gain and is poised to retest the 1778 (50% FR) territory, supported by the bullish 10d/20d SMA crossover and MACD/RSI readings. Nevertheless, as the Stochastic oscillators are extremely overbought, upside may be capped near 1778 region, while the supports will be located around 1715-1740.

Tracking another healthy market undertone from Dow overnight, we may expect the KLCI to trend higher towards the resistance zone of 1778. Positive sentiment is driven by potential resumption of foreign buying after notching a net BUY of RM79m yesterday (2nd net buy since 29 June), expectations of more construction projects revival after the LRT3 resumption (albeit on a smaller scale basis) coupled with positive expectations of Economic Affairs Minister, Azmin Ali’s visit to Singapore (end July) and PM’s China visit in mid Aug.

Although mid to long term KLCI outlook remain positive amid bullish weekly indicators, the index could be due for a pullback amid extremely overbought daily slow stochastic indicator (after a 5.8% rally from a low of 1657 on 28 June) and ahead of Aug reporting season Key supports are located near 1715-1740.

TECHNICAL OUTLOOK: DOW JONES

Following the bullish a symmetrical triangle breakout and supported by the bullish MACD/RSI readings, we believe the Dow may revisit 25500-25900 levels in the near future but further upside could be capped by overbought stochastic readings. Meanwhile, the support will be pegged around 24900-25000.

In the US, we believe the uptrend move above the 25000 may sustain on the back of ongoing strong reporting seasons, coupled with the upbeat economic picture. Nevertheless, market may turn choppy again if the trade discussion between the US-China is stalled following comments by President Trump’s top economic adviser Larry Kudlow that President Xi does not have “any intention of following through with discussions and President Trump is 'so dissatisfied' with China trade talks that he is keeping the pressure on”.

Source: Hong Leong Investment Bank Research - 19 Jul 2018

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024

goreng_kaki

KLCI testing 1800, better buy FBMKLCI-C5A, less than 3.5% premium

2018-07-19 09:18