Traders Brief - Softer Foreign Outflow, KLCI May Extend Rebound

HLInvest

Publish date: Tue, 24 Jul 2018, 04:44 PM

MARKET REVIEW

Asian stock markets ended on a mixed note as USD extended its declining mode after Donald Trump commented his disagreement on the interest rate pace by the Federal Reserve. Also, cautious sentiment was noticed amid the escalating trade tension after Trump’s administration proposed tariffs on a new list of Chinese goods worth USD200bn last week. The Nikkei declined 1.33%, but Shanghai Composite Index and Hang Seng Index rose 1.07% and 0.11%, respectively.

On the local front, market tone was sluggish after the opening bell; the FBM KLCI traded towards an intraday low of 1,749.95 pts before creeping higher to end positively at 1,757.96 pts (+0.19%). Market breadth was positive with advancers leading decliners by a ratio of 5-to- 3, market traded volumes were higher at 3.03bn vs. 2.89bn last Friday. Also, construction and ACE market stocks were traded actively higher for the session.

In the US, stocks were generally mixed amid ongoing trade concerns. However, positive sentiment emerged as financials and tech sectors managed to gain buying support in the anticipation of stronger quarterly results this week. The Dow (-0.06%) was flattish at 25,044.29 pts, while S&P500 and Nasdaq increased 0.18% and 0.28%, respectively.

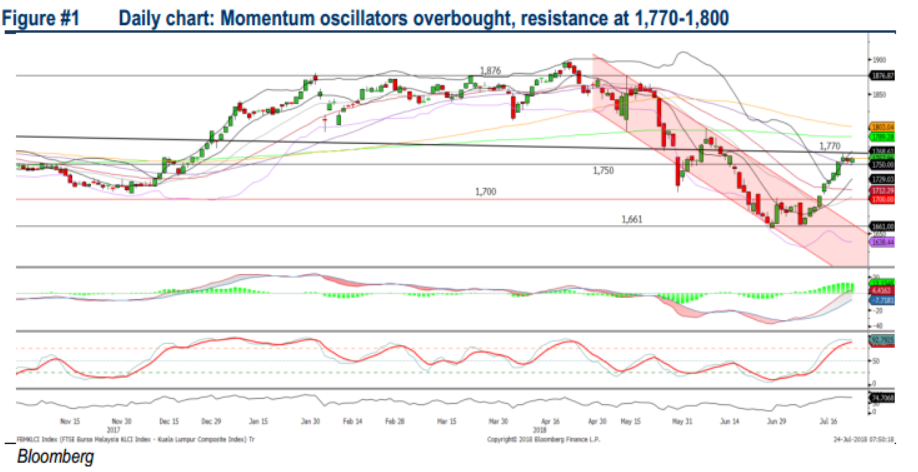

TECHNICAL OUTLOOK: KLCI

The FBM KLCI maintained its short term uptrend as it is hovering above the SMA20. The MACD Line is above zero, but both the RSI and Stochastic oscillators are overbought. Upside resistance will be envisaged around 1,770, followed by 1,800. Meanwhile, support will be pegged around 1,730-1,740.

Tracking the positive Nasdaq on Wall Street, we think the current bullish rebound on the FBM KLCI and technology-related stocks may extend this week ahead of the reporting season. Nevertheless, the lingering trade concerns between the US and China may limit the upside potential of the KLCI, capping around the 1,770-1,800 levels.

TECHNICAL OUTLOOK: DOW JONES

The Dow is threading along the upper band of the symmetrical triangle and ended above the psychological support of 25,000. Similarly, we noticed the MACD Line is above zero, but Stochastic oscillator is overbought. Hence, the Dow is likely to stay sideways over the near term with the trading range likely to be located around 24,500-25,500.

On Wall Street, investors could be trading on a cautious tone ahead of the 2Q US GDP that will be announced later this week. Moreover, should there be any negative comments coming from President Trump on the trade disputes, we may expect a weaker buying interest within the stock markets.

Source: Hong Leong Investment Bank Research - 24 Jul 2018

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024