Strategy 20180730 SST2.0 - HLIB - Coming in Sept: SST 2.0

HLInvest

Publish date: Mon, 30 Jul 2018, 11:32 AM

We recently engaged a tax consultant to understand the GST-SST migration. The impact of each tax regime on a product’s final price largely depends on its value chain dynamics. However, in the past, GST was blamed for higher prices because of delays in ITC reimbursements. As SST only encapsulates 38% of the CPI basket (GST: 60%), purchasing power should be higher. Administrative cost for SST is also lower relative to GST and does not suffer the problem of tardy ITC reimbursements. The GST-SST migration is neutral to most sectors, positive for consumer, property, building materials and healthcare but negative for autos. Our KLCI target of 1,770 is unchanged (15.5x P/E on 2018 earnings).

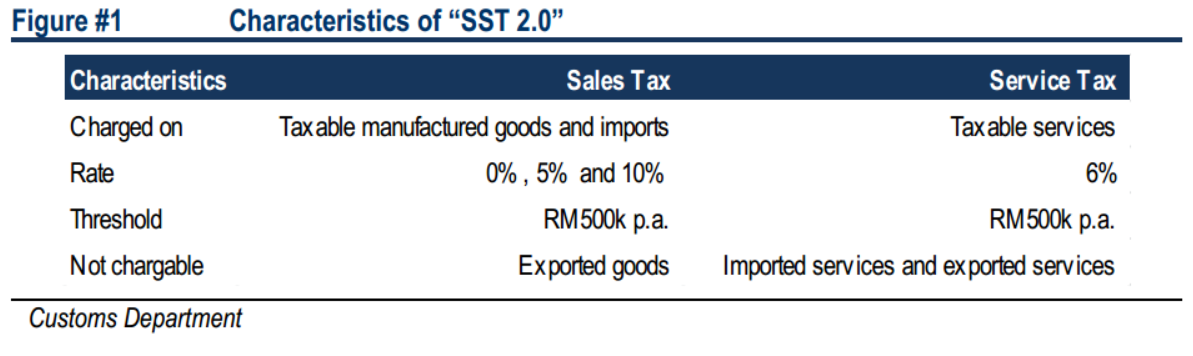

Back to SST. Last week, the Customs Department released a list of proposed goods and services that would be exempted from the reintroduction of the Sales and Services Tax (SST) on 1 Sept. To get a better understanding, we recently engaged a reputable tax consulting firm to brief us on the upcoming “SST 2.0”. The proposed sales tax rates are 0%, 5% and 10% on (i) taxable goods manufactured in Malaysia by a taxable person and sold, used or disposed of by him and (ii) taxable imported goods into Malaysia. For service tax, this is proposed at 6%.

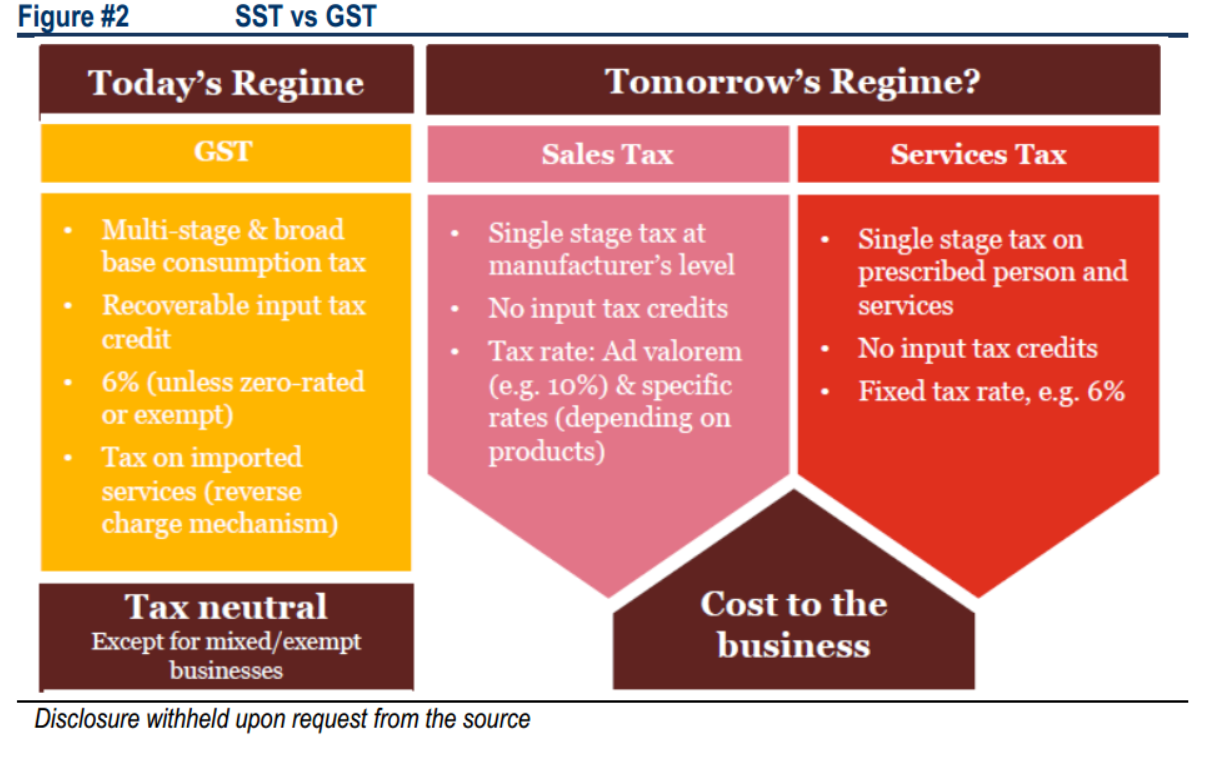

SST vs GST in a nutshell. SST is a single stage tax applied at the manufacturer’s level (for goods) or service. On the other hand, GST is a consumption tax that is multi stage which is implemented at every level of the value chain. As SST is a single stage tax, unlike GST, there are no input tax credits (ITC) to be claimed.

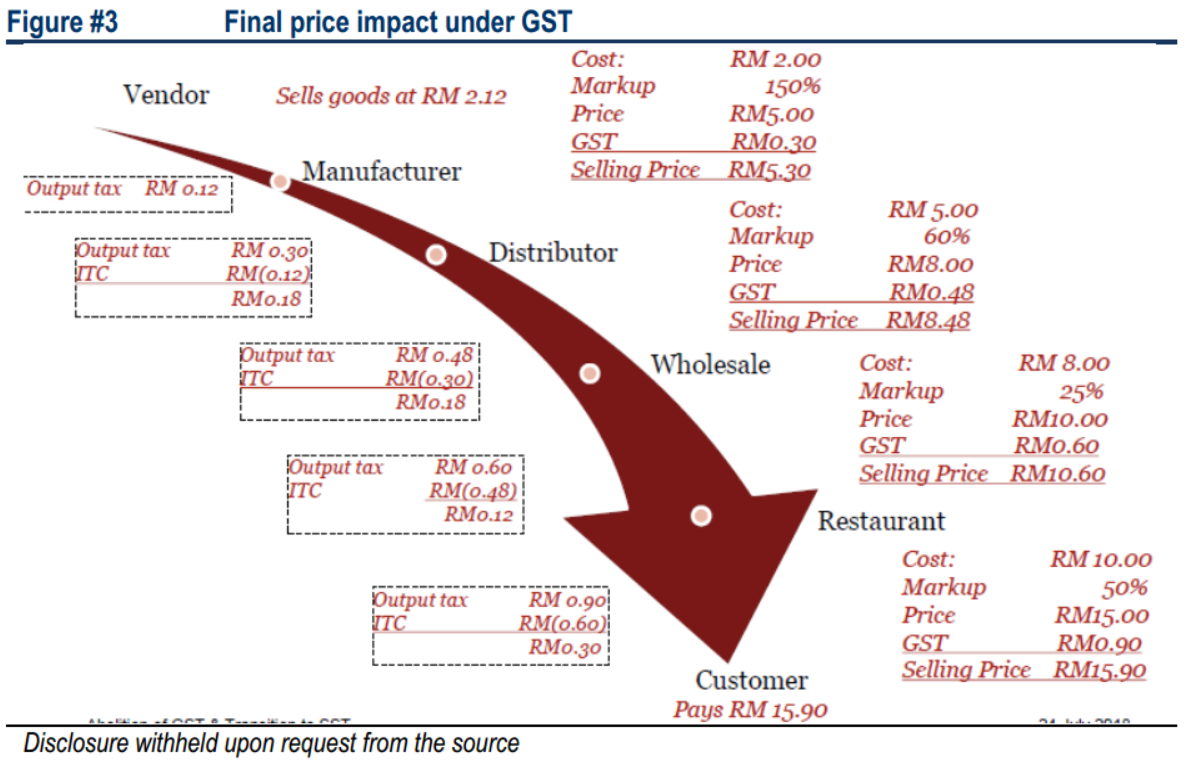

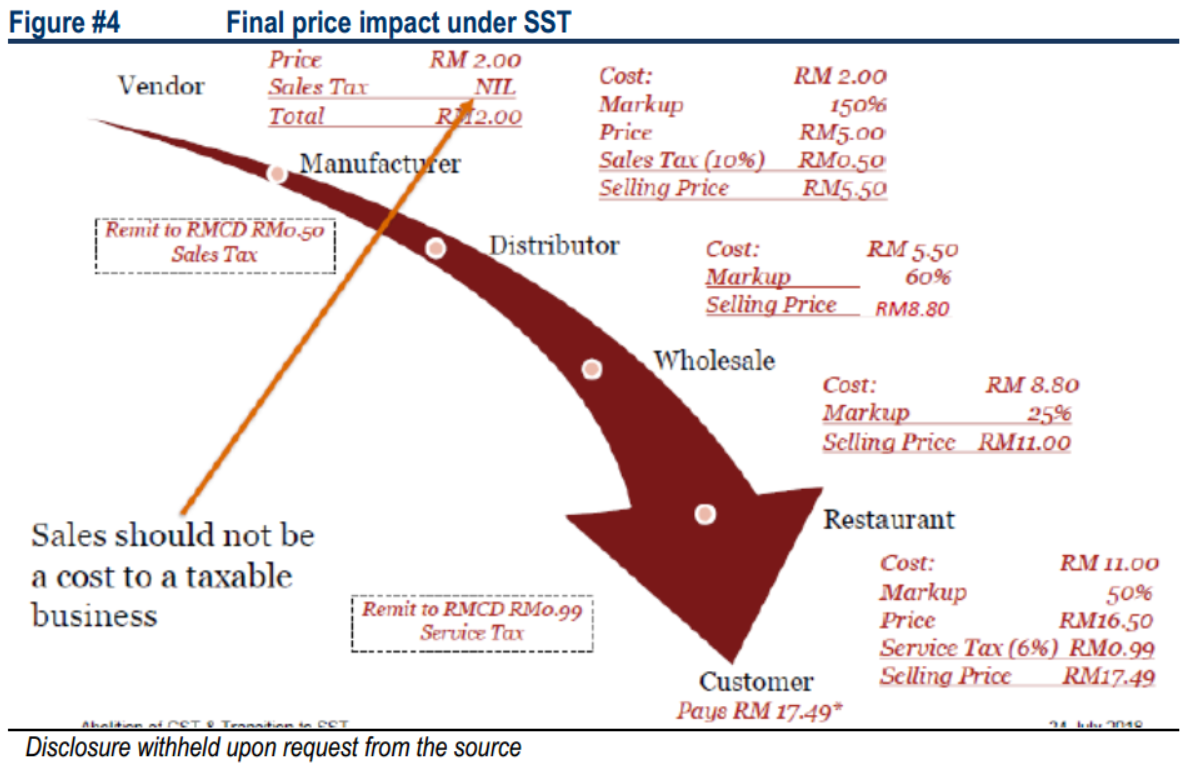

An example: GST vs SST. The difference between GST and SST is best illustrated by the example given by the tax consultant below which shows that the final price for a restaurant drink under SST (RM17.49) is higher than GST (RM15.90). Although GST is a multi-stage tax, the final tax paid by the customer is only 6% of the final selling price as ITC is claimed at the various stages of the value chain. For SST, although only 1 layer of tax is imposed (i.e. RM0.50 from manufacturer to distributor), this tax is compounded at every mark-up in the value chain in addition to the final 6% service tax imposed at the restaurant level. This compounding effect is known as “tax cascading” which is evident for SST but does not happen with GST (theoretically) because of ITC reimbursements.

So which results to higher price? That depends. Theoretically speaking, if firms along the value chain mark-up the product price based on a predetermined percentage (as opposed to an absolute amount), then 10% SST will always result to higher final price vs 6% GST. However, if firms mark-up the product price along the value chain based on an absolute predetermined sum (as opposed to percentage), this could result to the final price under 6% GST being more expensive than 10% SST. The higher the absolute mark-up is, the more expensive the final price will be under 6% GST vs 10% SST. In a nutshell, the final price impact of each tax regime is dependent on the product’s value chain dynamics.

Why is GST blamed for higher price? As elaborated, which tax regime result to a higher price depends on the mark up method along the value chain, ceteris paribus. However, since its implementation in Apr 2015, several quarters have blamed GST for the rise in the price. We understand this could be due to possible previous delays in firms receiving their ITC. As a result of the delays which led to working capital constraints, firms passed on some (if not all) of the delayed ITC sum along the value chain which led to the tax cascading effect for GST. This view was also echoed by Finance Minister Lim Guan Eng (FM Lim).

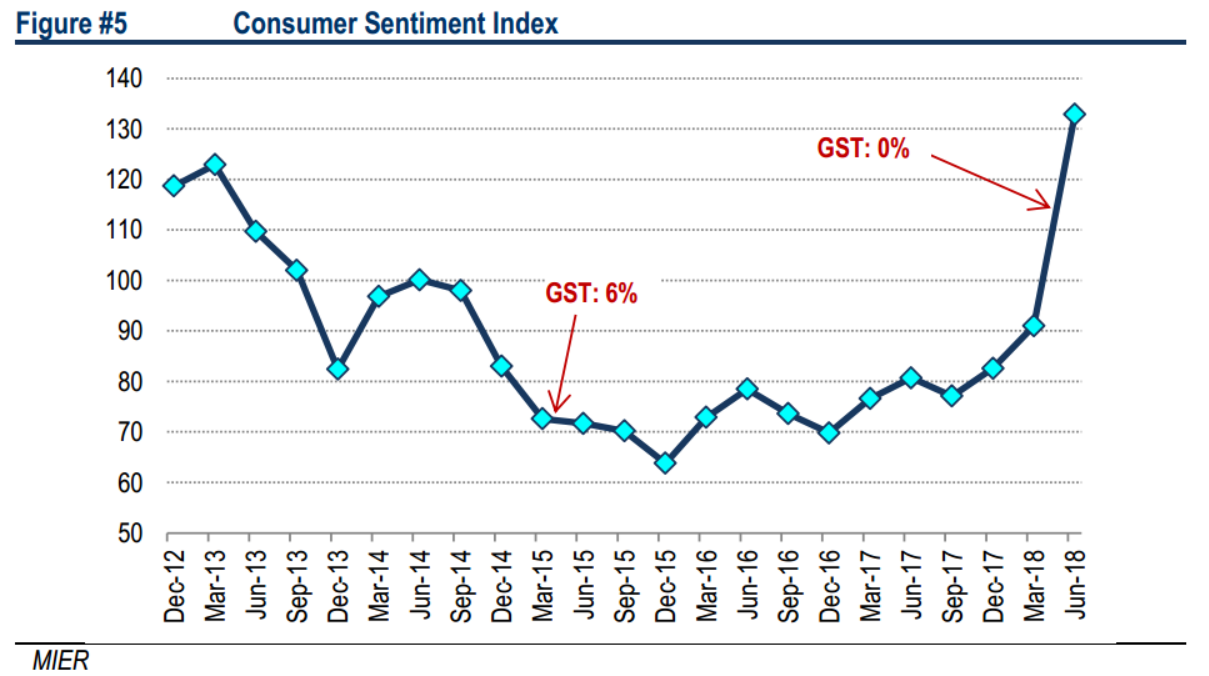

Higher purchasing power and revived sentiment. While the SST impact on price varies depending on industry and supply chain, we believe that its implementation to replace GST should generally result to higher purchasing power for the rakyat. This is because SST encapsulates a narrower base of goods and services compared to GST. FM Lim recently mentioned that SST will only cover 38% of the CPI basket compared to 60% for GST. From a sentiment perspective, Malaysian consumers appear to be very adverse to GST. This is evident from the Consumer Sentiment Index (CSI) slumping to a low subsequent to the GST implementation. Following the move to “zerorise” GST on 1 June, the latest CSI reading charted a 20-year high at 132.9.

Cost of doing business. While it is tempting to paint the GST-SST migration impact to cost of doing business in black and white, the reality is a grey area for now. On one hand, the tax cascading effect could raise the cost of doing business. However, this would be mitigated by (i) absence of tardy ITC reimbursements (hence lower working capital requirement) given the single stage tax structure of SST and (ii) lower implementation and administrative cost (personnel, IT systems, consultancy, etc.) of SST given its relatively simpler structure vis-à-vis GST.

Lower inflationary impact from SST. We reckon that SST would have a lower inflationary impact compared to GST due to (i) lower proportion of the CPI basket of the former as previously elaborated and (ii) absence of a multi-tiered tax structure which previously may have led businesses to pass on some of the delayed ITC claims to purchasers. Following the “zerorisation” of GST in June, CPI recorded a disinflationary reading of +0.8% YoY, lower than consensus estimate of +1.3% YoY. Following the tax holiday window in June-Aug, expected introduction of SST 2.0 in Sept, as well as lower food inflation pressure, we downgrade our 2018 CPI forecast to 1.3% YoY (previous: +1.8% YoY).

Fiscal deficit target should be met. The government expects to collect RM21bn from SST on a full year basis. Our estimate suggests that this could amount to RM22.5bn but there could be an upside to this coming from an increase in SST registrants under version 2.0 vs 1.0. As we understand, a manufacturer or service provider who is GST registered would be automatically registered as for SST. Hence, companies who evaded SST 1.0 may have to pay SST 2.0 now due to this automatic registration. In addition, the threshold for some SST registrant service providers (restaurant, bar, coffee houses located outside hotel) has been lowered to RM500k from RM3m under SST 1.0. However, as the government is expected to collect lower revenue from SST vs GST (RM44bn), we think that it will be able to fill the gap from higher oil-related revenue, tighter compliance in certain sectors (alcohol, tobacco) and reduction of government spending to rationalise unproductive outlays and minimise leakages. We maintain our forecast for Malaysia to achieve the fiscal deficit of -2.8% of GDP in 2018 and continue its fiscal consolidation efforts in 2019.

Sectorial impact. Our sectorial impact analysis of the GST-SST migration indicates that it will mostly be neutral. For most services such as domestic flights (aviation), casinos & NFOs (gaming), advertising (media) and prepaid reloads (telco), the service tax of 6% under SST will be the same rate as GST. There should also be insignificant impact for export oriented sectors such as gloves, tech and wood based products. For banking, GST-SST migration will see (i) lower annual credit card fee from RM50 to RM25 and (ii) possible 50% reduction in tax on IB fee. Key building materials (i.e. bricks, steel and cement) which previously had 6% GST will be exempted from SST and hence should see lower price. This is positive for residential developers as they were unable to claim ITC given their GST-exempt status. However, lower building material price is neutral for contractors as they have been claiming ITC in the past. Commercial developments (6% GST) should be cheaper as they are exempted under SST. Healthcare may see more exemptions under SST for hospital services and drugs compared to GST. While electricity bills will be cheaper (no SST), this is unlikely to significantly spur demand. For autos, the migration from 6% GST on final car price to 10% SST on ex-factory price may see car prices increase by 2-3%.

Maintain KLCI target at 1,770. We feel that the GST-SST migration would not be a market moving factor in the near term and hence, maintain our KLCI target of 1,770 based on 15.5x P/E (-1SD) tagged to 2018 earnings. Our 2018 KLCI earnings growth of 6% is below our nominal GDP growth projection of 7.1%. We believe the market will only start to gain further traction post Budget 2019 (2 Nov) once more concrete clarity on policy is unveiled by the first term Pakatan Harapan administration. There are no changes to our top picks.

Source: Hong Leong Investment Bank Research - 30 Jul 2018

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024