Traders Brief - Foreign-led Rally May Revisit Pre-GE14 Level of 1846

HLInvest

Publish date: Thu, 09 Aug 2018, 10:08 AM

MARKET REVIEW

Asian markets rose in early sessions, spurred by overnight earnings-led advance in Dow and expectations of stimulus-driven rebound in the battered SHCOMP. However, most of the markets lost steam as SHCOMP reversed early gains to a 1.27% slide amid news that US would impose 25% tariffs on USD16bn in Chinese goods effective 23 Aug, followed by the next phase of a propose tariffs of 25% on the US$200bn worth of Chinese goods (pending a scheduled hearing during 20-23 Aug).

Brushing off the mixed regional markets and ahead of the PH’s 100 days post GE14 as new Government, KLCI surged 13.6 pts on late buying interests in blue chips to end comfortably above 200d SMA at 1804.7 pts. Trading volume increasd 9.5% to 2.77bn, valued at RM2.71bn. Market breadth was bullish with 590 gainers vs 322 losers, supported by focus in smallcaps and ACE counters (FBMSCAP: +0.8% and FBMACE: +0.7%).

Dow slipped 45 pts on profit taking after recording a 4th winning streak as investors grappled with a fresh round of US-China tariff clashes after China retaliated with a 25% charge on USD16bn worth of US goods. Sentiment was also clouded by a batch of weak earnings from high-profile firms such as Walt Disney Co. and Snap Inc.

TECHNICAL OUTLOOK: KLCI

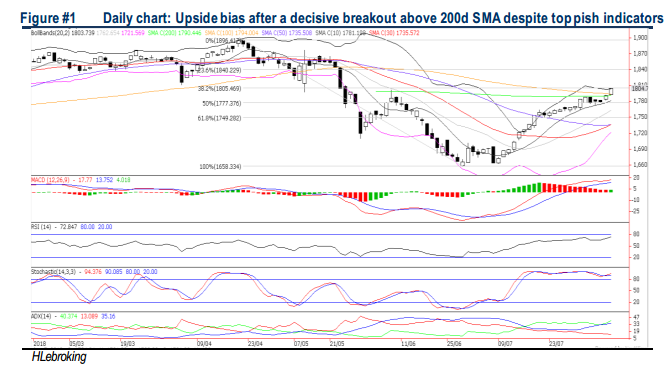

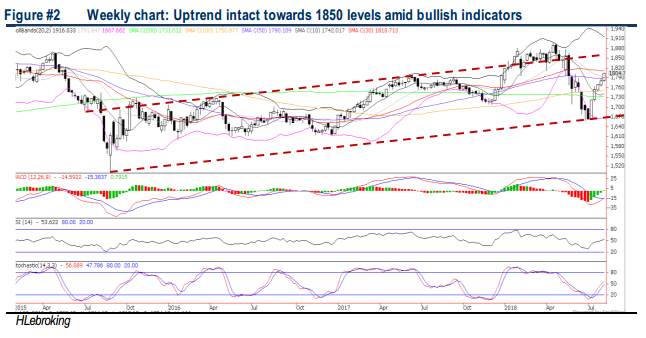

With a decisive breakout above 200d SMA (now at 1790) to end at 1804 yesterday, accompanied by the bullish weekly technicals and the return of foreign inflows (recorded 6th net inflows over the last 7 sessions), current upleg may prolong for a while.

As long as the immediate support near 1790 is not violated, we envisaged KLCI could scale higher towards more formidable resistances at 1810 (30w SMA), followed by the 1846 zones (8 May or pre-GE14 closing), with intermittent profit taking consolidation amid nagging concern by US/China tit-for-tat trade war and ongoing Aug reporting season coupled with the steeply overstretched daily technicals.

TECHNICAL OUTLOOK: DOW JONES

After rebounding strong post the downtrend line breakout, the Dow could be heading towards stiff resistances near 25900-26000 territory, reflected by the toppish technical readings. Reiterate positive undertone unless immediate supports near 25000-25300 are decisively violated.

We believe that the trade developments between the US-China have turned uglier lately with the latest rounds of tit-for-tat tariffs, ahead of the next critical scheduled hearings of the proposed 25% charges on the US$200bn worth of Chinese goods on 20-23 Aug. Hence, upside on the market could be limited and brace for more choppy trends after the ongoing robust 2Q18 reporting season take a backseat.

Source: Hong Leong Investment Bank Research - 9 Aug 2018

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024