Traders Brief - Spill Over of Buying Support on FBM KLCI

HLInvest

Publish date: Tue, 28 Aug 2018, 09:27 AM

MARKET REVIEW

Key regional benchmark indices ended on a positive note following the Jackson Hole gathering over the weekend, where Jerome Powell reaffirmed the interest rate hike in the future as well as the China’s central bank announced changes to the methodology for the fixing of China yuan’s daily midpoint to stabilise the currency market. The Shanghai Composite Index and Hang Seng Index increased 1.89% and 2.17%, respectively.

In tandem with the regional indices, the FBM KLCI gained 0.17%. Market breadth, however was negative with 572 decliners vs. 376 advancers. Nevertheless, selected export stocks (Hartalega, MPI and Vitrox) were traded actively higher as ringgit was traded near the RM4.10/USD.

Despite the on-going concerns related to the US-China trade war, Wall Street ended on a bullish tone as both the US and Mexico were close to resolving key differences on trade on the back of striking a new trade deal. The Dow added 1.01%, while both the S&P500 and Nasdaq increased 0.77% and 0.91%, respectively and closed at the all-time-high.

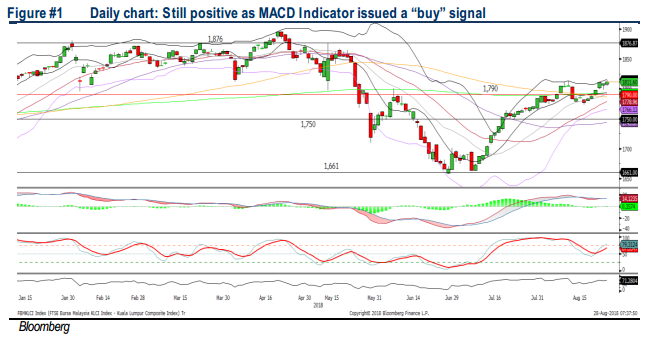

TECHNICAL OUTLOOK: KLCI

The FBM KLCI maintained its uptrend position, hovering above the SMA200 level. The MACD Indicator has issued a “buy” signal and both the RSI and Stochastic oscillators are on a recovering trend. We see potential upward bias on the key index to retest the 1,830-1,840 levels. Support will be located around 1,790.

Tracking the overnight Wall Street performance, we believe the bullish undertone may spill over on the FBM KLCI and the key index is likely to retest the pre-GE14 levels near 1,830- 1,840. Also, further trading interest could be noted within the O&G sector amid the former recovery in crude oil prices.

TECHNICAL OUTLOOK: DOW JONES

Following the flag formation breakout, the Dow has surpassed the 26,000 level. The MACD Indicator is rising positively, but both the RSI and Stochastic is slightly overbought. We believe the upside may be capped near the 26,616 level. Support will be located around 25,500.

We see some breakthroughs on the trade fronts between the US and Mexico and investors may take this opportunity to speculate that it could turn positive for the trade relationship between the US and China in the near term. Hence, we could expect the current breakout on Dow above 26,000 may extend further towards the previous high of 26,600.

TECHNICAL TRACKER: CLOSED POSITIONS

Yesterday, we had squared off our Technical Tracker stock picks, POHUAT (6% loss) and HEVEA (5.1% loss) amid weakening technicals.

TECHNICAL TRACKER: TALIWORKS CORPORATION

Beneficiary of the resolution of Selangor water saga. Following the resolution of Selangor water issue, we anticipate TALIWORK to be a beneficiary of this good progress within the water segment in Malaysia. Also, TALIWORK is expected to recover its outstanding receivables amounted to c.RM650m (54 sen per share). Following this settlement, we expect more upside for the dividend in the future, which may translate to c.10% dividend yield based on current share price. Technicals are positive as volumes picked up on a sideways formation. Should there be a breakout above RM1.26, the next target will be at RM1.37-1.40, followed by RM1.60. Support will be at RM1.18-1.19, with a cut loss at RM1.11.

Source: Hong Leong Investment Bank Research - 28 Aug 2018

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024