Nova MSC - Beneficiary of digitisation of government and healthcare applications

HLInvest

Publish date: Wed, 29 Aug 2018, 04:40 PM

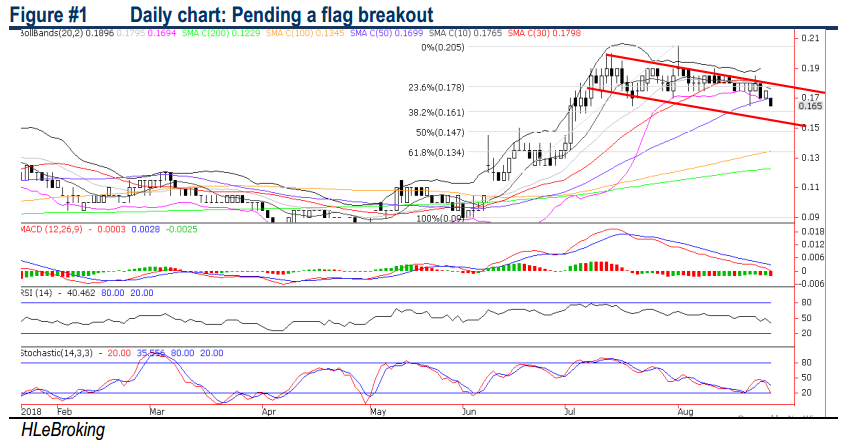

Nova MSC focuses on developing and providing smart e-solution systems in smart healthcare and digital government and is cautiously optimistic that the worst is over and following the disposal of Primustech in July 2018, Nova MSC can now fully focus on better prospect and higher growth potential of the Application Solution segment (with RM129m orderbook as at 30 June 2018). Valuation is not expensive based on 2.63x P/B (37% discount to peers 4.16x). Technically, it is poised for a flag breakout after a brief sideways consolidation.

Company profile: Listed on the ACE market in Aug 2003, Nova MSC operates in two business segments, namely: (i) Application Solution segment (i.e. smart healthcare and digital government solutions); (ii) Building Automation and Control segment (disposed in July 2018). In FY3/18, its building automation segment contributed 51.9% of total revenue, with the balance coming from the application solutions division.

Proven track record and rising trend in e-government applications. Nova MSC views e-government segment as its crown jewel based on a report by McKinsey & Company that the government digitalisation industry globally is estimated to be worth USD 1 trillion annually. Under this segment, Nova MSC provides tailored application software and services to governments and has a 20-year track record in the e government segment.

Overall, Nova MSC has digitally transformed time-consuming and complex submission and approval processes such as planning permits or building permits, and rendered them to be easily accessible and highly-efficient processes, increasing the transparency of the processes and improving the Business to Government (“B2G”), Government to Government (“G2G”) and Government to Business (“G2B”) interactions. Its customers include governments in Malaysia, Indonesia, Brunei, Saudi Arabia, and Singapore.

Focusing more on Healthcare segment to boost earnings. In July 2018, the Group decided to dispose its 51% equity interest in Primustech Pte Ltd (“Primustech”) for SGD3m or RM8.9m to focus on the Application Solution segments, which the Group is of the opinion would have a better prospect and higher growth potential as compared to Primustech. The Application Solution segment has an order book of approximately RM129m as at 30 June 2018.

Under its healthcare segment, Nova MSC provides core systems such as hospital information systems, clinic information systems, patient portals, as well as consultancy services. Some of its completed projects include those at the National University Hospital and National Skin Centre in Singapore, and Mahkota Medical Centre in Melaka. Moving ahead, management is looking to take up the role of systems integrator/main contractor for this segment, as it is actively participating in tenders. It may also embark on the supply, delivery and installation of hospital equipment to suit its customers’ needs, and at the same time, explore the possibility of rolling out the pay-per-use model to enhance long term earnings visibility

Potential flag breakout. After correcting 20% from 39M high of RM0.205 (1 Aug) to RM0.165 yesterday, Nova MSC is getting oversold. We see further mild retracement to test the lower flag channel near RM0.16 before staging a technical rebound. A successful violation above RM0.175 (10d SMA) will spur prices higher towards RM0.18 (upper channel) before reaching our LT objective at RM0.205. Meanwhile, key supports are located at RM0.155-0.16. Cut loss at RM0.15.

Source: Hong Leong Investment Bank Research - 29 Aug 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024