Traders Brief - Extended Sideways Consolidation Unless a Strong Breakout Above Downtrend Line Near 1818

HLInvest

Publish date: Thu, 20 Sep 2018, 04:47 PM

MARKET REVIEW

Asia markets mostly rose on Wednesday as investors took an escalation of trade tensions between the US and China in their stride. Japan's Nikkei 225 rose 1.08% to 23673 as the BOJ kept its monetary policy steady and maintained an upbeat view on the economy. On the other hand, despite intensifying trades war with the US, China remains comfortable with its economic situation, and that Beijing has prepared sufficient policy tools to boost the country's resilience in coping with various difficulties.

In wake of an overnight rally in Dow and higher Asian bourses as investors regarded the latest salvos in the US-China trade war is likely to be less intense than feared, KLCI jumped 7.8 pts to 1800.7 pts. Sentiment was also boosted by banking stock as Moody’s Investors Service has maintained its stable outlook for Malaysia’s banking system this year in view of the continuous robust operating conditions in the country. Trading volume increased to 12% to 2.01bn shares worth RM1.9bn, supported by positive market breadth of 502 gainers against 368 losers.

The Dow soared 158 pts to 26406 (off 210 pts from all-time high of 26616), as rising Treasury yields (ahead of a widely expected 25 bps hike on 25-26 Sep FOMC meeting) boosted the financial sector and trade worries subsided. While many are concerned that a full-blown trade war will become a huge headwind to global economic growth, investors have repeatedly shrugged off the issue over the past several months, choosing instead to focus on signs of improving economic fundamentals and robust corporate earnings.

TECHNICAL OUTLOOK: KLCI

Taking cue from a second consecutive rallies in Dow, KLCI is expected to grind higher towards the next key resistances near 1810 (the support-turned-resistance trend line from 1657) and 1818 (downtrend line from 1897), as technical indicators are on the mend. Unless KLCI can reclaim above these levels convincingly, it is likely to extend its short term sideways consolidation with supports at 1770 (SMA 50) and 1763 (38.2% FR).

The second consecutive rallies on Dow may boost KLCI to higher grounds today towards 1810-1818 zones, but we reiterate that sentiment is likely to remain cautious due the lack of domestic rerating catalysts, given the prospects of escalating US-China trade war, EM contagion risks, tightening financial conditions and expectations of further “belt-tightening budget 2019” to be tabled on 2 Nov.

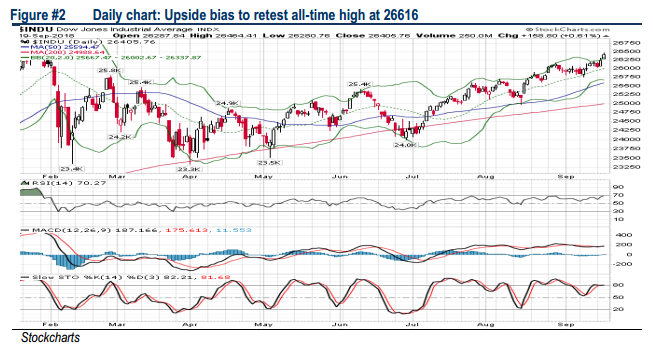

TECHNICAL OUTLOOK: DOW JONES

The Dow’s upward momentum remain intact following the recent strong posture above the SMA20 near 26000. The MACD Indicator is still positive, while the RSI and Stochastic oscillators are on the mend. As long as the SMA20 support is not violated, the Dow could retest the all-time high of 26616 in the short term. On the flip side, a decisive fall below SMA20 will trigger further retracement towards 25500-25600 territory.

As US-China remains stern and bold on their statements on the trade issues, the prospects for significant progress towards de-escalation in the short term are low. However, the Dow may continue to grind higher in sideways pattern to retest 26616 (all-time high) as investors have repeatedly shrugged off the issue over the past several months, choosing instead to focus on signs of still robust economic fundamentals and corporate earnings, driven by Trump’s significant tax cut and fiscal stimulus.

Closed positions: Yesterday, we had squared off our technical trackers positions in DESTINI (+11.5% returns), HUPSENG (4% loss) and KPJ (1.8% loss).

Source: Hong Leong Investment Bank Research - 20 Sept 2018

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024