Pestech International - Impeccable Track Record at Undemanding Valuations

HLInvest

Publish date: Tue, 02 Jul 2019, 10:17 AM

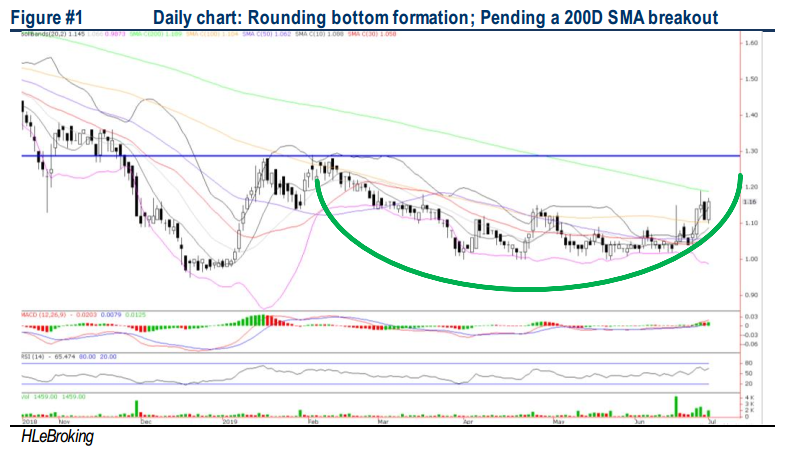

PESTECH is likely to ride on the fast growing regional demand for electricity and rail related infrastructure. In Malaysia, the continuation of ECRL, LRT 3, and the pending RTS projects presents positive prospects for further involvement in rail electrification in addition to its current on going projects. Regionally, the Thailand 3-airports high speed rail link, and Philippine National Railways Clark 1 projects are the major infrastructure undertakings that Pestech may explore for further growth potential in rail electrification. The stock is trading at undemanding valuations at 8.5x FY20 P/E (27% below 10Y average 11.7x) as well as 1.71x P/B (10% below 10Y average of 1.9x), supported by current order book of RM1.8bn. Technically, the rounding bottom formation bodes well for PESTECH to retest RM1.29-1.45 in the mid to long term.

Integrated power technology company. PESTECH has successfully expanded its market share into 20 countries such as Cambodia, Papua New Guinea and Philippines with growing number of other countries consistently. The proposed listing of Pestech (Cambodia) on the Cambodian Stock Exchange (CSX) in the future will help to strengthen its foothold in the Indochina market. Its major businesses are mainly segregated into:

1. Power Transmission Infrastructure: PESTECH offers the design, engineering, manufacturing, installation, testing and commissioning of high voltage (HV) and extra high voltage (EHV) substations, transmission lines, underground cables and equipment for build-up of a fully integrated electricity transmission infrastructure.

2. Power Generation and Rail Electrification: This division involves in power system automation and electrical services for power plant and rail industries and it adds value to the overall Group performance by engaging in projects involving management and engineering for combined cycle, thermal, hydro and solar power plant.

3. Transmission Asset: Riding on the strength of the Group in the power transmission infrastructure’s engineering, procurement, construction and commissioning (EPCC) segment, PESTECH’s Transmission Asset division embarks on the BOT business model to nurture a long term sustainable and recurring income stream for the Group.

4. Power Products & Embedded System Software: This division excels in the supervisory control and data acquisition (SCADA) system catering for various process control industry. This Australian based subsidiary of PESTECH is a leading company in offering substation automation, smart grid control technology and turnkey solutions to global electrical utility industry.

Generating sustainable growth. According to the Global Transformers Market analysis (2018 Annual report), the Asia-Pacific is the largest and fastestgrowing market, primarily driven by the transmission and distribution (T&D) developments and industrial growth amid the increasing upgradation of power and distribution infrastructure, replacement of aging equipment, and the increasing development in heavy industries, and renewable energy. Overall, Pestech is upbeat on the overall regional power infrastructure development in transmission and rail electrification areas. In Malaysia, the continuation of East Coast Rail Link (ECRL), Light Rail Transit 3 (LRT3), and the pending Rapid Transit System (RTS) projects presents positive prospects for further involvement in rail electrification in addition to its current projects in Klang Valley Double Track Phase 1, Mass Rapid Transit 2 (MRT2), and Southern Double Track (SDT) projects, which are progressing accordingly as planned. Regionally, the Thailand 3-airports high speed rail link, and Philippine National Railways Clark 1 projects are the major infrastructure undertakings that the Group may explore for further growth potential in rail electrification.

Recently, the Group has collaborated with RS Renewables KK of Japan for a bid towards the Large Scale Photovoltaic Plants for Peninsular Malaysia (LSS3). This would mark the Group's initial foray into renewable energy (RE) generation segment as an independent power producer, and the start of the Group’s regional exploration in the RE potentials in the region. The management believes that the Group’s continuous strive for various aspects of power infrastructure build up, with consistently reliable, and value-added offerings will sustain its growth in the long run.

Rounding bottom formation signals potential downtrend reversal. PESTECH’s share prices were locked in sideways consolidation in the last three months. Following the rounding bottom formation (daily chart) and the long term downtrend line breakout (weekly chart), we expect the uptrend to sustain towards RM1.19 (200D SMA) and RM1.29 (7 Feb) territory, supported by improving daily and weekly technical readings. LT objective is located at RM1.45 (100W SMA) while key supports fall on RM1.10 (100D SMA) and RM1.06 (30D SMA). Cut loss at RM1.05.

Source: Hong Leong Investment Bank Research - 2 Jul 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024