Rohas Tecnic - Ripe for Further Rebound in Anticipation of Improving 4Q19 Results and a Strong FY19-21 EPS CAGR of 22%

HLInvest

Publish date: Fri, 13 Dec 2019, 08:55 AM

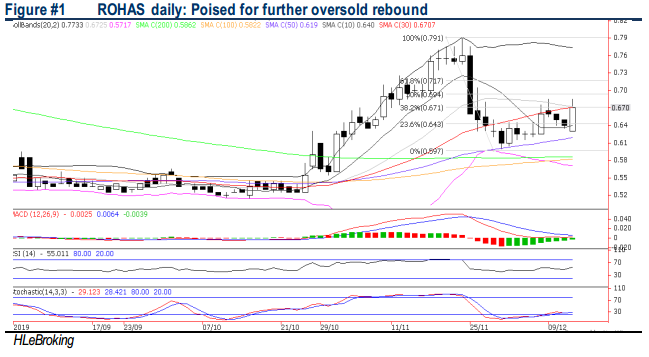

We are sanguine on ROHAS’s mid- to long-term outlook, underpinned by completion of its loss-making HGPT legacy contracts as well as tower fabrication orderbook at RM200m (1.1x cover of FY18 revenue) and EPCC projects at RM340m (1.5x cover of FY18 revenue). In addition, potential fabrication and EPCC orderbook replenishments would be buoyed by Sarawak state’s initiative to rollout 5,000 towers and the transmission line (JV with Muhibbah) from Butterworth to Penang Island which will run parallel to the Penang Bridge (estimated project value: RM1bn). Technically, after building a base above 50D SMA, ROHAS is poised for an oversold rebound towards RM0.695-0.83 levels, in anticipation of a better 4Q results and a strong FY19-21 EPS CAGR of 22% coupled with undemanding valuations at 10.2x FY20E P/E and 0.96x P/B (4% and 40% below PESTECH’s P/E and P/B).

Ripe for further oversold rebound. After hitting YTD high of RM0.79 (22 Nov), ROHAS experienced a 24% correction to a low of RM0.60 (29 Nov) before creeping higher at RM0.67 yesterday. Despite the pullback, the stock is able to build a base above 50d SMA (near RM0.62), which bodes well for further oversold rebound towards RM0.695 (50% FR) and RM0.745 (76.4% FR). A decisive breakout above RM0.745 will augur well for further advance to LT objective at RM0.83 (123.6% FR), supported by bottoming up indicators. Meanwhile, retracement supports are situated at RM0.63 (12 Dec low) and RM0.62. Cut loss at RM0.605.

Source: Hong Leong Investment Bank Research - 13 Dec 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024