Traders Brief - Decent Window Dressing in December for KLCI

HLInvest

Publish date: Thu, 02 Jan 2020, 11:02 AM

Market Review

Tracking the negative performance on overnight Wall Street, Asia’s stock markets ended on a mixed note on the final trading day of 2019. The Hang Seng Index and Nikkei 225 declined 0.46% and 0.76%, respectively, but Shanghai Composite Index gained 0.33% after China’s official manufacturing PMI for December came in slightly above expectations (PMI for Dec stood at 50.2 vs. consensus of 50.1 reading).

Meanwhile, stocks on the local front were traded mostly in the negative territory with the FBM KLCI trended lower by 1.67% to 1,588.76 pts led by significant profit taking activities on the final trading day of 2019 after a decent rebound since early December. Market breadth was negative with decliners led advancers by a ratio of 5-to-3, accompanied by market trading volume of 2.25bn, worth RM1.75bn. Also, plantation stocks were traded actively higher as crude palm oil price hit the range near RM3,000-3,100.

In the US, Wall Street managed to rebound after a two-day of losing streak as President Donald Trump commented in a tweet stating that he will be signing a comprehensive Phase One Trade Deal with China on January 15, which will be taking place at the White House and will be going to Beijing at a later date to begin with the Phase Two discussion. The Dow and S&P500 rose 0.27% (2019: 22.3%) and 0.29% (2019: 28.9%), respectively while Nasdaq added 0.30% (+35.2%)

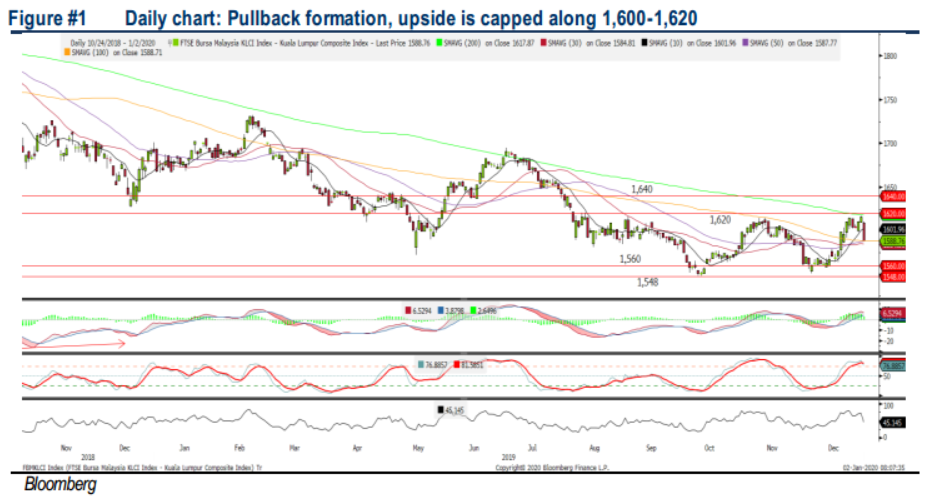

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has formed a bearish candle on the final day of trading in 2019 after revisiting 1,617 level on 30 Dec. The MACD Line and Histogram have declined sharply on Tuesday following the sharp decline. Meanwhile, both the RSI and Stochastic oscillators are overbought. Hence, with the negative bias technical readings, we believe KLCI’s upside is likely to be capped along 1,600-1,620, while support is located around 1,548-1,560.

Despite the sell down in index heavyweights on the index heavyweights in FBM KLCI on the final trading day of 2019, we expect the near term sentiment to stay positive with President Trump stated firmly on the upcoming signing ceremony of the Phase One Trade Deal with China. Hence, the FBM KLCI could regain traction in January and may revisit 1,600 level. At this juncture, traders may look into plantation stocks amid the firm crude palm oil prices holding steadily above RM3,000 level.

TECHNICAL OUTLOOK: DOW JONES

The Dow’s uptrend is fairly intact for the time being after the rebound on final trading day of 2019. The MACD indicator is still hovering above zero, while both the momentum oscillators (RSI and Stochastic) are hovering above 50. With the positive technical readings, we expect the Dow to remain positive bias with the trading range located between 28,000-29,000.

In the US, Wall Street could remain in the uptrend intact formation with the positive newsflow on the trade front and traders will be focusing on the upcoming signing ceremony in White House on 15 Jan, coupled with the next major discussion on the Phase Two trade discussion moving forward. The Dow may stay within the uptrend formation over the near term and trading range could be located around 28,000-29,000.

TECHNICAL TRACKER: CLOSED POSITIONS

Closed position: Last week, we have squared off entirely our technical trackers stock picks on FPI (1.3% gain), SPSETIA (22.3%) and ROHAS (4.3% loss) as well as 4Q19 stock picks on OKA (15.1% gain), KIMLUN (1.6% gain) and CYPARK (8.8% gain). To recap, we had achieved successful hit rates of 69% and an average return of 55.3% in 2019 compared with 50% and 41.2% respectively, in 2018.

TECHNICAL TRACKER: MTAG

Ripe for further rebound in anticipation of a steady FY19-22 EPS CAGR of 11%. We like MTAG for its: (i) strong barrier to entry via its technical expertise with comprehensive range of printing and converting solutions for diversified customers in various industries (over 600 customers, 25% of which have dealt with the group in the past 10 years), (ii) steady FY19-22 EPS CAGR of 11%, led by a targeted doubling of its existing capacity (from 324.5m pieces to 636.8m pieces by FY22), riding on the growth of key Dyson suppliers, such as ATA IMS, SKPR, VS as well as trade diversion opportunities amid protracted US-China trade war, (iii) less labour-intensive nature of its business, and (iv) attractive valuation of 10.4x FY20E PE (36% below peers). Technically, after building a base near RM0.495-0.52, MTAG is poised for an impending downtrend line breakout to advance further towards RM0.58-0.635 zones.

Source: Hong Leong Investment Bank Research - 2 Jan 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024