Traders Brief - Technical rebound likely amid overnight Dow’s 168-pt gain

HLInvest

Publish date: Thu, 09 Jan 2020, 09:51 AM

MARKET REVIEW

Asian markets slumped on Wednesday, with SET (-1.66%) and NIKKEI 225 (-1.57%) taking the biggest hit, as investors scurried from riskier assets due to heighted geopolitical conflicts in Middle East. According to Pentagon, Iran launched more than a dozen ballistic missiles against multiple bases housing American troops in Iraq following the assassination of Iran’s influential General Qassem Soleiman by US airstrikes on 3 Jan.

Tracking sluggish regional markets, KLCI slid 21.9 pts or 1.36% to 1589.1. Trading volume increased to 3.86bn shares worth RM2.22bn as compared to Tuesday’s 2.99bn shares worth RM1.80bn. Market breadth was positive with 492 gainers as compared to 447 losers as market participatons focused on lower liners as blue chips consolidated. Gold-related stocks such as BAHVEST, POHKONG and TOMEI traded actively higher for the session amid increased geopolitical tensions.

The Dow rallied as much as 303 pts to 28866 after Trump suggested the US and Iran were refraining from further military action following attacks on US bases overnight. However, the gains were pared down to 161 pts at 28745. Meanwhile, as investors switched from safe havens to equities, gold (-1.1%) and bond prices slipped (US 10Y yield +2.7%) whilst the WTI tumbled 4.4%.

TECHNICAL OUTLOOK: KLCI

Following the window dressing activities that triggered a 66-pt rally from a low of 1551 (4 Dec) to 1617 (31 Dec), KLCI had retreated 1.7% or 28 pts to 1589 yesterday amid rising geopolitical tensions in Middle East. As long as the KLCI is unable to break above the 200D SMA near 1616 decisively, KLCI is likely to extend its profit taking consolidation amid external shocks and weakening technical indicators. Key supports are 1582 (50% FR)/1574 (61.8% FR)/1564 (76.4% FR) while formidable resistances are 1600/1617.

In the short term, Bursa Malaysia is likely to remain cautious amid rising geopolitical risks in Middle East, the repercussions of protracted US-China trade war (despite the impending Phase 1 trade deal signing next week), coupled with the weak earnings delivery by Bursa Malaysia companies and nagging internal (policy, politics) uncertainties. Ahead of the upcoming CNY holidays and Feb reporting season, we expect KLCI to trap in range bound pattern with key resistances at 1600-1620 whilst supports fall on 1570-1580 levels, barring further escalation in US-Iran geopolitical conflicts into a full-fledged war.

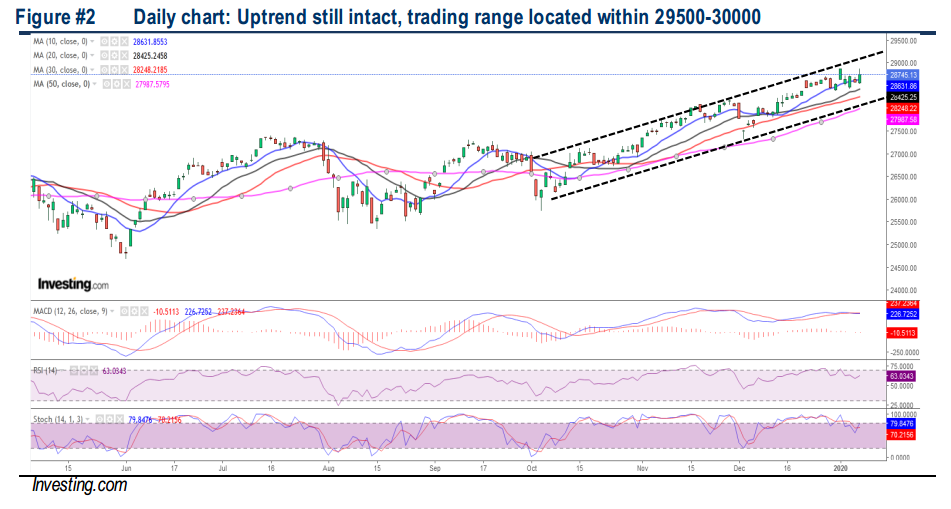

TECHNICAL OUTLOOK: DOW JONES

Despite ongoing geopolitical tensions, the Dow has been hovering sideways over the past two weeks and standing above multiple key 20D/30D/50D SMAs. As indicators remain fairly neutral at this juncture with the MACD indicator still engaged in a negative cross (MACD Line below Signal Line) while both the RSI and Stochastic oscillators are ticking up, the Dow could still break all-time high of 28873 (2 Jan high) and advance further to 29500-30000 zones, barring any decisive breakdown below 28000-28400 supports.

In the near term, Wall Street is likely to remain volatile with key focus on the development in Middle East, impending Phased One trade deal signing as well as the start of Jan reporting season (for 4Q19 results) next week. Barring any escalation in US-Iran geopolitical tensions into a full-fledged battle, the Dow’s trading range will be located around 28000-29500 as geopolitical risks are here to stay, and will cause episodic volatility.

Source: Hong Leong Investment Bank Research - 9 Jan 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024