Traders Brief - Cautious Ahead of the Feb Reporting Season and 2019-nCoV Outbreak

HLInvest

Publish date: Thu, 30 Jan 2020, 09:23 AM

MARKET REVIEW

In spite of a show of confidence by the WHO and President Xi in containing the 2019-nCoV virus, Asian markets ended mixed, led by a 2.8% slump on HSI (as the markets reopened after CNY holidays) amid coronavirus fears. As per 29 Jan, the ongoing virus outbreak has killed 132 people in China and about 6200 confirmed cases (mortality rate is below 3% compared to +10% for SARS), according to Chinese health officials.

In line with mixed regional markets, KLCi eased 1.2 pts to 1550.5 (after traded within a range intra-day high of 1554.4 and a low of 1547.9), registering its 7th consecutive declines. Trading volume decreased to 2.69bn shares worth RM2.55bn as compared to Tuesday’s 3.36bn shares worth RM2.89bn. However, market breadth was positive with 513 gainers as compared to 392 losers, as bashed down smallcap (FBMSCAP +1.1%) and ACE (FBMACE +1.2%) stocks rebounded.

The Dow surged as much as 222 pts to 28944 following better-than-expected results from blue-chip names, including Apple, McDonald and Microsoft. However, cautious remark by Fed Chairman Powell that the coronavirus epidemic in China introduces “uncertainty” into the outlook and called asset valuations “somewhat elevated” reduced the gains to 12 pts at 28734. After markets closed, Facebook shares plunged on downbeat results whilst Tesla and Microsoft prices jumped amid upbeat earnings.

TECHNICAL OUTLOOK: KLCI

After hitting 1M high at 1617 (30 Dec), KLCI corrected as much as 72 pts to 1545 (28 Jan) before paring the losses to 67 pts 1550. Given the sluggish technical readings and wild swings in overseas markets, KLCI is bracing for further headwinds ahead. A decisive breakdown below the crucial neckline support at 1545 may aggravate further selling spree towards 1531 (123.6% FR)/1521 (138.2% FR)/1510 (lower downtrend channel) levels. Key resistances are 1558/1568 (28 Jan gap), 1574 (61.8% FR) and 1583 (50% FR).

Pending to refill the 1558-1568 gap (28 Jan), KLCI is likely to trend sideways amid growing concerns over the economic fallout from the deadly coronavirus outbreak in China and ahead of the Feb reporting season. For oversold rebound, GENM (BUY-TP RM3.64) could see potential upside towards RM3.14/3.21/3.30 following the Doji pattern on 28 Jan whilst supports are found at RM3.00/2.90. Similarly, Genting (BUY-RM6.73) should attract investors to accumulate for upside targets at RM5.77/5.85/6.03. Crucial supports are capped at RM5.52/5.36/5.27.

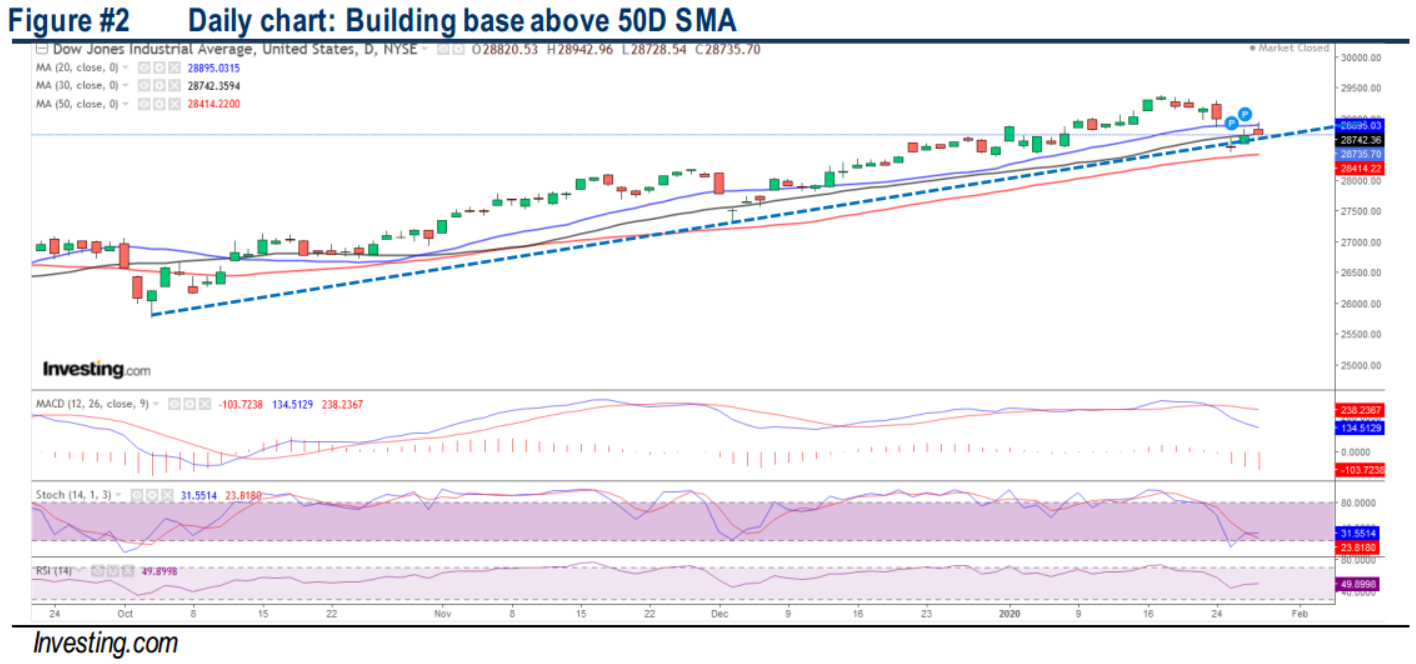

TECHNICAL OUTLOOK: DOW JONES

From an all-time high of 29374 on 17 Jan, the Dow had corrected 2.2% or 639 pts to 28722, a tad above the uptrend line support from a low of 25743 (3 Oct). In wake of negative MACD and neutral RSI/stochastic readings, the Dow is likely to experience some choppy sessions ahead. Only a decisive reclaim above 20D SMA near 28900 will resume its uptrend to retest 29000/29374 zones. Key supports are situated at 28000-28400 zones.

In the short term, the Dow is expected to remain in choppy as investors are closely monitoring the coronavirus outbreak (which could grow into a global pandemic). Nevertheless, downside risks are likely to be well-cushioned by the Fed’s positive US economic outlook and accommodative monetary policy coupled with the strong 4Q19 results (as for the 141 S&P 500 members that have reported Q4 results 70% beating EPS estimates and 69% beating revenue estimates). Crucial supports are situated at 28000-28400 whilst resistances are at 29000- 29400 levels.

TECHNICAL TRACKER: CLOSED POSITION

We took profit on MTAG (6.6% gain) yesterday after hitting upside target at R1.

Source: Hong Leong Investment Bank Research - 30 Jan 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024