Traders Brief - Markets may be due for technical rebound

HLInvest

Publish date: Tue, 04 Feb 2020, 09:28 AM

MARKET REVIEW

Asia’s stock markets took a dive led by China markets on its reopening after the Lunar New Year break as the ongoing concerns over the Wuhan coronavirus outbreak persisted; Shanghai Composite Index and Shenzen composite plunged 7.72% and 8.41%, respectively despite the PBoC announcing that it will inject 1.2 trillion yuan worth of liquidity into the markets. Meanwhile the Nikkei 225 ended lower by 1.01%, but Hang Seng Index added 0.17%.

On the local front, soon after the FBM KLCI hit an intraday low around 1,517 level, the key index rebounded sharply amid bargain hunting activities narrowing the losses to close at 1,521.95 pts (-0.6%). Market breadth was still bearish with 738 decliners vs. 281 advancers, accompanied by market traded volume of 3.98bn, worth RM2.85bn. We noticed selected O&G stocks such as ARMADA and KNM traded actively higher for the session despite the slide in crude oil prices.

Wall Street ended higher on Monday led by Nike and Tesla (after analyst upgraded the stock’s target price), recouping partial selloffs (amid lingering fears on coronavirus outbreak impact on US economy) on Friday. Meanwhile, Institute for Supply Management suggested the US factory activity unexpectedly rebounded in January to 50.9 (highest level since July). The Dow and S&P500 rose 0.51% and 0.71%, respectively, while Nasdaq advanced 1.34%.

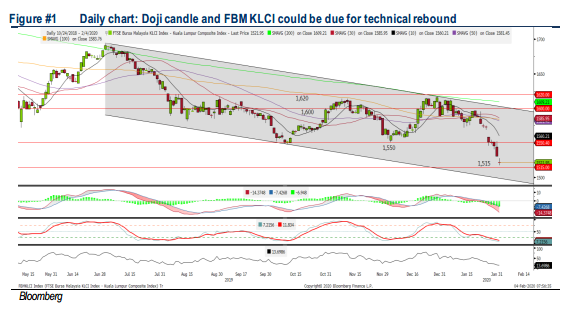

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has formed a doji candle after hitting a low near the 1,517.61 pts. The -DMI component in the ADX indicator has surged above 40 (suggesting extremely oversold and may warrant a rebound). Meanwhile, both the RSI and Stochastic oscillators are severely oversold as well. Hence, we believe the key index could be due for a technical rebound. Resistance is set around 1,550, while support is located around 1,515.

Given the rebound in overnight Wall Street, coupled with the injection of liquidity by PBoC into the markets, we believe it would cushion the downside tone on regional markets and the FBM KLCI could be due for a technical rebound (as ADX component – negative DMI has surged above 40, suggesting an oversold condition). Traders could look out for oversold technology and O&G stocks for trading opportunities

TECHNICAL OUTLOOK: DOW JONES

The Dow has formed a bear flag breakout last Friday, declining below the 28,600 level and ended sharply lower for the session. The MACD Indicator is trending lower (but still above zero). Meanwhile, both the RSI and Stochastic oscillators are hovering below 50 (indicating that the momentum is still negative). The resistance is located around 28,800, while support is set around 28,000.

Although Wall Street managed to rebound mildly yesterday, the persisting worries on the Wuhan coronavirus (China’s death toll has surpassed SARS outbreak during 2002-2003) could still dampen the stock markets moving forward. Nevertheless, traders may still focus on the ongoing reporting season in the US. The Dow’s trading range will be set around 28,000 - 28,800.

Source: Hong Leong Investment Bank Research - 4 Feb 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024