Traders Brief - Fading worries on coronavirus likely to lift sentiment

HLInvest

Publish date: Thu, 06 Feb 2020, 09:54 AM

MARKET REVIEW

Asia’s stock markets trended higher led by Shanghai markets, which managed to rebound higher for the second consecutive day following the sharp drop on Monday due to worries of the coronavirus outbreak. Also, China’s central bank lowering interest rates on reverse repurchase agreements, coupled with the injection of c.USD242bn liquidity into money markets on Monday and Tuesday managed to stabilize the sentiment and cushion the downside risk on Shanghai markets. The Shanghai Composite Index rose 1.25% and 0.42%, respectively, while Nikkei added 1.02%.

Meanwhile, FBM KLCI reversed from the negative territory to close in the positive region for the session amid last hour buying support in KLK, AIRPORT and MISC. Market breadth was positive with advancers led decliners by a ratio of 5-to-3. Market traded volume stood at 3.06bn shares, worth RM2.68bn. We observed that CAREPLS and OCNCASH traded actively higher after the recent pullback.

Wall Street extended its rebound for the third consecutive day led by energy stocks as market participants are optimistic that efforts to contain the outbreak of coronavirus and any potential economic fallout will be supported by central banks. Also, media reported that a Chinese University has found an effective drug to treat people with the 2019 -nCoV has lifted the market sentiment across Europe and the US. The Dow and S&P500 rose 1.68% and 1.13%, respectively, while Nasdaq added 0.36%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has rebounded higher after traded towards an intra-day low of 1,529.10 pts. The MACD Histogram continues to recover for the second day, while the MACD Line has turned flattish below zero. Meanwhile, both the RSI and Stochastic oscillators have turned higher within the oversold region. With the oversold conditions, we anticipate the FBM KLCI to rebound higher over the near term. Resistance will be set around 1,550 -1,560, while support is anchored around 1,515-1,530.

As Wall Street ended in a bullish tone, we believe the buying interest could spillover towards stocks on the local front; extending the rebound on the FBM KLCI. Also, traders may look out for recent bashed down stocks after the coronavirus outbreak for trading opportunities. The FBM KLCI could trade within the higher range between 1,530-1,550

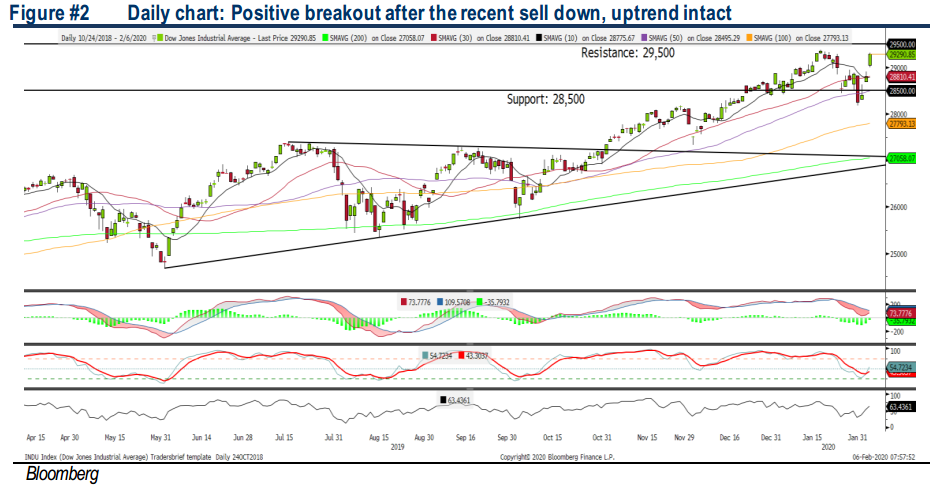

TECHNICAL OUTLOOK: DOW JONES

The Dow has rebounded for the second consecutive day, recouping most of the losses in Friday’s sell-off and the MACD Indicator remains positive (MACD Histogram recovering, while MACD Line is hovering above zero). Meanwhile, both the RSI and Stochastic oscillators have hooked upwards; indicating that the positive momentum is returning. The resistance is located around 29,500, while the support is pegged around 28,500.

With the trading tone turning more positive amid fading worries over the coronavirus outbreak, coupled with the support from PBoC, we think most of the negative factors have priced into the markets and market participants are looking beyond the outbreak at this juncture and focusing on the ongoing reporting season in the US. Hence, the Dow could revisit the all-time-high zone in the near term, trading range will be located between 28,500-29,500

Source: Hong Leong Investment Bank Research - 6 Feb 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024