Traders Brief - Awaiting Details on the Covid-19 Stimulus Package

HLInvest

Publish date: Fri, 27 Mar 2020, 09:08 AM

MARKET REVIEW

Global: Despite the news that the US has struck a deal on a USD2 trillion stimulus aid to tackle the impact from the ongoing Covid-19 outbreak, most of the regional stock markets ended lower prior to the US jobs data, which may provide clues to the economic impact of the Covid-19 pandemic. However, in the US, Wall Street rebounded for the third trading day, brushing off the release of a record initial jobless claims (soared to 3.28 million last week) which was sparked by the Covid-19 pandemic; the Dow has reclaimed more than 20% since the recent low of 18,591 level.

Malaysia: Bucking the regional trend, the FBM KLCI managed to trade higher at 1,328.09 pts (off intraday high of 1,336.74 pts) as selling pressure has declined following the suspension of short selling by Bursa and SC. Market breadth was positive with 540 gainers vs. 295 decliners, accompanied by 3.53bn shares traded for the session, worth RM2.27bn. Trading interest has seen rotated to construction and property stocks after both of the sectors were bashed down and severely oversold previously.

TECHNICAL OUTLOOK: KLCI

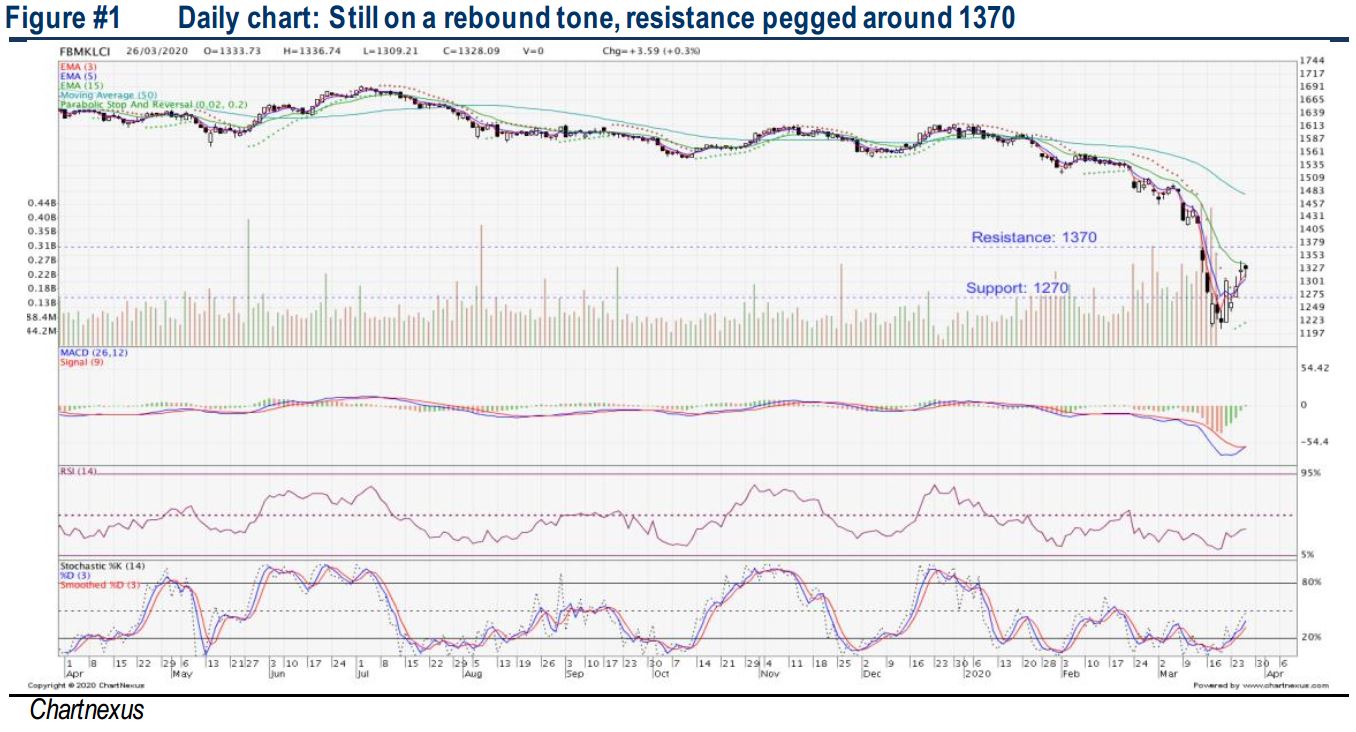

The FBM KLCI continues to trend marginally higher by 0.3% yesterday forming the third consecutive positive candle and rebounded more than 10% from the recent low of 1207 level (19th Mar). The MACD Indicator has issued a bullish crossover signal (but below zero). Meanwhile, both the RSI and Stochastic oscillator trended higher for the session. Resistance is envisaged around 1,370, while support is set around 1270.

MARKET OUTLOOK

Given the positive trading tone from Wall Street after striking a deal of USD2 trillion stimulus, coupled with the Fed stepping in to boost the economy by announcing unprecendented QE program and slashing interest rates near to zero, we believe buying support would spillover towards stocks on the local front, lifting FBM KLCI for another upward move today. At this juncture, downside risk is lowered with Bursa and SC suspending the short selling activities as well as Bursa Malaysia relaxes margin financing rules to ease force selling pressure on market. The KLCI’s trading range will be located around 1,270-1,370 at this moment. Also, market participants will be awaiting more details for a comprehensive stimulus package today.

Source: Hong Leong Investment Bank Research - 27 Mar 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024