Traders Brief - Likely to Consolidate With Key Supports at 1340-1360

HLInvest

Publish date: Wed, 22 Apr 2020, 08:53 AM

MARKET REVIEW

Global: Tracking Dow’s 592-pt slide on Monday, Asian markets were in a sea of red, rattled by a historic crash in US WTI crude for May delivery owing to the Covid-19 and rising geopolitical risk amid speculation about a possible political upheaval brewing in North Korea after unconfirmed reports indicate that Kim Jong Un is fragile after recovering from heart surgery . Adding to the risk-off sentiment, the WHO warned that any optimistic expectations of lifting the lockdowns and reopening of the economy must be gradual to avoid a resurgence of infections. Overnight, the Dow slid 632 pts or 2.7% to 23018 as the historic dive in WTI oil and gloomy corporate forecasts stirred worries of a deep recession amid coronavirus shutdowns and massive layoffs, offsetting news that Washington would approve additional ~US$500bn for coronavirus relief measures.

Malaysia: In line with the rout in regional markets, KLCI slid 31.4 pts or 2.2% to 1381.7 on profit taking after refilling the 1369-1419 gap on 20 Apr. Trading volume jumped to 6.53bn shares worth RM2.94bn against Monday’s 5.99bn shares worth RM3.21bn. Market breadth was bearish with 827 losers vs 198 gainers as the G/L ratio of 0.24x were substantially lower than 1.16x (20 Apr), 17 Apr (3.6x), 16 Apr (2.46x) and 15 Apr (1.55x).

TECHNICAL OUTLOOK: KLCI

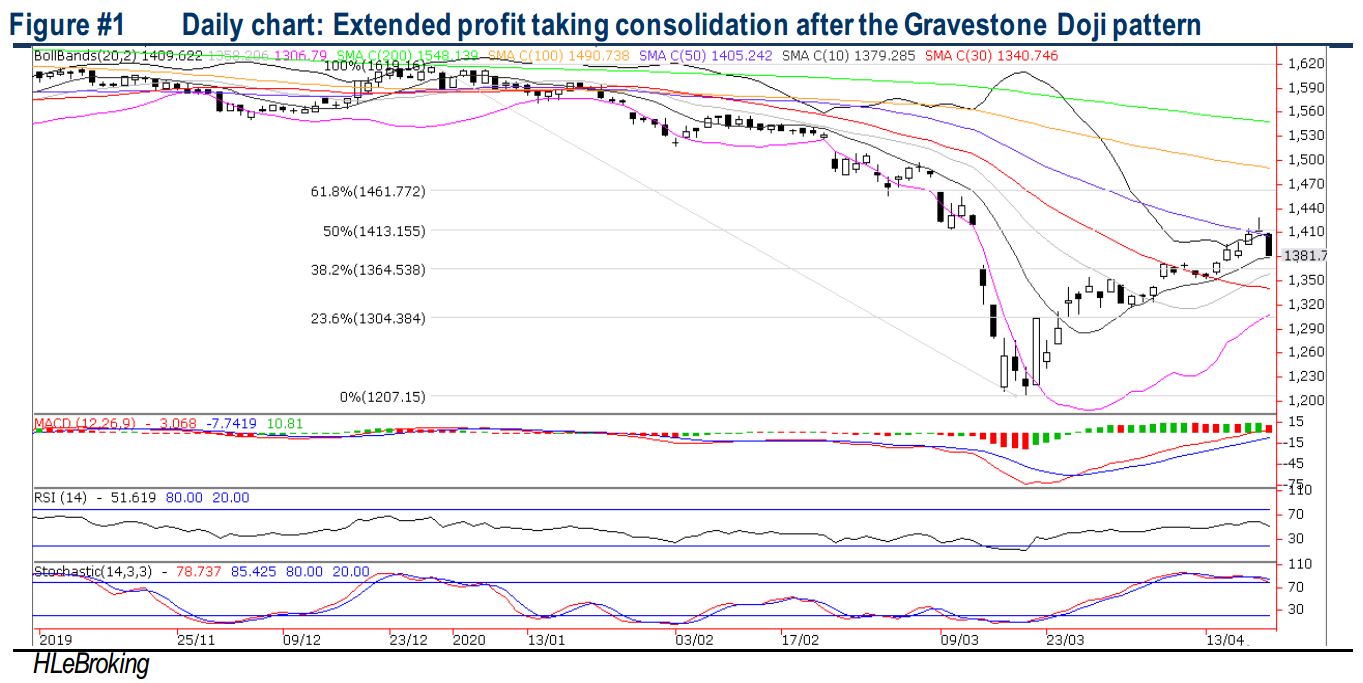

After refilling the long awaited 1369-1419 gap on 20 Apr and ended with a bearish trend reversal Gravestone Doji formation, KLCI plunged 31.4 pts to 1381.7, taking cue from the overnight slump on Dow and WTI crude. As the MACD/RSI/Stochastic indicators appear levelling off from their respective resistances, the next leg down may be taking place right now. Failing to hold near 1358 (20D SMA) would likely confirm that the bears are in control, with lower supports located near 1340 (30D SMA) and 1304 (23.6% FR). Stiff resistances are near 1400 and 1429 (20 Apr high) levels.

MARKET OUTLOOK

The 2nd day of sharp selloffs on Dow and the unprecedented plunge in oil prices coupled with technically negative outlook, KLCI is expected to experience more downward consolidation today (with key supports at 1340-1350). We reiterate we continue to advocate selling on strength as we roll into May as the economic reality should start to sink in soon due to concerns about weaker corporate earnings and relatively expensive valuations coupled with potential extension in after the phase 3-MCO ending on 28 April.

Source: Hong Leong Investment Bank Research - 22 Apr 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-29

PPHB2024-07-27

PHARMA2024-07-26

INARI2024-07-26

INARI2024-07-26

INARI2024-07-26

INARI2024-07-26

INARI2024-07-26

ZHULIAN2024-07-26

ZHULIAN2024-07-25

INARI2024-07-25

INARI2024-07-25

INARI2024-07-25

TALIWRK2024-07-25

TALIWRK2024-07-25

TALIWRK2024-07-25

TALIWRK2024-07-25

TALIWRK2024-07-25

TALIWRK2024-07-25

TALIWRK2024-07-25

TALIWRK2024-07-25

TALIWRK2024-07-25

ZHULIAN2024-07-25

ZHULIAN2024-07-24

INARI2024-07-24

INARI2024-07-24

UNISEM2024-07-24

ZHULIAN2024-07-24

ZHULIAN2024-07-23

INARI2024-07-23

INARI2024-07-23

TALIWRK2024-07-23

TALIWRK2024-07-23

TALIWRK2024-07-23

TALIWRK2024-07-23

TALIWRK2024-07-23

TALIWRK2024-07-23

TALIWRK2024-07-23

TALIWRK2024-07-23

TALIWRK2024-07-23

TALIWRK2024-07-23

TALIWRK2024-07-23

TALIWRK2024-07-23

TALIWRK2024-07-23

TALIWRK2024-07-23

TALIWRK2024-07-23

TALIWRK2024-07-23

TALIWRK2024-07-23

TALIWRK2024-07-23

ZHULIAN2024-07-23

ZHULIAN2024-07-22

INARI2024-07-22

INARI2024-07-22

INARI2024-07-22

INARI2024-07-22

INARI2024-07-19

EDGENTA2024-07-19

EDGENTA2024-07-19

EDGENTA2024-07-19

INARI2024-07-19

INARI2024-07-19

INARI2024-07-19

INARI2024-07-19

INARI2024-07-19

INARI2024-07-19

PHARMA2024-07-18

INARI2024-07-18

INARI2024-07-18

INARI2024-07-18

INARI2024-07-18

ZHULIAN2024-07-17

INARI2024-07-17

ZHULIAN2024-07-16

INARI2024-07-16

INARI2024-07-16

INARI2024-07-16

INARI2024-07-16

INARI2024-07-16

INARI2024-07-16

INARI2024-07-16

INARI2024-07-16

INARI2024-07-16

INARI2024-07-16

INARI2024-07-16

TALIWRK2024-07-16

TALIWRK2024-07-16

TALIWRK2024-07-16

TALIWRK2024-07-16

TALIWRK2024-07-16

TALIWRK2024-07-16

TALIWRK2024-07-16

TALIWRK2024-07-16

TALIWRK2024-07-16

TALIWRK2024-07-16

TALIWRKMore articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024