Traders Brief - Partial Economic Sectors Reopening May Support KLCI

HLInvest

Publish date: Wed, 29 Apr 2020, 09:07 AM

MARKET REVIEW

Global: Given WTI and Brent oil prices continued to decline during Asian hours on the back of concerns over global storage capacity will soon be full as a result of softer demand caused by coronavirus pandemic, key regional markets ended mixed. Meanwhile, Wall Street ended on a softer tone as the Dow ended in the negative territory, snapping a 4-day winning streak after a volatile session led by profit taking in tech stocks offsetting optimism over a potential reopening of the US economy; the Nasdaq and S&P 500 fell 1.4% and 0.52%, respectively.

Malaysia: Despite declining oil prices, the FBM KLCI gained marginally by 0.15% to 1,372.2 pts following the extension of the short selling ban announcement. Market breadth was however negative with decliners leading advancers by a ratio of 5-to-3. Market traded volume stood at 5.02bn, worth RM2.49bn for the session. We noticed throughout the trading session, ACE market technology stocks such as K1, KGROUP and VIS were traded actively higher.

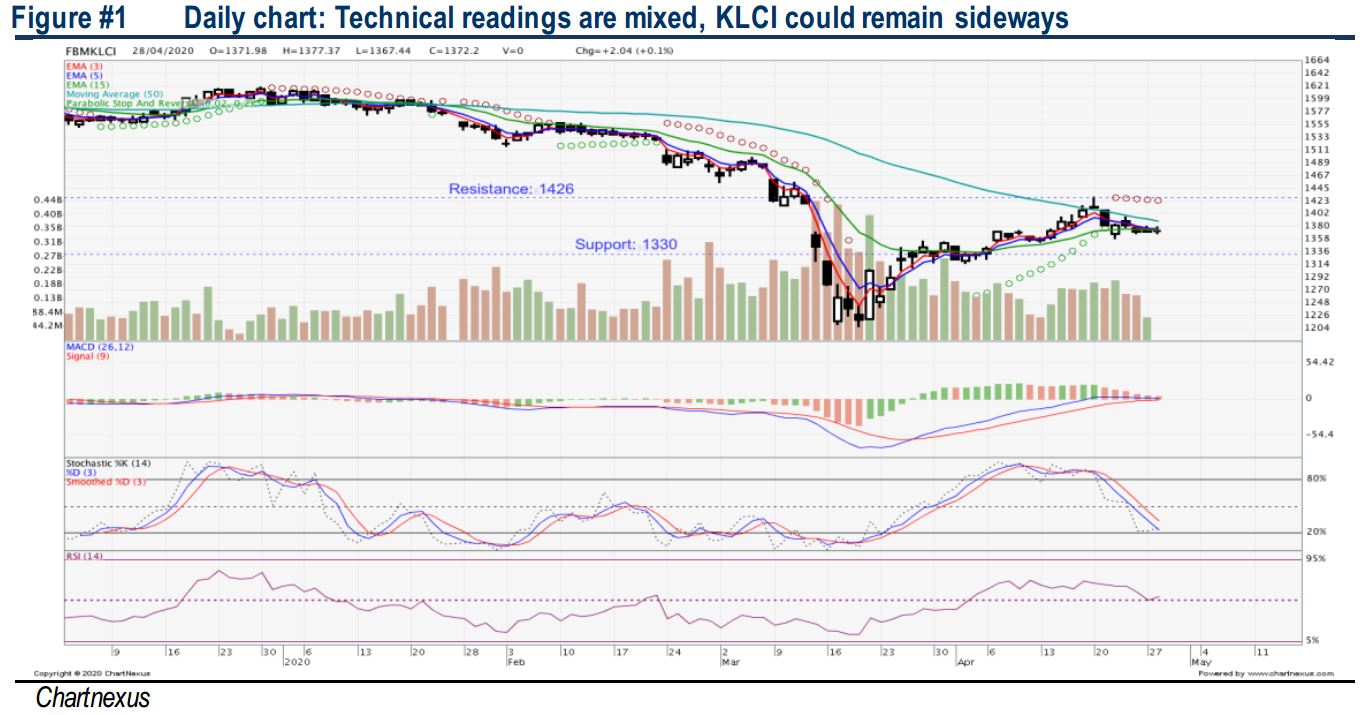

TECHNICAL OUTLOOK: KLCI

After forming a Gravestone Doji on 20th Apr, it has drifted along the immediate support 1,363- 1,368 levels over the past 5 trading days. Meanwhile, technical indicators are mixed as the MACD Indicator is hovering slightly above zero and the RSI is hovering above 50, but the Stochastic oscillator is below 50. Hence, with this mixed technical readings, we anticipate KLCI to remain sideways over the near term. Resistance will be located around 1389-1400, followed by 1,426. Should the FBM KLCI breaches below 1,363, next support is located along 1,317 - 1,330.

MARKET OUTLOOK

We believe market may resume its recovery path after International Trade and Industry Minister Datuk Seri Mohamed Azmin Ali mentioned that all economic sectors that have been allowed to operate during the MCO period can ramp up their operations to full capacity starting today. With this positive statement, coupled with the extension of the short selling ban till end June, KLCI may be supported over the near term. However, given the weaker outlook in oil prices following the Covid-19 episode, coupled with the upcoming reporting season in May June, it may limit the upside potential moving forward.

Source: Hong Leong Investment Bank Research - 29 Apr 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024