SDS Group - Rising Demand for Bread During MCO Period

HLInvest

Publish date: Mon, 04 May 2020, 09:19 AM

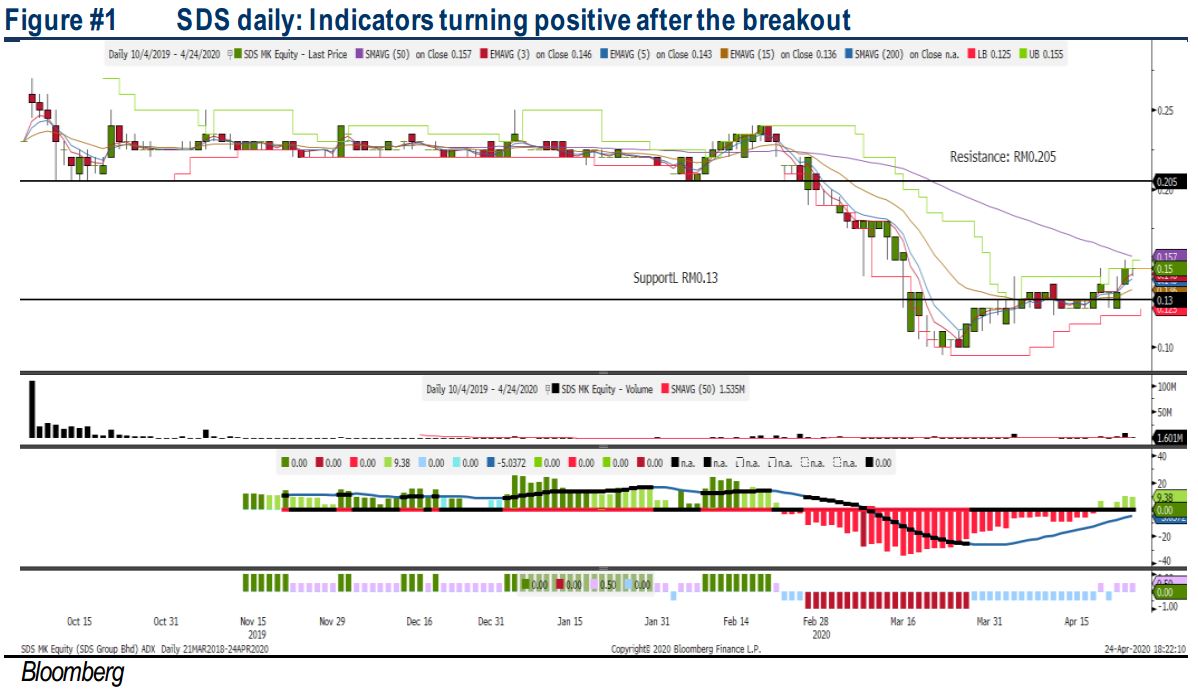

SDS has declined below its IPO price of RM0.23 following the recent coronavirus pandemic situation. However, we believe it is overdone and SDS could rise quickly on the back of (i) shortages of bread during MCO period, (ii) business as usual in Seremban automated bread factory and (iii) continuous effort to expand its footprint to the northern region. Technically, it has experienced a sideways breakout above RM0.145, targeting RM0.17-0.185-0.205. Support is located at RM0.135-0.14, with a cut loss set around RM0.13.

Bread shortages during MCO period. We understand from several news media that shortages of bread during MCO have been quite serious. It suggests that people could be panic-buying or purchasing more than usual amount. Also, some of the bread factories have been operating at max capacity, which gives rise to people buying into other brands (i.e. Top Baker and Daily’s) and rather than the usual Gardenia or Massimo.

State-of-the-Art Seremban bread factory. SDS has a fully automated bread factory in Seremban which is able to churn out 3,000 loaves per hour. Its distribution segment is contributing roughly 70% of revenue towards the group with c.30% gross profit margin.

Sideways breakout. SDS has experienced a sideways consolidation breakout above RM0.145 with significant volumes. With the recovering indicator, we expect share price could trend higher towards RM0.17-0.185, followed by a LT target of RM0.205 (HLIB’s TP of RM0.26 - non rated). Support is located around RM0.135-0.14, with a cut loss set around RM0.13.

Source: Hong Leong Investment Bank Research - 4 May 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024