Traders Brief - Continue To Trade With Caution Amid Lingering Political Uncertainty And Expectation Of A Weak 2q20 Gdp And Corporate Results

HLInvest

Publish date: Thu, 06 Aug 2020, 11:43 AM

MARKET REVIEW

Global: Asian markets ended modestly higher as investors mulled the progress of stimulus talks in Washington and a gradual recovery in the Chinese economy, as the PBOC adviser Ma Jun told local media there is no need to step up counter-cyclical adjustments in monetary policy as an economic recovery is well underway, forecasting 2% growth for 2020. However, the sentiment was affected by the Wall St Journal report that high-level talks between the US and Chinese officials will be held on Aug 15 to discuss China’s compliance with the trade deal signed in January.

Overnight, the Dow rallied 373 pts to settle at 27202 for a 4th straight gain, as investors embraced recent better-than-expected corporate earnings and service-sector data coupled with some progress in Congress toward a fresh coronavirus relief package as early as this weekend, overshadowing a sluggish ADP pri vate-sector report. The sentiment was also boosted by news that drugmakers will likely have tens of millions of doses of coronavirus vaccines in the early part of next year, with production ramping up to a billion doses by the end of 2021, according to Dr. Anthony Fauci.

Malaysia. KLCI lost 7.8 pts to 1568.1 amid lingering speculation that an early GE15 would be held as early as Oct/Nov following the recent dissolution of the state assembly in Sabah and profit taking on glove companies. However, fuelled by active participations in ACE market, healthcare and technology stocks, trading volume stayed elevated despite easing to 15.58bn shares worth RM8.27bn as compared to Tuesday’s 15.62bn shares worth RM10.45bn. Market breadth was positive with 797 gainers as compared to 390 losers.

Yesterday, foreigners remained the net sellers (-RM337m) whilst local institutional funds and retailers were the net buyers with RM136m and RM221m, respectively. YTD, foreigners sold RM19.57bn shares compared with purchases by local institutional funds (RM10.7bn) and retailers (RM8.9bn).

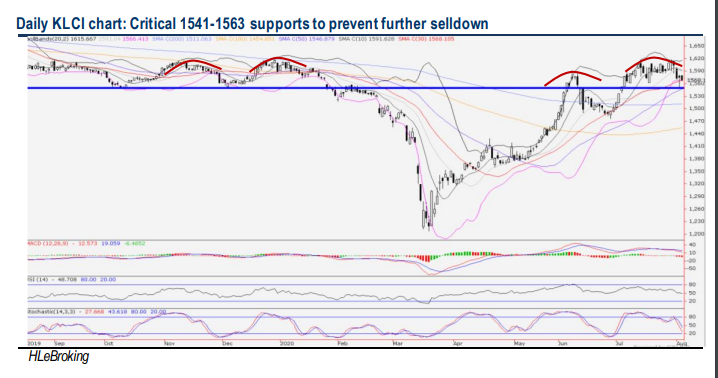

TECHNICAL OUTLOOK: KLCI

Following a 50-pt pullback from 7M high of 1618 (29 July high) to 1568 yesterday, KLCI’s overbought technical momentum has been neutralised as slow stochastic indicator returned into oversold position below 30%. Nevertheless, an extended rangebound consolidation may prevail in wake of ongoing domestic political uncertainty and August reporting season, a resurgence of Covid-19 cases and intensified US-China geopolitical tensions. Weighing both directions, KLCI is likely to exhibit an extended range bound consoliation mode with key downside supports at 1563 (17 July) and 1541 (4 Aug low) supports whilst facing formidable tops at 1591 (9 June) and 1618 (29 July) levels.

MARKET OUTLOOK

In wake of fading impact of past stimulus measures and evidence that the global V-shaped recovery has stalled amid lingering fears of a 2nd wave Covid-19 infections coupled with heightened US-China geopolitical conflicts, it remains to be seen what will help to keep global stock markets elevated in the coming weeks. On the domestic scene, nagging political uncertaitny and expectations of worsening reported numbers for 2Q20 (both GDP and corporate results) are the risks that could trigger further consolidation in August.

Weighing both directions, KLCI is likely to exhibit an extended range bound consoliation mode with key downside supports at 1563 (17 July) and 1541 (4 Aug low) levels whilst facing formidable tops at 1591 (9 June) and 1618 (29 July) levels.

CLOSED POSITION (FIG1)

In wake of the uncertaitnies, we had squared off our positions in EDGENTA (17.7% gain), DRBHCOM (11.7% gain), WPRTS (9.6% gain) and TEXCYCL (13.9% gain).

Source: Hong Leong Investment Bank Research - 6 Aug 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-28

DRBHCOM2024-07-26

WPRTS2024-07-26

WPRTS2024-07-26

WPRTS2024-07-26

WPRTS2024-07-26

WPRTS2024-07-25

WPRTS2024-07-24

WPRTS2024-07-24

WPRTS2024-07-24

WPRTS2024-07-24

WPRTS2024-07-23

DRBHCOM2024-07-23

WPRTS2024-07-22

DRBHCOM2024-07-22

WPRTS2024-07-19

DRBHCOM2024-07-19

EDGENTA2024-07-19

EDGENTA2024-07-19

EDGENTA2024-07-19

WPRTS2024-07-16

WPRTSMore articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024