Traders Brief - Still Trapped In Downtrend Channel As The Odds Continue To Favour The Bears

HLInvest

Publish date: Fri, 02 Oct 2020, 09:17 AM

Global. In holiday-thinned trade (China, South Korea, Taiwan and Hong Kong markets were closed), most Asian markets climbed as the mood was bolstered by signs of progress on US fiscal stimulus despite the chaotic presidential debate on Tuesday’s night (US time 9 pm). Overnight, the early strong Dow’s gains of 260 pts were reduced to a modest 35-pt gain at 27817 pts as the approval on the USD2.2 trillion Democratic stimulus bill is further delayed until tonight to allow more time for Pelosi and Mnuchin to hash out a bipartisan plan that could get through both chambers of Congress.

Malaysia. Bucking higher regional markets, KLCI slipped 8.1 pts to 1496.8 after hovering between 1491.1 and 1503.9, as sentiment was dampened by the surging 260 Covid-19 cases in Malaysia, the 2nd highest since 277 infections on 4 June. Trading volume decreased to 4.92bn shares worth RM2.61bn as compared to Wednesday’s 5.64bn shares worth RM2.64bn. Market breadth was positive with 501 gainers as compared to 499 losers.

In the wake of persistent selling by foreign investors (-RM58m) and local retailers (- RM13m), local institutional investors (RM71m) were the main buyers in equities for the 7th consecutive sessions. YTD, local institutional and retail investors were the major buyers with RM10.7bn and RM11bn, respectively whilst foreign investors net sold RM21.7bn in equities.

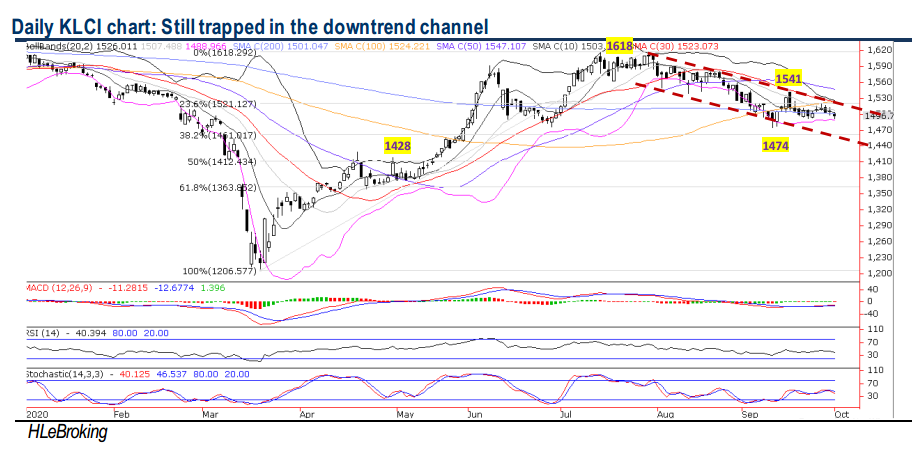

TECHNICAL OUTLOOK: KLCI

Following the breakdown below the key 1507 (mid BB) and 1501 (200D SMA) supports to 1497 yesterday, the odds continue to favour the bears, with deeper retracements towards 1488 (lower BB), 1474 (11 Sep low) and 1461 (38.2% FR) levels before staging a more solid oversold rebound. Key resistances are now situated at 1501, 1507 and 1523 (downtrend line from 1618) levels. Only a decisive breakout above the 1523 hurdle will reignite a resumption of uptrend towards 1541 (17 Sep high) and 1582 (100W SMA) zones.

MARKET OUTLOOK

The bulls attempted to push the KLCI above the 1523 (downtrend line from 1618) resistance in the last few days but buying momentum could not be sustained as concerns over a liquidity squeeze on the stock market after the expiry of 6M grace period for loan repayments, coupled with soaring coronavirus cases and clusters locally and the reintroduction of further MCOs will dampen the ongoing nascent economic recovery (World Bank had downgraded Malaysia’s 2020 GDP to -4.9% from -3.1% earlier). Nevertheless, the recent announcement of the RM10bn Kita Prihatin package and expectation of further stimulus measures in the Budget 2021 (on 6 Nov) may cushion near term downside. Major supports are pegged at 1488-1474-1461 zones.

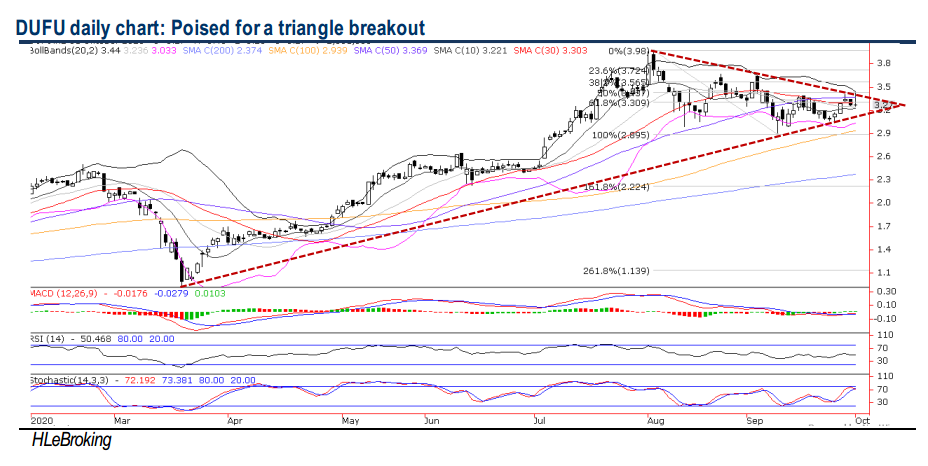

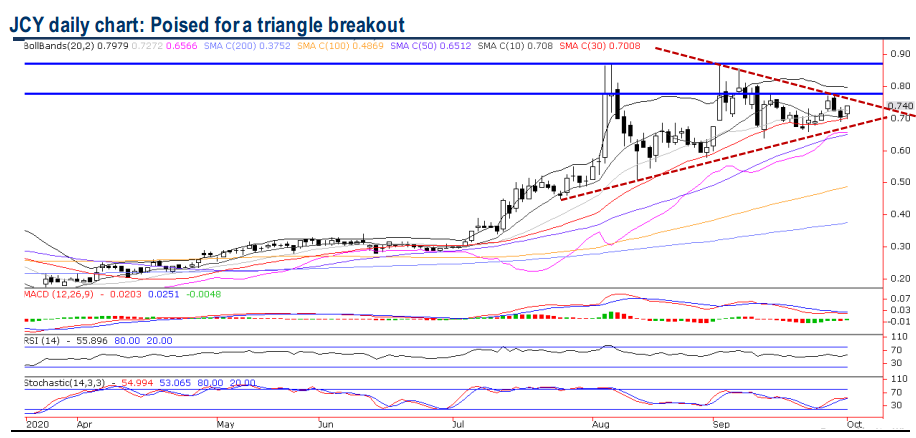

Technical stock picks. Being well-positioned in the HDDs supply chain, DUFU (RM3.27- Not rated) and JCY (RM0.74-Not rated) are poised for a huge upcycle on rising demand for HDDs, supported by the growing emphasis of social distancing and home -based working since Covid-19 lockdowns coupled with the continuous upgrading of the data center with increased storage capacity as more companies are preparing themselves for 5G technology rollout, big data, powerful analytics, artificial intelligence and other key innovations to drive growth.

Technically, DUFU has been trading sideways but we see a triangle pattern taking form here. A decisive breakout above RM3.37 (200D SMA) will lift prices higher towards RM3.56 (38.2% FR) and our LT target at RM3.72 (23.6% FR) levels. Key supports are pegged at RM3.13 (support trendline) and RM3.03 (lower BB) supports. Cut loss at RM2.99. Meanwhile, JCY is also poised for a downtrend line breakout after closing above 30D SMA in the last few sessions. A decisive breakout above RM0.76 (downtrend line) will spur prices higher towards RM0.80 (higher BB) and our LT target at RM0.87 (near 5Y high on 6 Aug) levels. Key supports are pegged at RM0.72 (mid BB) and RM0.70 (support trendline) levels. Cut loss at RM0.68.

Source: Hong Leong Investment Bank Research - 2 Oct 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024