Traders Brief - Expect knee-jerk selloff from Fitch downgrade but downside is cushioned near 1562-1592 territory

HLInvest

Publish date: Mon, 07 Dec 2020, 09:00 AM

MARKET REVIEW

Global. Asian markets ended mostly higher on growing prospects of a large US economic stimulus package, overshadowed news of potential supply-chain problems for a Covid-19 vaccine by Pfizer and rising US-China tensions after Pentagon added more Chinese firms to a blacklist of alleged Chinese military companies. The Dow jumped 248 pts to 30218 (+1% WoW) as a weaker-than-expected Oct job data could pressure lawmakers to move forward with additional fiscal stimulus, offsetting a record-breaking Covid-19 cases and rising economic activities’ restrictions.

Malaysia. After closing 29.5 pts higher to 16M high at 1628.3 on 3 Dec, KLCI surrendered 6.4 pts to end at 1621.9 last Friday (+170 pts from the 2 Nov low 1452) on profit taking. Market breadth was largely negative with losers outnumbering gainers at 731 against 580. Meanwhile, trading volume today rose to 14.2bn shares valued at RM6.7bn against Thursday’s 12.4bn shares worth RM6.2bn.

TECHNICAL OUTLOOK: KLCI

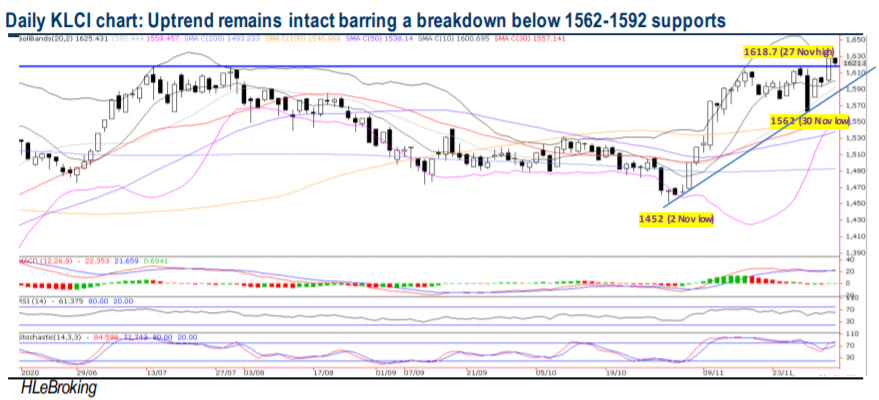

WoW, KLCI rose 14.3 pts at 1621.9 last Friday to record its 5th consecutive gains, above the critical 1618 neckline. Barring any decisive breakdown below 1590 (uptrend line support from 1452 low), we believe further advance towards 1639 (150W SMA) and 1668 (200W SMA) zones is still underway. We remain optimistic that further strong breakout above the said hurdles could signal a LT bullish view to re-challenge the 1700 psychological barrier. Conversely, a fall below 1590 support may trigger a renewed selldown towards 1562-1545 territory.

MARKET OUTLOOK

Following a powerful technical breakout above the much-awaited 1618 neckline resistance last week, KLCI is ripe for further profit taking consolidation, given the overbought momentum (+170 pts from the 2 Nov low 1452) and concerns over the huge amount of global economic uncertainty created by Covid-19 despite vaccines’ optimism, expectations of weaker 4Q20 economy in Malaysia (post CMCO 2.0), coupled with possible knee-jerk selldown after Fitch downgraded Malaysia’s sovereign credit rating to ‘BBB+’ from ‘A-’ last Friday. Nevertheless, we believe the traditional Dec window dressing (average +3.8% return from 1990-2019 with a 87% successful hit rates) and continued shift from pandemicthemed to recovery-focused beneficiaries may cushion downside near 1592 (uptrend line support from 1452) and 1562 (30 Nov low).

VIRTUAL PORTFOLIO POSITION-FIG1

In the wake of the grossly overbought KLCI indicators, we decided to took profit on our virtual portfolio stocks i.e. DRBHCOM (5.4% gain) and KERJAYA (8.8% return) on 4 Dec.

Source: Hong Leong Investment Bank Research - 7 Dec 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-28

DRBHCOM2024-07-25

KERJAYA2024-07-24

KERJAYA2024-07-23

DRBHCOM2024-07-23

KERJAYA2024-07-22

DRBHCOM2024-07-19

DRBHCOM2024-07-19

KERJAYA2024-07-19

KERJAYA2024-07-19

KERJAYA2024-07-19

KERJAYA2024-07-19

KERJAYA2024-07-19

KERJAYA2024-07-19

KERJAYA2024-07-19

KERJAYA2024-07-18

KERJAYA2024-07-18

KERJAYA2024-07-18

KERJAYA2024-07-17

KERJAYA2024-07-17

KERJAYAMore articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024