Dufu Technology Corp - Riding on the strong HDD markets

HLInvest

Publish date: Fri, 11 Dec 2020, 09:13 AM

Dufu anticipates another strong 4Q20 results (translating into a better FY20 vs FY19), driven largely by the high HDD demand from the enterprise sector and cloud storage which require more spacers installed in one unit of HDD to equip themselves for 5G technology rollout, big data, powerful analytics, AI and other key innovations to drive growth. Meanwhile, Dufu’s risk mitigation strategy in 2015 to diversify into the nonHDD segment has started to bear fruits. DUFU is also optimistic with the ongoing new projects and potential new customers, which are offering high value creation and carrying better margins than the HDD segment. Valuation is undemanding at 32x trailing P/E (48% below peers), supported by a RM26m net cash.

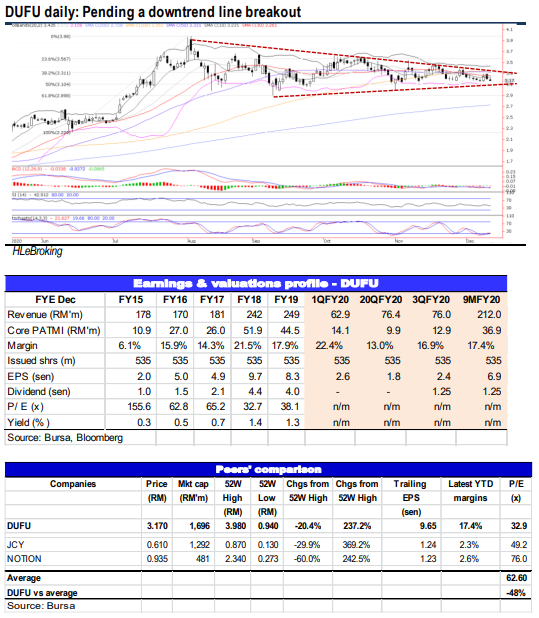

Pending a downtrend line breakout. After hitting the all-time high of RM3.98 (4 Aug), DUFU share prices slipped 27% to a low of RM2.90 (9 Sep) before closing at RM3.17 yesterday. The stock has been hovering above the RM2.90-3.00 trend line in the last 3 months and is ripe for staging a downtrend line breakout soon. Breaking above the RM3.30 hurdle (downtrend line from RM3.98) will spur prices towards RM3.50 (upper BB) before reaching our LT objective at RM3.80 (monthly upper BB). Cut loss at RM2.88.

Source: Hong Leong Investment Bank Research - 11 Dec 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024