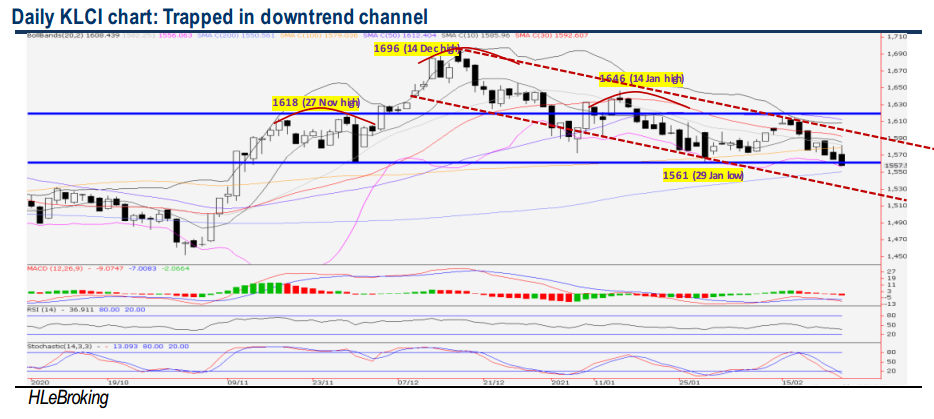

Traders Brief - Trapped in Downward Channel

HLInvest

Publish date: Thu, 25 Feb 2021, 10:09 AM

MARKET REVIEW

Global. Despite Fed’s dovish undertone and aggressive Covid-19 vaccines rollout, most Asian bourses slid on worries over steep asset valuations and tightening in policies amid elevated Treasury yields. Sentiment was also dampened by a 3% plunge on HSI after the city announced its first stamp-duty hike on stock trades in almost three decades. The Dow rallied 424 pts to a record high at 31962, as value sectors like energy and industrials continue to gather steam amid expectations that another round of stimulus and the ongoing vaccine rollouts will spur a stronger economic recovery, overshadowed the concern of rising bond yields driven by by economic optimism rather than inflation fears.

Malaysia. In spite of the National rollout of vaccination program, KLCI shed 7.5 pts at 1557.5 (its 6th decline in 7 days), in line with the sluggish regional markets and Moody’s pessimistic economic assessment for Malaysia after two rounds of MCO. Market breadth was bearish as losers 995 edged gainers 332 amid heavy selling pressures on the small cap stocks and lower liners, with a total of 12.7bn shares traded valued worth RM7.0bn. Local retailers (+RM274m) remained the main net buyers in the last 8 days whilst the local institutional (-RM95m) and foreign (-RM179m) investors were the major net sellers.

TECHNICAL OUTLOOK: KLCI

Unless staging a strong reclaim above 1582 (mid BB) and 1600 (downtrend line from 1696 peak) zones, KLCI is likely to stay trapped within the downtrend channel in the short term. Following the 1561 H&S neckline support breakdown yesterday, the index is envisaged to test the next key supports of 1550 (200D SMA) and 1530 (lower downtrend channel) zones, before staging a more sustainable relief recovery. On the flip side, a successful breakout above the congested 1582-1600 levels will encourage more upside towards 1618 and 1646 (14 Jan high) zones.

MARKET OUTLOOK

In the wake of the recent multiple supports breakdown and awaiting more clues on local corporate earnings front, KLCI is still vulnerable to further consolidation. Nevertheless, downside risk seems limited near 1550-1530 levels (resistances: 1582-1600-1618), cushioned by the oversold slow stochastic readings, Fed’s dovish outlook, huge US stimulus package, falling Covid-19 infections globally, and the planned vaccination program in Malaysia starting from 26 Feb.

On stock selection, MBMR (RM3.29-HLIB Research-BUY TP RM5.70) is expected to stage a downtrend resistance breakout soon in anticipation of continued strong earnings in 4QFY20 and its LT prospects, underpinned by solid balance sheet (NCPS of RM0. 40 and BVPS RM4.49), handsome FY21-22 DY of 6% and undemanding 6x FY21E P/E. A successful downtrend line breakout above RM 3.31 will spur prices higher to RM3.46-3.56- 3.73 levels. Key supports are pegged at RM3.22-3.15 zones. Cut loss at RM3.12

Source: Hong Leong Investment Bank Research - 25 Feb 2021