Traders Brief - Market Is on the Verge of Further Relief Rally Towards 1558-1568 Zones

HLInvest

Publish date: Fri, 24 Sep 2021, 09:36 AM

MARKET REVIEW

Global. Tracking a relief rally in US markets, Asian bourses ended higher, as investors reacted calmly to the Fed’s timeline to taper asset purchases and hike rates as a vote of confidence that the US recovery is on track. Investors also found some solace after China Evergrande's chairman reassured investors the company's unit had resolved the interest due on RMB-bond (though questions remained over its interest payment on its USD-bond) and China’s central bank continued to inject liquidity into the financial system. Overnight, the Dow rallied 507 pts to 34762 underpinned by energy, financials and cyclical stocks as worries about Evergrande’s ripple effect faded and investors appeared relieved with a more clarity and carefully-planned Fed tapering and tightening monetary policy timeline on the back of a resilient US economic growth.

Malaysia. Tracking higher Wall St and regional markets, KLCI jumped 10.3 pts to 1539.3 amid bargain hunting activities on recently bashed down heavyweights such as TENAGA, AXIATA, SIMEPLT, CIMB and GENTING as economic reopening is gaining traction and Covid-19 cases fell to a 2-month low. This appeared to overshadow the latest government’s proposals to boost its coffer with capital gain tax and one-off higher tax rate for companies benefited under the Covid-19 environment. Meanwhile, foreigners resumed buying for a 3rd day amounting to RM118m whilst local institutions net sold RM104m, logging its 21th consecutive day of net outflow totalling RM3.05bn. Meanwhile, local retailers net sold RM14m, logging its 1st outflow after recording 15th straight day of net inflow totalling RM825m.

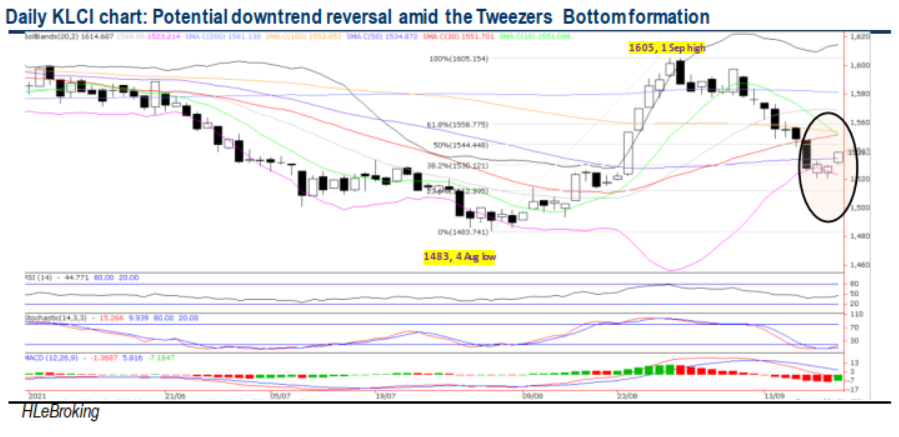

TECHNICAL OUTLOOK: KLCI

After plunging as much as 85 pts from 1605 to 1520 on 21 Sep, the benchmark staged a meaningful rebound to close at 1539 yesterday, forming a bullish Tweezers Bottom downtrend reversal pattern. As technical indicators are on the mend, the index is envisaged to revisit 1544-1558-1568 hurdles in the short term. A successful breakout above these hurdles may lift the benchmark out of the sideways consolidation mode to revisit 1581-1605 territory. On the downside, key supports are situated at 1530-1512-1500 levels.

MARKET OUTLOOK

On the back of more clarities from the FOMC meeting and easing fears of Evergrande’s debt crisis, we expect the KLCI to find a floor at 1500-1512 levels (resistances: 1544-1558- 1568), underpinned by grossly oversold stochastic reading and positive hopes from the tabling of 12th Malaysia Plan announcement (27 Sep) and Budget 2022 (29 Oct), which are expected to paint a clearer picture of Malaysia’s short-to-medium-term growth prospects and offer various investment opportunities to investors. Meanwhile, we reckon that current market weakness could be the next boat to catch on the broader re-opening theme play, underpinned by Bursa Malaysia’s laggard status (KLCI: - 5.9% YTD; 14.5x CY22E EPS), hopes of easing political risks and confidence in policy continuity as well as further re-opening of economic sectors as the nation is entering endemic phase by year-end.

VIRTUAL PORTFOLIO POSITION-FIG1

We took the opportunity from the market rebound to trim positions in ASTRO (4.6% loss), TNLOGIS (1.7% loss), DUFU (4.8% gain) and OCK (8.3% gain) yesterday.

Source: Hong Leong Investment Bank Research - 24 Sept 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024