Traders Brief - Upside Bias Amid Expectations of Year-end Window Dressing and China’s Reopening

HLInvest

Publish date: Thu, 15 Dec 2022, 09:49 AM

MARKET REVIEW

Asia/US. Ahead of the key FOMC decision, Asian markets ended mostly higher in anticipation that the Fed would slow the pace of its tightening following a softer-than expected US Nov CPI print. The Dow swung between gains and losses before closing 142 pts at 33,966, as Fed hike 50 bps as expected to 4.25-4.5% and lifted its forecast for rates to peak at 5.1% and remain at that level through 2023 to tame inflation, before easing to 4.1% in 2024.

Malaysia. In line with higher regional markets and expectations of year-end window dressing, KLCI staged a strong rebound to end 13.1 pts at 1,483.2, spearheaded by bargain hunting on selected heavyweights such as PBBANK, AXIATA, TENAGA, CIMB, PMETAL, and TM. Local retailers (-RM30m; Dec: -RM84m) were the major net sellers whilst foreigners turned net buyers after net sold RM1.14bn in the last 8 consecutive sessions (+RM22m; Dec: -RM1.01bn) and local institutions continued its buying spree for the 11th sessions (+RM8m; Dec: +RM1.1bn).

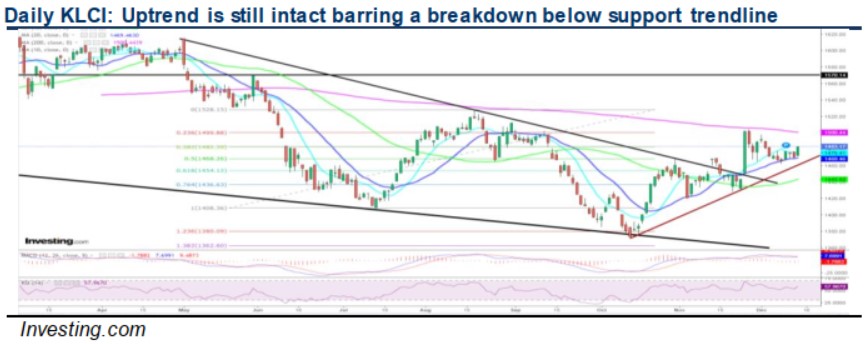

TECHNICAL OUTLOOK: KLCI

Following the strong closing above 10D/20D MAs coupled with rising technical indicators could push the benchmark higher to retest the key 200D MA at 1,500 soon, before advancing further towards 1,528 (17 Aug high) levels. In the short term, we reiterate that KLCI’s uptrend remains intact barring any decisive breakdown below the support trend line from 2Y low of 1,373 (now near 1,468 territory) and 1,454 (61.8% FR) zones.

MARKET OUTLOOK

Ahead of the vote of confidence on the PM when Parliament convenes on 19 Dec, KLCI is expected to trade sideways with an upward bias (1,454-1,468; resistance: 1,500-1,528) as investors look forward to i) more reform policies from the unity government, ii) expectations of slower Fed rate hikes in future, iii) further relaxations of China’s zero Covid curbs, iv) strengthening political stability as a coalition agreement involving all parties in the unity Government will be signed soon, and v) year-end window dressing in Dec (10Y/20Y: +2.6%/2.8%). For risk-takers, any pullback on TOPGLOV (HLIB-SELL-TP RM0.53)

towards near term supports at RM0.67-0.70-0.75 following a downbeat 1QFY23 results may attract bargain hunting activities. Potential technical rebound targets are situated at RM0.82-0.87-0.90.

Source: Hong Leong Investment Bank Research - 15 Dec 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|