KTC (Kim Teck Cheong) - All time high Revenue + Net Profit

icn88

Publish date: Mon, 03 Sep 2018, 06:28 PM

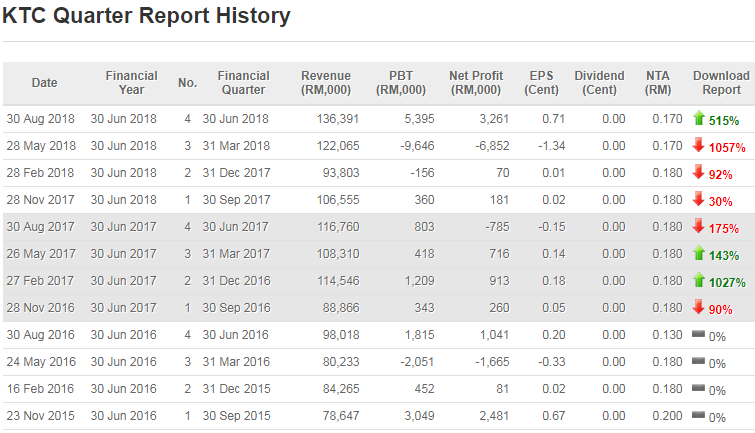

Comparative with Immediate Preceding Quarter’s Results

The Group’s revenue experienced a reasonable level of revenue growth. There has been positive demand for its consumer-packaged goods. The Group’s revenue for Q4 2018 increased by RM14.33 million or 11.74%, from RM122.07 million to RM136.39 million, as compared to the immediate preceding quarter ended 31 March 2018 (Q3 2018).

The increase in revenue was mainly due to increase in revenue contribution from its operations in Sarawak from RM44.19 million (Q3 2018) to RM53.25 million (Q4 2018), operations in Sabah from RM55.67 million (Q3 2018) to RM60.29 million (Q4 2018) and operations in Brunei from RM 20.26 million (Q3 2018) to RM20.46 million (Q4 2018).

The Group’s profit before tax in Q4 2018 is RM 5.40 million compared to a loss in Q3 2018 RM9.65 million. The profit is due to increase in revenue and streamline of operating costs. The loss before tax in previous quarter was mainly due one off write off of claims and inventories.

Prospect From Recent Quarter Report

In view of the increase in the Group’s revenue for the current quarter contributed from the following distribution contracts which were secured during the Q3 2018, we believe that the distribution contracts will keep up the momentum and are expected to continue to contribute positively to our Group’s revenue moving forward:

(i) Nestle Products Sdn Bhd for Nestle grocery products to cater for the modern trade channel in Brunei;

(ii) Heineken Marketing Malaysia Sdn Bhd for Kuching, Sibu and Sri Aman in Sarawak;

(iii) L’Oreal Malaysia Sdn Bhd for L’Oreal consumer products under the brands of “L’Oreal Paris”, “Maybelline” and “Garnier” for Sabah, Labuan and Sarawak; (iv) Oriental Food Industries Sdn Bhd for Sabah and Sarawak;

(v) Sincere Match & Tobacco Factory Sdn Bhd for Sabah, Sarawak and Brunei; (vi) Power Root Marketing Sdn Bhd for Kuching, Sibu, Miri and Bintulu; and

(vii) Oriental Food Marketing (M) Sdn Bhd for Kuching, Sibu, Miri and Bintulu.

With the removal of Goods Services Tax, stabilisation of petrol prices and Sales Service tax due to be announced in September, we believe that this will have a positive impact on the purchasing power of the consumers on consumer-packaged goods and this is expected to contribute positively to the financial performance of our Group. The Group has streamlined some of its operating costs and these savings that be reinvested back to the Company. The Board of Directors of KTC Consolidated (“Board of Directors”) is of the view that the Group’s overall performance for the next quarter will be satisfactory with the current momentum of revenue and better control of cost efficiencies.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on huat8888

Created by icn88 | Oct 01, 2018

Created by icn88 | Aug 23, 2018

Created by icn88 | Jul 24, 2018