Top Glove on Top of The World

livingston

Publish date: Mon, 19 Oct 2015, 09:55 PM

1. Management Team / Major Shareholders:

Tan Sri Lim humble beggining since 1991 has made Topglove the largest rubber glove manufacturer in the world commanding 25% market share. Company is paying consistent dividends. Renewal of mandate buying back her own shares is a good news. Proposal of Bonus Issue and Share Grant Plan is indeed a good move to maintain the performers.

2. Financial Health Analysis

Income Statement

i.Profit Margin = 11.2% / PASS (if < 5% fail)

ii.Profit for the past 5 years = PASS

iii.Interest Cover = -29 / FAIL (if <3x fail)

Balance Sheet

iv.Current Ratio = 1.73x/ PASS (if < 1x fail)

v.Debts to Equity Ratio = 0.38x / PASS (if > 3x fail)

Cash Flow

vi.Positive at least 1 year = YES / PASS

3. Pricing Analysis

i. P/E Ratio:

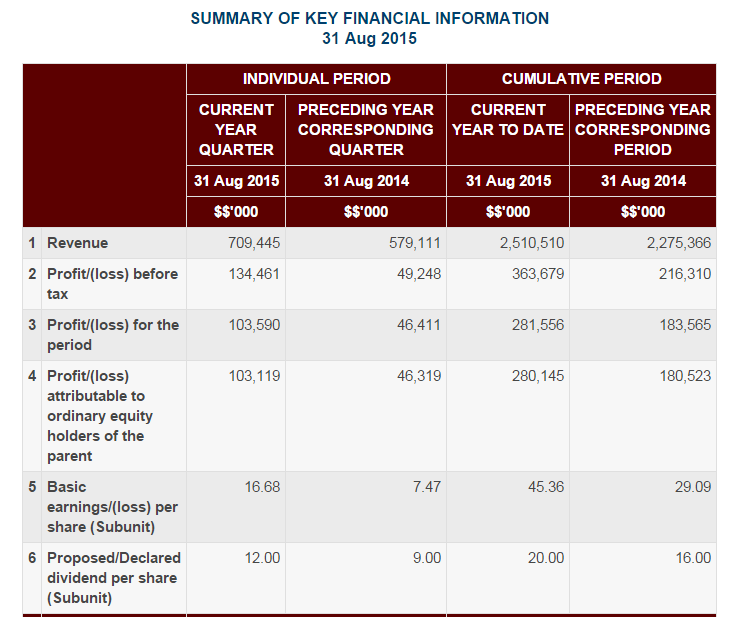

Nov 14 + Feb 15 + May 15 + Aug 15

7.85 + 9.09 + 11.7 + 16.68 = EPS 44.8

Price 8.81 / 44.80 = PE 19.5x Higher than PE for FD (Not Cheap)

ii. P/BV 3.35 (Not Cheap)

iii. Dividend Yield 2.3% - Negligible

4. Economic / Industry - Theme play for now?

Yes. The volatility of RM/USD definately gives a good impact on TopGlove forex gain. The suprise EPS for Q4 2015 gives us the confident that the next quarter will be better due to the impact from forex gain for the period of June to Sept. We believe it has not been factored in. The challenging environment in Malaysia will be a minor issue to Topglove as most of their businesses are in oversea. The PE is 19x is indeed not cheap but it climb up from RM7.99 till 8.81 is well supported by their spetacular Quarterly Result.

Conclusion

Northcape Capital was a net sell while KWAP is accumulating from the market. From FA (di li)perspective, it is pricey and difficult to gauge. When we quoted on 'Stocks to Watch' on 11 October 2015, it was base on Theme Play (tian shi) and Price Volume Action (ren her). We were expecting a good Quarterly Report but it came out as an excellant Quarterly Report. For those investors who bought earlier last week, congratulations and do prepare to take profit. Happy Trading.

Disclaimer and Declaration

The full content of the article is for educational purposes only and should not be used as investment recommendations. We are not responsible for all investment activities conducted by the participants and cannot be held liable for any investment loss. Examples of specific shares is citied for illustration purposes.

Regards,

Humblepie188

Bursa Blue Ocean (by MIVCO)

Please like us at our facebook page - Bursa Blue Ocean

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Humblepie188

Created by livingston | May 10, 2017

Created by livingston | Aug 08, 2016

Created by livingston | Jan 03, 2016