LONG STEEL PRODUCERS WITH PE BELOW 2

iedge

Publish date: Fri, 06 Oct 2017, 01:33 PM

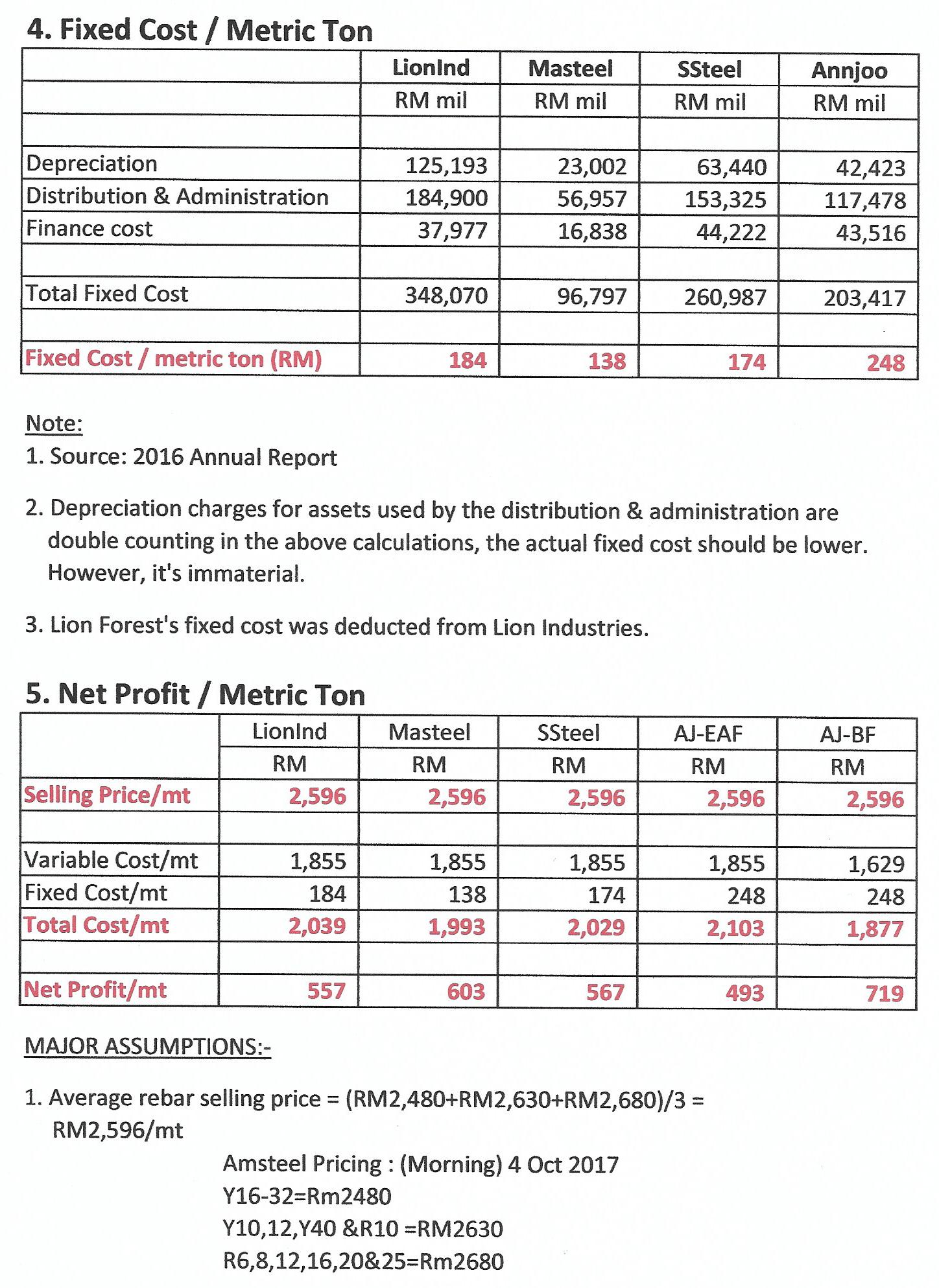

STEELMAKING STANDARD COST & LONG STEEL PRODUCERS

WITH PE BELOW 2

The objective of this write up is to use the standard cost approach to calculate cost

per metric ton of long steel production and also to project the profit target of

Big 4 long steel companies in Malaysia.

Standard Cost is defines as the predetermined cost based on technical estimates for

materials, labour, and overhead for a selected period; for a prescribed set of working

conditions. Standard costing pre-determines all costs, compares them with actual costs,

and analyses the reasons for variance. The management then either takes steps to

eliminate the variance, or revise standard costs based on new realities.

STEELMAKING STANDARD COST

The steelmaking standard cost model that I used here was extracted from

http://steelonthenet.com, a United Kingdom's steel industry news and information

portal and I adjusted the input cost of raw material, labour and overhead to reflect local

scenario.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Discussions

Please adjust your machine capacity. Design capacity no equivalent to operation capacity. Machine got downtime, setting time, and routine maintenance. 70 to 80% of design capacity is reality.

2017-10-06 14:24

Thank you. Very detailed analysis. Enhanced version compared to "earlier version".

2017-10-06 14:27

Market selling price also fluctuate from time to time, unless you can get an exactly average selling price for year 2017, else you won't get a more accurate figure of profit.

2017-10-06 14:27

Your piece of calculation is good. But, two variables you input need to review. First is capacity, Second which is most important is Average Selling Price (ASP) too optimistic.

2017-10-06 14:45

The demand (demand=full capacity) is also too optimistic.

Anyway, you give me hope. Hope is a good thing.

Thank you very much.

2017-10-06 14:58

since everything is so rosy, I decided to take all information at half valution

therefore, masteel 1.29 x 2 = PE 2.58 is still dirt cheap for a no borrowing companry

2017-10-06 15:48

please note that Masteel capacity is 700000mt, last year they run at 80% capacity utilisation. they stated to increase 8% from last year performance. Therefore, estimated volume is 600,000mt. 600,000 x assuming very conservation RM300 = 180million / 4 = 45million per quarter of NP.

2017-10-06 16:45

A commodity business. Lowest cost producer is the winner. Masteel look interesting in that aspect. But many other variables were not included in the model. Still a great model nonetheless!

2017-10-06 21:15

Ann joo is very different from other steel mills because its storage capacity is highest although its production capacity is lower.

2017-10-06 22:24

well, nice calculation. I am sure u have spend a lot of time on this article. Appreciate for ur dedication.

2017-10-07 01:36

@rojakmee, this is simply. not only lionind, ssteel and annjoo face the same problem. There are only one winner in Q2. This is because three of them buy expensive raw materials in Q1, but masteel didnt. Thus, when it come to Q2, only masteel have lower raw material, but take note that masteel is using the last year raw material. However, this wont make masteel show any advantage in future... Masteel just lucky for this time. Let see Q3 then we will know the truth.

2017-10-07 01:40

why both Annjoo eaf,bf profit not merge together then shares divide the total profit ? Should be PE 1.19 for Annjoo

2017-10-07 01:56

great work!! but too optimistic.top up RM200/t for each scenario for more realistic..

2017-10-07 08:39

Annjoo can use local iron ore.which is cheaper than USD70/t.but cannot use coal, should be use coke.

2017-10-07 08:41

Hi guys,

A Word of Caution from Peter Lynch

Steel is a cyclical stock.

And contrary to normal growth stock you must invest "DIFFERENTLY".

At its bottom Steel Stocks have high P/E and people will avoid

like

Prestar at 46 sen

Masteel below 40 sen

ANNJOO BELOW 70 SEN

SSteel below 80 sen

So if you base your investment criteria on P/E you would have missed the above 4 Stocks when prices are cheap.

Of course Cyclical Long Steel with good business due to Highways & MRT construction garnered the best sales. And now P/E is low.

But prices have surged 100% to 200% in tandem.

Therefore Steel Counters no longer cheap.

And low P/E now turns into a dangerous trap for those who chase High High Priced Steel Counters.

SO FOR CYCLICALS YOU MUST BUY WHEN P/E IS HIGH

AND YOU MUST CERTAINLY SELL NOW WHEN P/E IS LOW

Listen to Peter Lynch's words below:

"Anticipate a shrinking P/E multiple over the time as business recovers and investors begin to look ahead to the end of the cycle, when peak earnings are achieved."

IT SAYS,

"ANTICIPATE A SHRINKING P/E MULTIPLE OVER TIME AS BUSINESS RECOVERS"

As steel sells well P/E shrinks to lower digits (one or two p/e also possible)

"INVESTORS BEGIN TO LOOK AHEAD TO THE END OF THE CYCLE, WHEN PEAK EARNINGS ARE ACHIEVED"

What do these words mean?

1) TRUE SMART INVESTORS LOOK AHEAD.

To see that Business is Now at ITS PEAK.

2) LOOK AHEAD TO THE END OF THE CYCLE, WHEN PEAK EARNINGS ARE ACHIEVED

So the CYCLE WILL COME TO THE VERY PEAK. AND P/E WILL BE AT THE LOWEST.

AND THEN?

"THE END"!!!

FROM THE SUMMIT OF THE MOUNTAIN EARNINGS WILL THEN GO DOWNHILL.

SO BUY BUYING INTO LOW P/E NAIVE & SORCHAI WILL GET TRAPPED KAW KAW!!!

That was how Prestar rose from 60 Sen to Rm1.00

And Directors of Prestar got caught buying Prestar near Rm1.00 in year 2006/7 10 years ago.

This round Prestar Directors whose fingers have been burnt badly last round are wiser & selling now

See

ENCIK MD NAHAR BIN NOORDIN 27-Sep-2017 Disposed 67,200 1.350 View Detail

ENCIK MD NAHAR BIN NOORDIN 20-Sep-2017 Disposed 25,000 1.400 View Detail

ENCIK MD NAHAR BIN NOORDIN 19-Sep-2017 Disposed 40,000 1.410 View Detail

MR TOH YEW KEAT 13-Sep-2017 Disposed 20,000 1.450 View Detail

MR TOH YEW KEAT 08-Sep-2017 Disposed 10,000 1.450 View Detail

DATO' LIM CHEANG NYOK 06-Sep-2017 Disposed 50,000 1.410 View Detail

MR LIM CHEANG NYOK 28-Aug-2017 Disposed 50,000 1.400 View Detail

EN MD NAHAR BIN NOORDIN 24-Aug-2017 Disposed 70,000 1.450

This is from Calvin Tan Research personal experience with Steel Stocks over a 10 year period

Regards,

Calvin

2017-10-07 10:56

Speaking of directors/management, it might be prudent for those unaware to note this too:

http://www.malaysiastock.biz/Company-Announcement.aspx?id=939645

2017-10-07 12:43

Thx to iedge

for append us the thoroughly infos for the BIG4 Long Steel players.

2017-10-07 15:10

Jeffbkt

Good Job but please study if you can the operating cost of the 3 company in Q2 especially LIONIND and compare with your estimated Q3 operating cost.

2017-10-06 14:14