Invest Made Easy

Top 20 Best Performing Unit Trust Funds for 2015 plus Three Unit Trust Investing Tips for 2016.

Shane My

Publish date: Sat, 26 Dec 2015, 09:28 PM

2016 is just 5 days away! As we approach the end of 2015, let us take a look at the best performing unit trust funds for this year.

Tips on Unit Trust Investing

"Investors need to know about all the other SC-approved funds in the market in order to make informed decision to invest"

Apart from finding out the best funds for 2015, we will also highlight some interesting facts about these funds and share a few tips on unit trust investing.

Interesting Facts About The Top 20 Best Performing Unit Trust Funds for 2015

The Top 20 Funds all generated 20% or more returns:

| Category | No of Funds |

| Returns : 30% and above | 6 |

| Returns : 20.00% - 29.99% | 14 |

The Top 20 Funds come from 7 different fund categories/sectors:

| Fund Size | No of Funds |

| < RM50 million | 10 |

| RM50 million - RM200 million | 6 |

| RM200 million - RM500 million | 3 |

| >RM500 million | 1 |

Top 20 Best Performing Unit Trust Funds of 2015

Here's the Top 20 ranked according to Year To Date (YTD) performance:

|

| Top 20 Unit Trust Funds for 2015 Click to Enlarge |

Tip 1 : Popular does not equal to being the best

This is one misconception that many Malaysians have when it comes to investing into unit trust funds. Just because a fund house/company the biggest in terms of managed funds does not make their funds the best performing.

Take the sample advertisement above which declares itself as the No.1 Unit Trust company in Malaysia as well as the number No.1 Choice of Investors. Despite being hugely popular among Malaysians, none of the funds from this company made it to the top 20 for 2015. Hence if you intend to invest to achieve maximum returns, choosing the most popular might not be wisest after all.

This disparity between investing in a popular fund vs investing in a performing fund was also highlighted by this statement from Nazaruddin Othman, CEO of FIMM,

However, Mr Nazaruddin also added that investors can now turn to other channels such as Insitutional Unit Trust Advisers (IUTA) and Corporate Unit Trust Advisers (CUTA) for a wider selection of funds. One such IUTA which Invest Made Easy has been actively promoting to our readers is eUnittrust. For more details about eUnittrust, just click HERE.

Tip 2 : Size matters

Yeap, the size of a fund does contribute to the performance of the fund. Just take a look again at the top 20 table. 10 of the Top 20 funds have a fund size of RM50 million or lesser. This goes to say that small sized funds tend to perform better then bigger funds.

In other words, a fund that is small in size is akin to a mouse, quick and fast to react. Larger funds (RM500 million and above) are similar to an elephant, slow to react and generally struggle to generate higher returns.

Here's an example I would like to share on the growth of a top performing small fund. 4 Years ago, Kenanga Growth Fund has a fund size of only RM 53.63 million (31 January 2012). The fund was a rising star under the Category Equity Malaysia and grew over the next 4 years, garnering 7 Lippers Awards between 2013 to 2015.

Presently Kenanga Growth Fund has grown 10 times its size! At RM574.01 million, this fund is the largest in the top 20 list. However the fund is still considered small as compared to other popular funds that have ballooned to RM1 billion or more in terms of size.

At Invest Made Easy, Kenanga Growth Fund is still part of our Recommended Funds list due to its outstanding fund manager as well as excellent investment philosophy.

Tip 3 : Diversify your investment but don't over diversify.

Yes, the evergeen advice of "Don't put all your eggs in a single basket" is still philosophy held in high regards by smart investors.

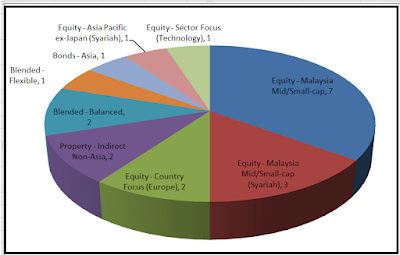

Stock investors for example practice diversification by selecting stocks from various industries. Unit Trust investors on the other hand diversify through different categories or sectors. As a matter of fact, the top 20 funds come from seven different categories/sectors as shown below:

| Sector/Category | No of Funds |

| Equity - Malaysia Mid/Small-cap | 7 |

| Equity - Malaysia Mid/Small-cap (Syariah) | 3 |

| Equity - Country Focus (Europe) | 2 |

| Property - Indirect Non-Asia | 2 |

| Blended - Balanced | 2 |

| Blended - Flexible | 1 |

| Bonds - Asia | 1 |

| Equity - Asia Pacific ex-Japan (Syariah) | 1 |

| Equity - Sector Focus (Technology) | 1 |

Diversifying your investment s into different categories and sectors helps to create a balanced portfolio that offers you protection in the event that funds from a particular category/sectors fail to perform. If you like to learn how to create your own portfolio of unit trust funds, do check out this post "Unit Trust Portfolio Diversification".

On the other hand, there's also the problem of over diversification. This tend to happen to investors whom are not aware of the funds they are investing in. A simple example is via the Top 20 list above. Some investors tend to have in their portfolio several fund from the same category or sector. The problems starts when a downturns occurs to a particular category or sector This will result to losses to multiple funds which you own. Therefore when you build your investment portfolio, make sure you're not making the mistake of "over diversifying". Always try to select the best fund from each category instead of several top funds from the same category.

Summary

These are the top 3 tips which you apply for your unit trust investment come 2016. Always remember, spending time into self learning and researching will definitely help you to make wiser and better investment decisions.

Here are some additional recommended reads from us:

- India, the next choice of investment for 2016?

- Global Economic Predictions, Key Events and Our Investing Advice For 2016

- Selecting the Best Funds To Invest from eUnittrust Sales Charge Promotion

If you like this post, do:

- Give us a like on our Facebook page

- Give us a "+1" for Google+ located below.

- Share this post on Facebook

More articles on Invest Made Easy

IME versus Market Analyst - Fun with Predicting UWC's Target Price

Created by Shane My | Dec 06, 2020

Discussions

Be the first to like this. Showing 2 of 2 comments

Recommended reading (e-book format):

1. John C. Bogle - Common Sense on Mutual Funds, Fully Updated 10th Anniversary Edition, WILEY (2009)

2. Christine Benz - Morningstar Guide to Mutual Funds, Five-Star Strategies for Success, WILEY (2005)

2015-12-27 12:22

koonbee9

Like this article so much

2015-12-26 22:04