Invest Made Easy

IME Unit Trust Investment Portfolio 2017 - Portfolio Changes as of 23 June 2017

Shane My

Publish date: Fri, 23 Jun 2017, 09:36 AM

Based on the latest updates from "The Guided Investor", there's a change to the attractiveness to invest of one of the country in our Recommended Unit Trust Portfolio 2017. In view of the recent change, I am putting up this post to highlight/recommend changes to the portfolio.

Latest Changes

There is a change to the attractiveness to invest in China as per the update from The Guided Investor. According to the latest indicator, China is currently at 66.67% attractive to invest in as shown from the screen capture below:

|

| The Guided Investor - updated as of 22 June 2017 |

Recommendation

In light of the change in China, I am recommending to redeem/sell the fund with exposure into China. For the Combination Portfolio, RHB Big Cap China Enterprise fund which takes up 10% of the portfolio will be sold.

|

| Sell RHB Big Cap China Enterprise fund |

For the Shariah Portfolio, Eastspring Investment Dinasti Equity fund which also takes up 10% of the portfolio will be sold.

|

| Sell Eastspring Investments Dinasti Equity fund |

Note:

- The redeemed value from the sale of those funds will be updated later in this blog post.

- It will be based on the selling price of the fund on the 28th of June 2017.

- 26th and 27th of June 2017 is a public holiday for Hari Raya.

Unit Trust Portfolio Allocation as of 28 June 2017

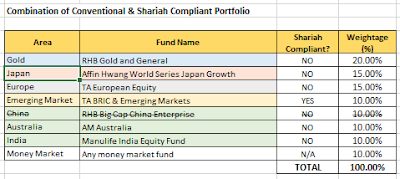

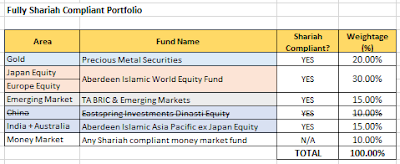

After the redemption of the China fund, this will be the latest portfolio allocation for our Recommended Unit Trust Portfolio 2017:

|

| Recommended Unit Trust Portfolio 2017 as of 28th June 2017 |

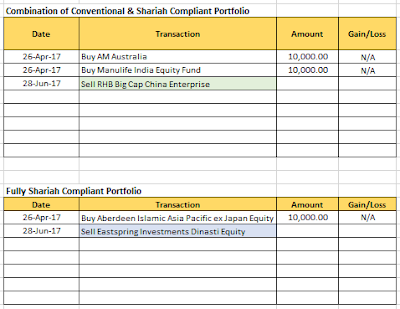

Historical Transaction:

To capture all transactions made to both the portfolios as well as the Gain/Loss for each sell transaction, I have prepared the tracking table as per below:

|

| Historical Transactions as of 28 June 2017 |

Note : The Gain/Loss for the sales of China fund will be updated once the price on the 28th of June 2017 is obtained.

Take Advantage of eUnittrust to Build Your own Unit Trust Portfolio!

Referring to my previous post, I mentioned one of the criteria of selecting fund is that the fund must be available on eUnittrust (online unit trust platform). If you are building your portfolio (or intend to start now) such as the one above, make sure to use an online platform to save on the sales charge. In fact, during promotional campaigns by eUnittrust, sales charges range only between 0% to 1%!

For further details on the eUnittrust and its benefit, click HERE.

More articles on Invest Made Easy

IME versus Market Analyst - Fun with Predicting UWC's Target Price

Created by Shane My | Dec 06, 2020

Discussions

Be the first to like this. Showing 0 of 0 comments