FOCUS LUMBER (All Stars Are Aligned) - PART 1

George Leong

Publish date: Thu, 04 Oct 2018, 02:18 PM

Source: Focus Lumber Company Website

Nature of the Company:

Focus Lumber is a Sabah-based company that manufactures and sells Plywood, Veneer and Laminated Veneer Lumber.

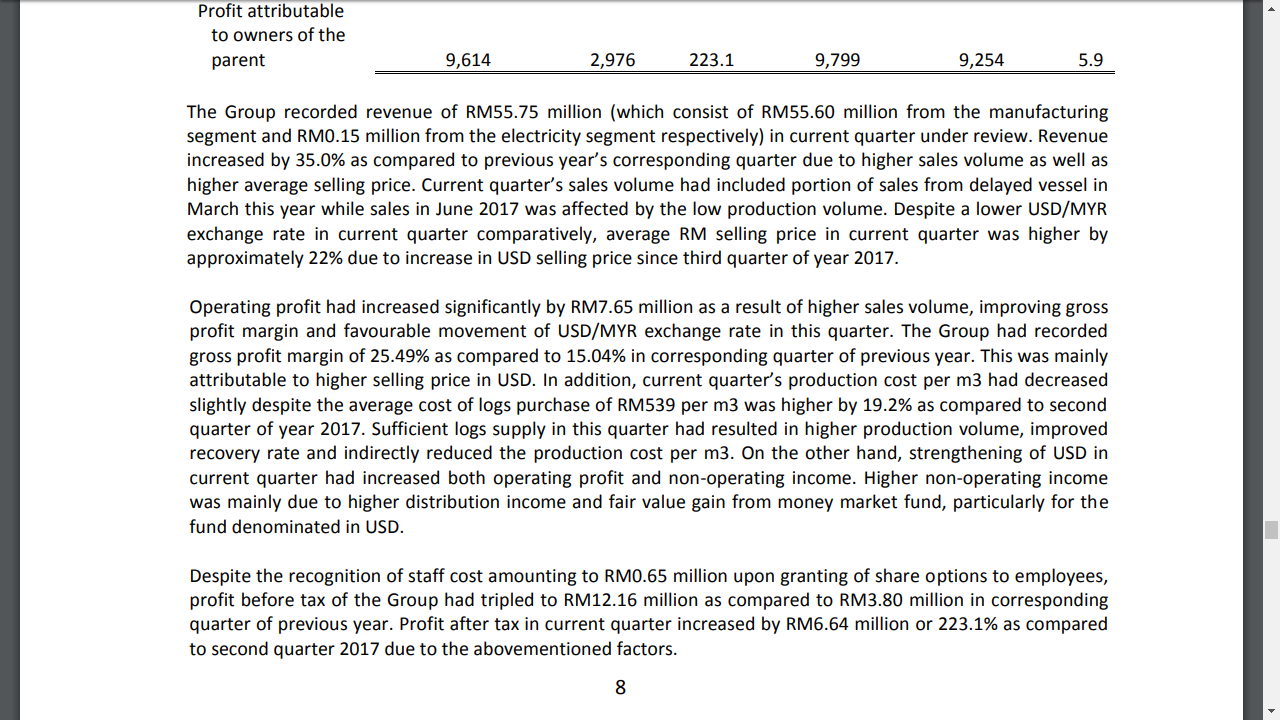

Source: Company Quarterly Report (Bursa Malaysia)

Financial Performance:

Based on its latest quarterly report (Quarter 2), Focus Lumber:

(a) Revenue: rm40.93 mil to rm55.75 mil.

(b) Net Profits: rm3.0 mil to rm9.6 mil.

The increased in revenue is due to higher sales volume (higher sales recorded including portion of sales from delayed vessels in March) and higher average selling price in USD.

The increased in net profits is due to the increase in revenue (factors mentioned above), higher production volume (sufficient logs supply), strengthening of the USD/MYR exchange rate.

From the above brief analysis, Focus Lumber operation is highly influenced by 2 key factors, namely:

(a) Sufficient logs supply - to ensure higher production volume and lower production cost

(b) USD/MYR exchange rate - to ensure higher gross margins from higher USD average selling price

Sufficient Logs Supply:

Source: The Star Online

Source: The Star Online

The Sabah government banned log export since May after winning the historic General Election. This should ensure lower log prices going forward and more importantly, a constant stream of logs supply to Focus Lumber and other logs processing mills companies to produce plywood, veneer and LVL.

Strengthening of the USD/MYR Exchange Rate:

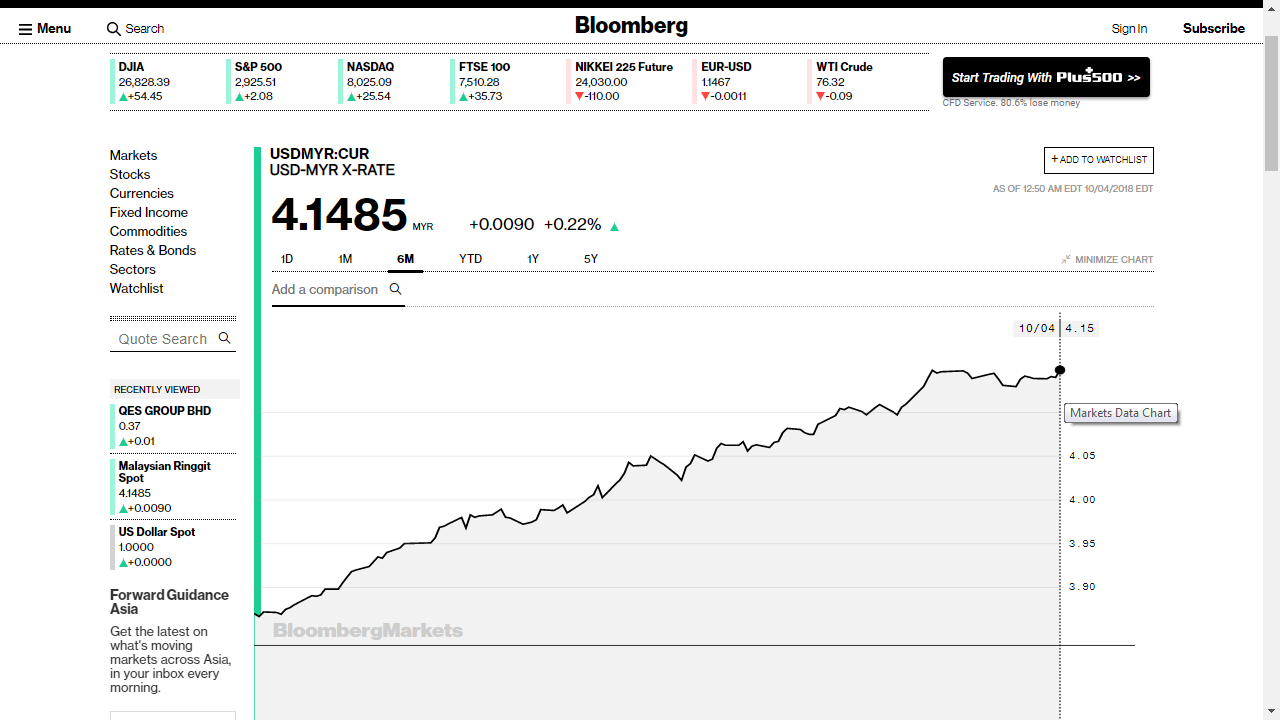

Source: Bloomberg Online

For the past 6 months, the USD has strengthen against the MYR. Going forward, the USD is more likely to remain its current strength against the MYR supported by the ongoing tit-for-tat trade war between the US and China; the latest interest rate hike by the US Fed last month (September), and the high probability of the Fed of raising interest rate once more in this last quarter of 2018.

Source: Bloomberg Online

Based on the above analysis, it seems Focus Lumber might benefit from the logs export ban and the strengthening of the USD/MYR. These are the external factors that are likely to be beneficial to the company. As for the company's fundamentals, I will discuss further in Part 2.

Disclaimer: The above is for educational and sharing purpose only. There is no buy or sell call. Please conduct your own diligence before buying or selling stocks in the capital market.

You may "LIKE" this page "Financial education 4 youth" to support our financial awareness initiative. https://www.facebook.com/financialeducation4youth/

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on George Leong's Blog

Created by George Leong | Oct 17, 2018

Created by George Leong | Jan 19, 2018