Focus Lumber (RM1.34, TP: RM2.12) - ALL STARS ALIGNED - PART 2

George Leong

Publish date: Wed, 17 Oct 2018, 01:19 PM

Source: Focus Lumber Company Website

Nature of the Company:

Focus Lumber is a Sabah-based company that manufactures and sells Plywood, Veneer and Laminated Veneer Lumber.

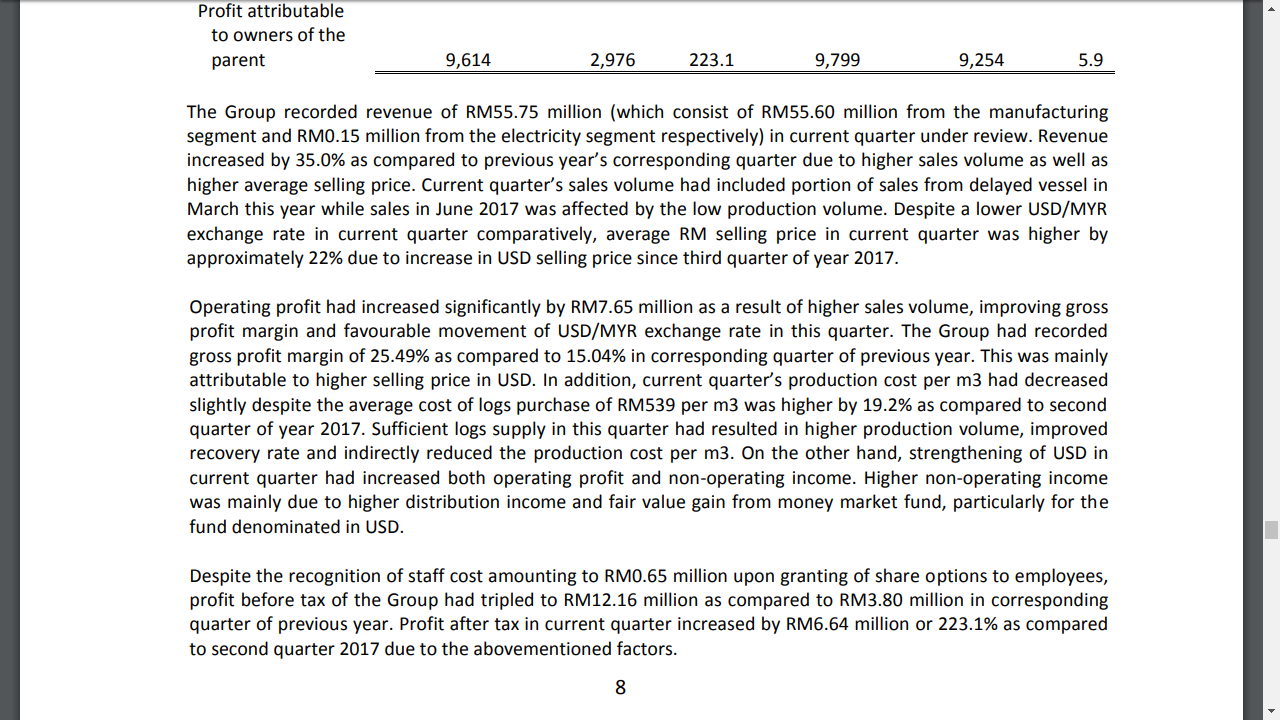

Source: Company Quarterly Report (Bursa Malaysia)

Financial Performance:

Based on its latest quarterly report (Quarter 2), Focus Lumber:

(a) Revenue: rm40.93 mil to rm55.75 mil.

(b) Net Profits: rm3.0 mil to rm9.6 mil.

The increased in revenue is due to higher sales volume (higher sales recorded including portion of sales from delayed vessels in March) and higher average selling price in USD.

The increased in net profits is due to the increase in revenue (factors mentioned above), higher production volume (sufficient logs supply), strengthening of the USD/MYR exchange rate.

From the above brief analysis, Focus Lumber operation is highly influenced by 2 key factors, namely:

(a) Sufficient logs supply - to ensure higher production volume and lower production cost

(b) USD/MYR exchange rate - to ensure higher gross margins from higher USD average selling price

Strong Financial Fundamentals:

Source: Company Quarterly Report (Bursa Malaysia)

Based on its latest quarterly report (Quarter 2), Focus Lumber has rm29 million cash, and the best of all ZERO DEBTS. The company is cash rich, and therefore can afford to pay dividends. Please refer below:

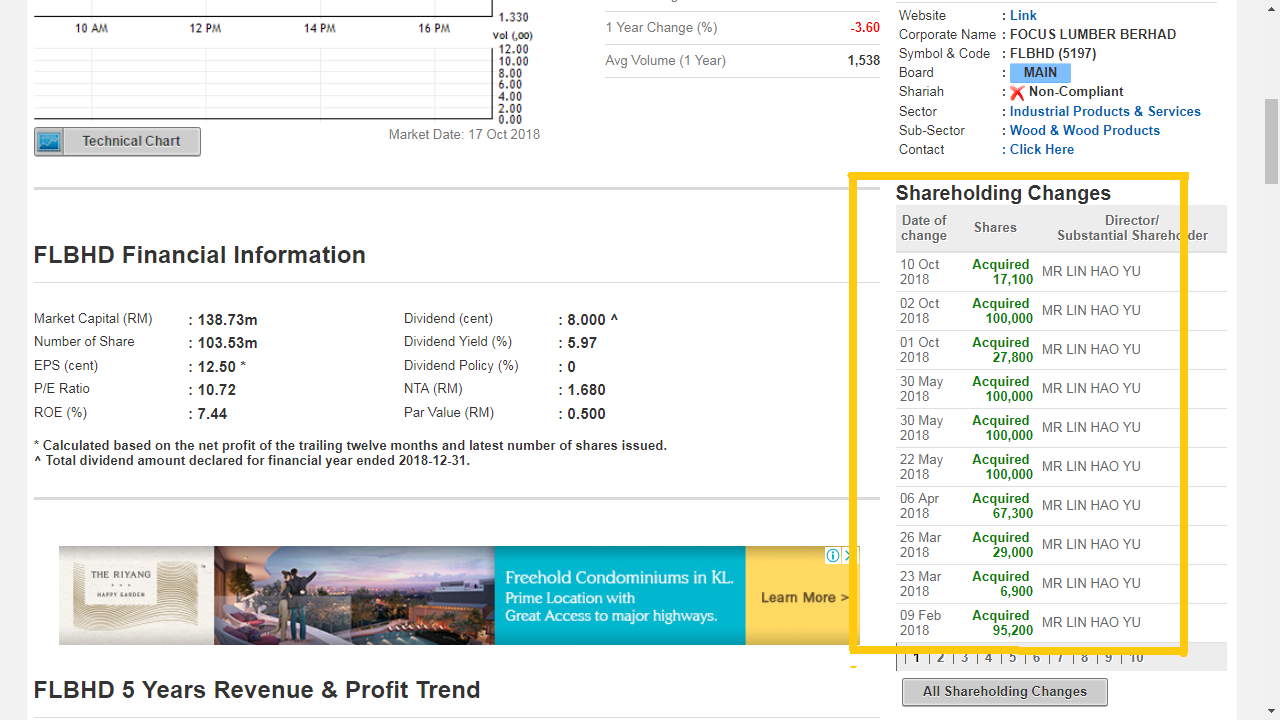

Source: Malaysiastockbiz

The company has a dividend yield of about 6%, probably a good stock for dividend investors. In addition, the company is also currently trading below its Net Tangible Asset (NTA) of rm1.68 / share. For cigar-butt investors, this company is undervalued.

Prospects:

Source: Company Quarterly Report (Bursa Malaysia)

Based on its latest quarterly report (Quarter 2), the management mentioned that the average selling price has decreased a little, but it is still very high as compared to 2017 average price. With the US economy remaining strong, demand is likely to sustain.

Moving forward, the company's cost should reduce, supported by Sabah's government ban on logs export. With the increase in logs supply, its logs prices should reduce which is a good contributing factor to Focus Lumber operations. With higher production volume, and the reduction in logs prices, the company's production cost per m3 should reduce, hence proving the notion of operational efficiency.

Insider is Buying:

Source: Malaysiastockbiz

Based on the above, one of the directors of the company is buying the company's shares.

Valuations:

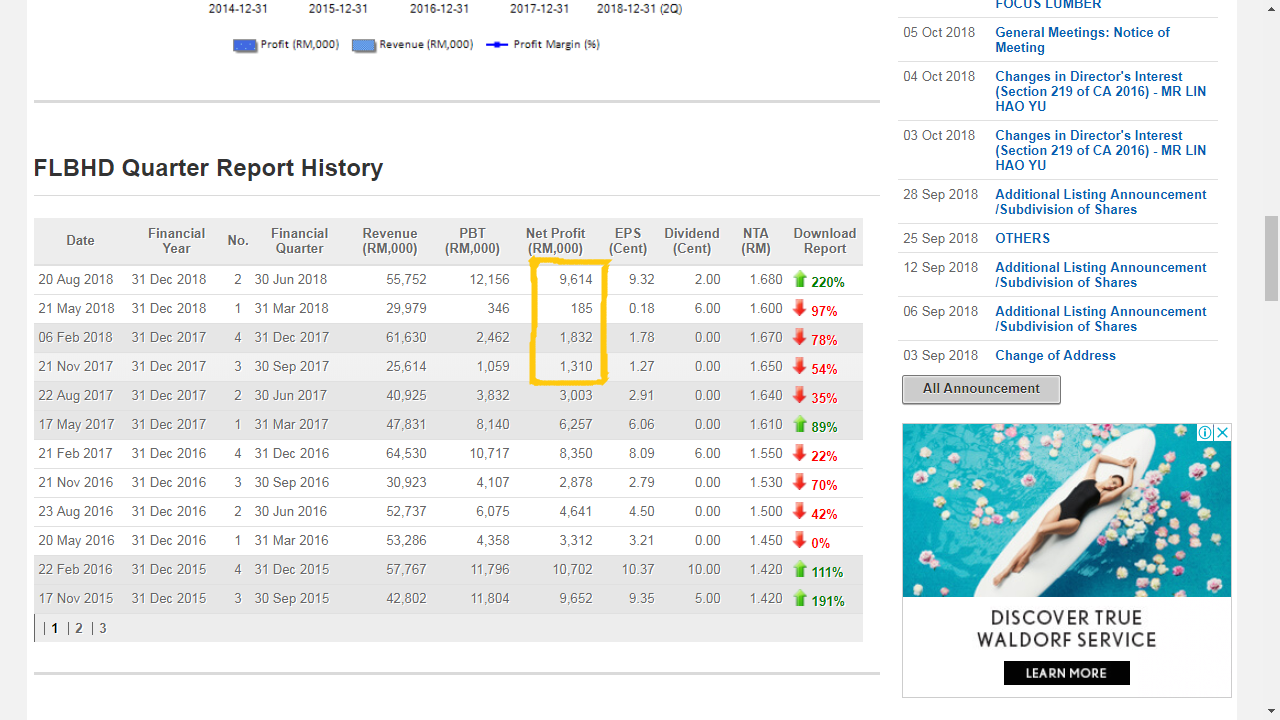

Focus Lumber financials:

2017:

Q1: rm 6.26 million

Q2: rm 3.00 million

Q3: rm 1.31 million

Q4: rm 1.83 million

Total: rm12.40 million

2018:

Q1: rm 0.19 million

Q2: rm 9.61 million

Q3: rm ???

Q4: rm ???

Total: rm???

2019:

Q1: rm ???

Q2: rm???

Q3: rm ???

Q4: rm ???

Total: rm???

In 2015, when logs supply is stable and USD is strong, Focus Lumber made rm31.72 million. For 2018 & 2019, with the key factors mentioned above (please also refer to my Part 1 sharing on October 4), if Focus Lumber can make rm22 million a year, based on shares outstanding of 103.53 million shares and a Price-Earnings Multiple of 10 times, Focus Lumber is valued at rm2.12 per share.

Based on current share price at rm1.34 per share, the upside potential is 58%, a comfortable margin-of-safety. Of course, please conduct your own research on this company, and have your own cut-loss point just in case if things do not go well as planned. I may make mistakes too.

Disclaimer: The above is for educational and sharing purpose only. There is no buy or sell call. Please conduct your own diligence before buying or selling stocks in the capital market.

Please "LIKE" this page "Financial education 4 youth" to support our financial awareness initiative. https://www.facebook.com/financialeducation4youth/

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on George Leong's Blog

Created by George Leong | Jan 19, 2018

Discussions

FLB has no growth, plus now bear market. PE 6 is more suitable. so TP = RM 1.27, now RM1.34 is overpriced. SELL CALL!!!

2018-10-17 19:17

Pe 10 is smart for certain research house to dude the ikan bilis to heed their unsubstantial calls to buy in while this bugger's keep disposing to make huge profits out of the ignorance to believe their motives behind. So far l had learnt this very lessons from this bugger's and I continued to exposed their intention behind . Believed me whether true or false, never trust any of this idiotic research house with vested interests to control the stocks price out of sheer ignorance to dude the foolish and uninformed !

Fuck this research house apart and do ur own research to minimize your capital resources from further short-changed to benefits the unreliable and untrusted scumbags !

2018-10-18 01:32

Agreed with George Leong.. FLB is having thick cash. foresee a good dividend this year. Their sales is good. Demand is high and USD increasingly strengthened. I have collected much at average price Rm1.3. TP Rm1.7 by end of this year. Price will soar soon. woohoo!!

2018-10-30 20:04

Fabien Extraordinaire

Why PE of 10 times?

2018-10-17 13:50